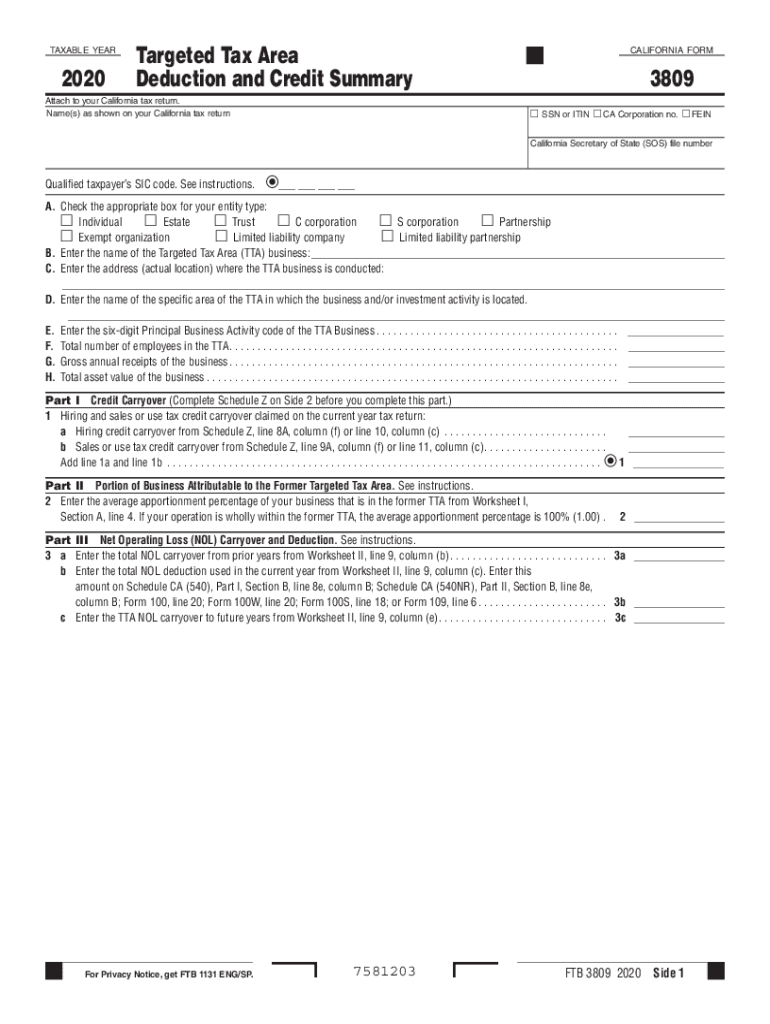

California Form 3809 Targeted Tax Area Deduction and 2020

Understanding the California Form 3801 Targeted Tax Area Deduction

The California Form 3801 is specifically designed for taxpayers who are eligible for the Targeted Tax Area Deduction. This deduction is aimed at encouraging economic growth in designated areas by providing tax relief to individuals and businesses operating within these zones. The form allows taxpayers to claim deductions based on their activities and investments in these targeted areas, ultimately reducing their overall tax liability.

Steps to Complete the California Form 3801 Targeted Tax Area Deduction

Completing the California Form 3801 involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of residency and any relevant financial records. Next, accurately fill out the form by providing personal information, income details, and specific deductions related to the targeted tax area. It is crucial to double-check all entries for errors before submission. Finally, submit the completed form to the California Franchise Tax Board by the specified deadline.

Eligibility Criteria for the California Form 3801 Targeted Tax Area Deduction

To qualify for the deductions available through the California Form 3801, taxpayers must meet specific eligibility criteria. Generally, individuals must reside or operate a business within a designated targeted tax area. Additionally, the taxpayer's income level may influence eligibility, as certain deductions are available only to those within specific income brackets. It is essential to review the guidelines provided by the California Franchise Tax Board to confirm eligibility before applying.

Required Documents for the California Form 3801 Targeted Tax Area Deduction

When filing the California Form 3801, taxpayers must provide several key documents to support their claims. These may include proof of residency, such as utility bills or lease agreements, and documentation of income, such as W-2 forms or 1099 statements. Additionally, any records that demonstrate business operations within the targeted tax area, including business licenses or permits, should be included. Having these documents ready will facilitate a smoother filing process.

Filing Deadlines for the California Form 3801 Targeted Tax Area Deduction

Timely submission of the California Form 3801 is crucial to avoid penalties and ensure the deduction is applied correctly. The filing deadline typically aligns with the annual tax return due date, which is usually April 15 for most individuals. However, taxpayers should verify specific dates each year, as they may vary due to weekends or holidays. It is advisable to file early to allow for any potential issues that may arise during the submission process.

Legal Use of the California Form 3801 Targeted Tax Area Deduction

The California Form 3801 is legally recognized as a valid method for claiming tax deductions related to targeted tax areas. To ensure compliance, taxpayers must adhere to the regulations set forth by the California Franchise Tax Board. This includes accurately reporting income, maintaining proper documentation, and submitting the form by the established deadlines. Misuse or fraudulent claims can result in penalties, so understanding the legal framework surrounding the form is essential.

Quick guide on how to complete california form 3809 targeted tax area deduction and

Complete California Form 3809 Targeted Tax Area Deduction And effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without delays. Handle California Form 3809 Targeted Tax Area Deduction And on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign California Form 3809 Targeted Tax Area Deduction And without hassle

- Obtain California Form 3809 Targeted Tax Area Deduction And and then select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a standard wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from any device you choose. Modify and electronically sign California Form 3809 Targeted Tax Area Deduction And and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 3809 targeted tax area deduction and

Create this form in 5 minutes!

How to create an eSignature for the california form 3809 targeted tax area deduction and

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

The best way to create an e-signature for a PDF on Android OS

People also ask

-

What is the california form 3801 and how can airSlate SignNow assist with it?

The california form 3801 is used for reporting certain business expenditures and tax credits. airSlate SignNow streamlines the process of filling out and signing this form digitally, saving you time and ensuring accuracy. With our user-friendly interface, you can easily manage this form along with other essential documentation.

-

What features does airSlate SignNow offer for managing the california form 3801?

airSlate SignNow provides several features specifically designed to simplify the handling of the california form 3801, including customizable templates, digital signatures, and real-time collaboration tools. These features ensure that your documents are not only easy to create but also secure and compliant with regulations.

-

How does airSlate SignNow support pricing for businesses needing the california form 3801?

airSlate SignNow offers competitive pricing plans tailored for businesses looking to manage documents like the california form 3801. Our plans can cater to teams of all sizes, ensuring that you have the right tools at a budget-friendly price. Plus, we often offer promotions that can further reduce your costs.

-

Can I integrate airSlate SignNow with other software to complete the california form 3801?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications, allowing you to easily manage your workflows related to the california form 3801. Whether you're using accounting software or project management tools, our integrations can enhance your efficiency and document handling.

-

What are the security features of airSlate SignNow for handling the california form 3801?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the california form 3801. Our platform uses advanced encryption, secure storage, and compliance with industry standards to ensure your information is always protected from unauthorized access.

-

How does using airSlate SignNow benefit my business for the california form 3801?

Using airSlate SignNow for the california form 3801 can signNowly improve your workflow by reducing the time spent on paperwork. Our cloud-based solution allows you to access and manage documents from anywhere, streamlining the eSignature process and enhancing collaboration among team members.

-

Is there a trial period available for using airSlate SignNow for the california form 3801?

Yes, airSlate SignNow typically offers a free trial period, allowing you to test our features and services before committing fully. This trial can help you understand how our platform can specifically assist you with the california form 3801 and improve your document management.

Get more for California Form 3809 Targeted Tax Area Deduction And

- Georgia subordination agreement of mortgage form

- Georgia commercial rental lease application questionnaire form

- Georgia residential application form

- Georgia trustees deed form

- Ga affidavit form

- Georgia request to proceed in forma pauperis habeas corpus

- Covenants restrictions sample form

- Easement agreement form

Find out other California Form 3809 Targeted Tax Area Deduction And

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney