Form ET 85 New York State Estate Tax Certification Revised 623 2023-2026

What is the Form ET 85 New York State Estate Tax Certification Revised 623

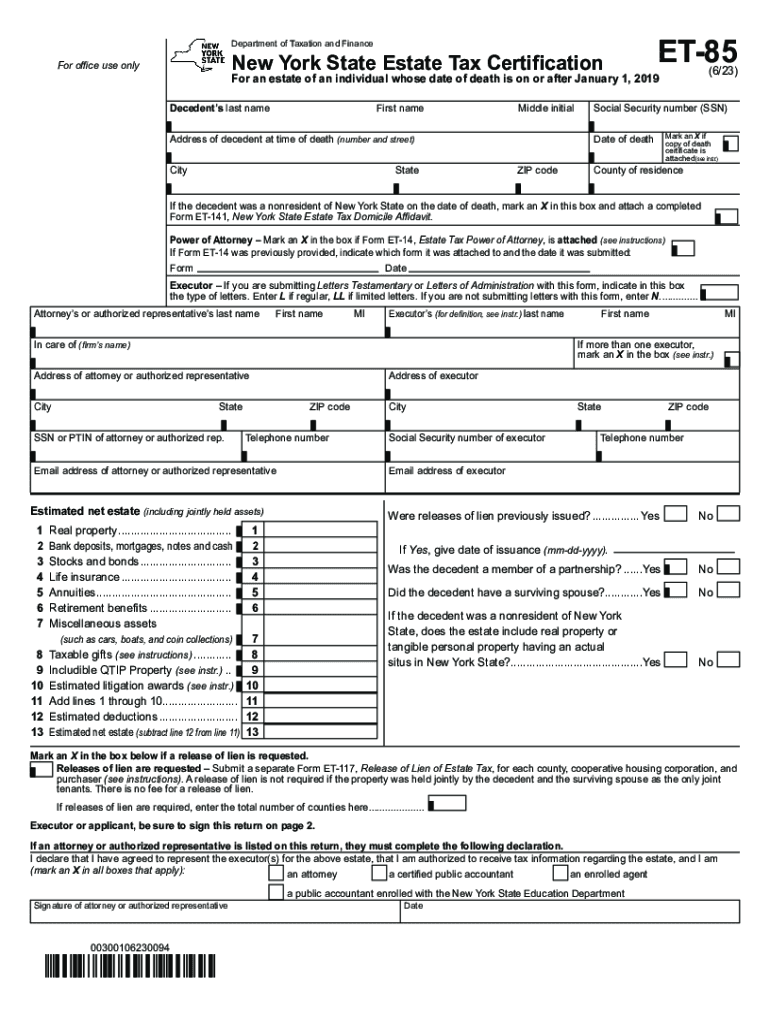

The Form ET 85 is a crucial document used in New York State for estate tax certification. Specifically, it certifies that the estate has complied with New York estate tax laws. This form is essential for the transfer of property and assets from the deceased to their beneficiaries. The revised version of this form, known as ET 85 Revised 623, includes updated guidelines and requirements that reflect current tax regulations. Understanding this form is vital for executors and administrators of estates to ensure compliance and avoid potential penalties.

Steps to complete the Form ET 85 New York State Estate Tax Certification Revised 623

Completing the Form ET 85 involves several important steps to ensure accuracy and compliance. First, gather all necessary information regarding the estate, including the decedent's details, asset valuations, and any relevant tax documents. Next, fill out the form by providing the required information in the designated fields. Pay close attention to sections that require specific details about the estate's assets and liabilities. Once completed, review the form for any errors or omissions. Finally, submit the form according to the instructions provided, ensuring that it is filed by the appropriate deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form ET 85 are critical to ensure compliance with New York State tax regulations. Generally, the form must be submitted within nine months of the decedent's date of death. However, if an extension is needed, it is essential to file for an extension before the original deadline. Missing the filing deadline can lead to penalties and interest on any unpaid estate taxes. Executors should keep track of these important dates and ensure all necessary documentation is submitted in a timely manner.

Key elements of the Form ET 85 New York State Estate Tax Certification Revised 623

The Form ET 85 contains several key elements that must be accurately completed. These include the decedent's name, Social Security number, date of death, and details about the estate's assets. Additionally, the form requires information about any deductions, debts, and other liabilities. It is also important to provide the names and addresses of the beneficiaries. Each section of the form is designed to gather specific information that will be used to determine the estate's tax liability, making accuracy essential for compliance.

Legal use of the Form ET 85 New York State Estate Tax Certification Revised 623

The legal use of the Form ET 85 is primarily to certify that the estate has met all tax obligations under New York State law. This certification is often required before transferring property or assets to beneficiaries. Executors and administrators must ensure that the form is completed correctly and submitted on time to avoid legal complications. Inaccuracies or delays in filing can result in legal repercussions, including fines or additional scrutiny from tax authorities.

How to obtain the Form ET 85 New York State Estate Tax Certification Revised 623

The Form ET 85 can be obtained through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, it may be possible to request a physical copy from local tax offices. Executors should ensure they are using the most current version of the form, as outdated versions may not be accepted by tax authorities.

Quick guide on how to complete form et 85 new york state estate tax certification revised 623

Accomplish Form ET 85 New York State Estate Tax Certification Revised 623 effortlessly on any device

Digital document administration has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form ET 85 New York State Estate Tax Certification Revised 623 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Form ET 85 New York State Estate Tax Certification Revised 623 with ease

- Locate Form ET 85 New York State Estate Tax Certification Revised 623 and click Get Form to begin.

- Employ the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure confidential information using tools that airSlate SignNow offers specifically for that functionality.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious document searches, or errors that require printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form ET 85 New York State Estate Tax Certification Revised 623 to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form et 85 new york state estate tax certification revised 623

Create this form in 5 minutes!

How to create an eSignature for the form et 85 new york state estate tax certification revised 623

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for managing 2023 New York tax documents?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSignature solutions. These features are designed to help users efficiently manage their 2023 New York tax documents while ensuring compliance and security. Streamlining the signing process can signNowly reduce the time spent on paperwork.

-

How can I ensure my 2023 New York tax documents are secure with airSlate SignNow?

airSlate SignNow utilizes advanced encryption protocols and complies with industry standards to keep your 2023 New York tax documents secure. The platform offers robust authentication options and audit trails to ensure that only authorized users can access sensitive information. This level of security is essential for maintaining confidentiality in tax matters.

-

Is there a cost associated with using airSlate SignNow for 2023 New York tax eSignatures?

Yes, airSlate SignNow offers various pricing plans tailored to business needs, including features specifically for 2023 New York tax eSignatures. The cost is competitive, and the platform is designed to be cost-effective, enabling businesses to optimize their document management without incurring excessive expenses. You can choose a plan that best fits your budget and requirements.

-

What benefits does eSigning provide for 2023 New York tax forms?

Using airSlate SignNow for eSigning provides numerous benefits for 2023 New York tax forms, such as faster turnaround times and reduced printing costs. It allows for remote signing, meaning that signatures can be collected from anywhere, streamlining the filing process. This efficiency can lead to timely submissions and potentially avoid penalties.

-

Can I integrate airSlate SignNow with other tools for 2023 New York tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax preparation tools that are essential for managing your 2023 New York tax documents. By connecting your existing software, you can enhance your workflow, making the entire process from preparation to eSignature more efficient. Integration is straightforward and user-friendly.

-

How does airSlate SignNow simplify the workflow for 2023 New York tax submissions?

airSlate SignNow simplifies workflows for 2023 New York tax submissions by automating tasks such as document routing and reminders. This helps users stay organized and ensures that no steps are missed during the submission process. With features like bulk sending and automatic notifications, users can focus on their tax strategy rather than paperwork.

-

Is airSlate SignNow mobile-friendly for handling 2023 New York tax documents?

Yes, airSlate SignNow is designed to be fully mobile-friendly, allowing users to handle 2023 New York tax documents on the go. The mobile app provides access to all essential features, enabling you to send, sign, and manage documents from your smartphone or tablet. This convenience ensures that you can manage your tax responsibilities anytime, anywhere.

Get more for Form ET 85 New York State Estate Tax Certification Revised 623

Find out other Form ET 85 New York State Estate Tax Certification Revised 623

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online