Form G 49, Annual General ExciseUse Tax Return & Reconciliation, Rev 2023-2026

What is the Form G-49?

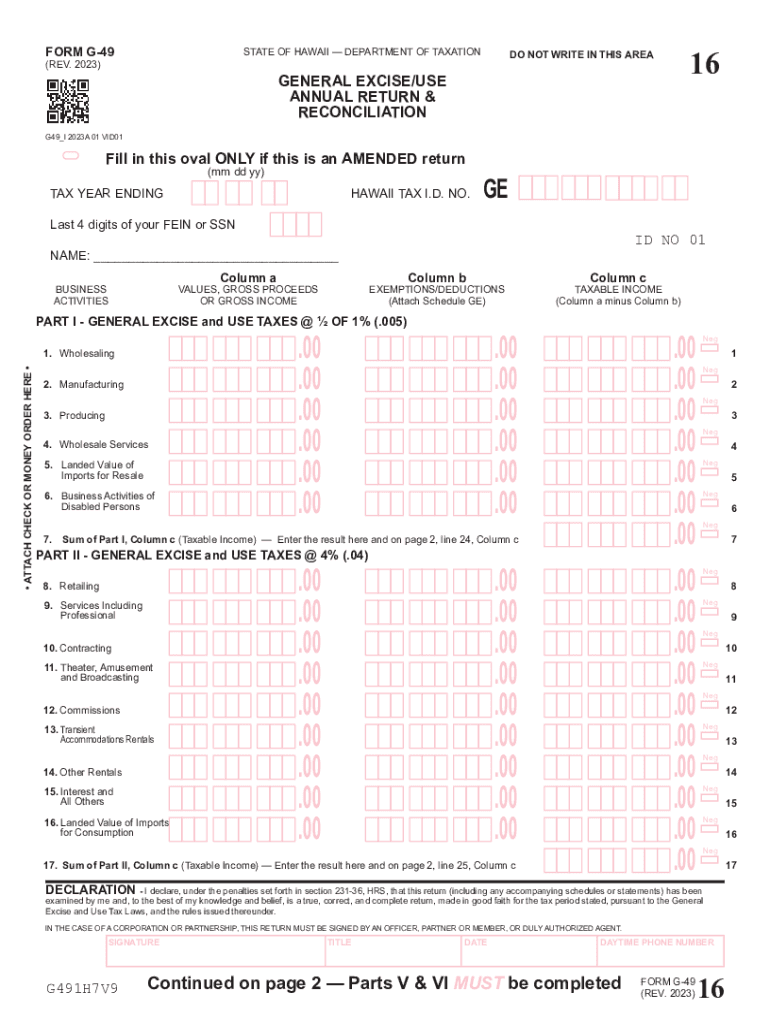

The Form G-49, known as the Annual General Excise Use Tax Return & Reconciliation, is a crucial document for businesses operating in Hawaii. This form is used to report the general excise tax (GET) due to the state, which is a tax on income derived from business activities. The G-49 allows businesses to reconcile their tax liabilities, ensuring compliance with state tax regulations. Understanding this form is essential for maintaining good standing with the Hawaii Department of Taxation.

How to Use the Form G-49

Using the Form G-49 involves several steps to ensure that all required information is accurately reported. Businesses must first gather their financial records for the reporting period, including gross income and deductions. The form requires detailed entries of total sales, exempt sales, and the applicable tax rates. Once completed, the form must be submitted to the Hawaii Department of Taxation by the specified deadline. Proper use of this form helps businesses avoid penalties and ensures they fulfill their tax obligations.

Steps to Complete the Form G-49

Completing the Form G-49 involves a systematic approach:

- Gather all relevant financial documents, including sales records and previous tax returns.

- Fill out the form by entering total gross income, deductions, and the applicable tax rates.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Sign and date the form, certifying that the information provided is true and complete.

- Submit the form by the deadline, either online or via mail, as per the instructions provided.

Required Documents for Form G-49

To accurately complete the Form G-49, businesses need to prepare several documents:

- Financial statements that detail income and expenses for the reporting period.

- Invoices and receipts that substantiate sales and deductions claimed.

- Any prior tax returns that may provide context for current filings.

- Records of exempt sales, if applicable, to ensure proper reporting.

Filing Deadlines for Form G-49

Timely filing of the Form G-49 is essential to avoid penalties. The form is typically due on the last day of the month following the end of the reporting period. For example, if the reporting period ends on December 31, the form must be filed by January 31 of the following year. Businesses should mark their calendars for these deadlines to ensure compliance with state tax laws.

Penalties for Non-Compliance

Failure to file the Form G-49 on time or inaccuracies in the information reported can lead to significant penalties. The Hawaii Department of Taxation may impose fines, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is crucial for businesses to adhere to filing requirements and maintain accurate records to mitigate these risks.

Quick guide on how to complete form g 49 annual general exciseuse tax return reconciliation rev

Complete Form G 49, Annual General ExciseUse Tax Return & Reconciliation, Rev effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form G 49, Annual General ExciseUse Tax Return & Reconciliation, Rev on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Form G 49, Annual General ExciseUse Tax Return & Reconciliation, Rev seamlessly

- Obtain Form G 49, Annual General ExciseUse Tax Return & Reconciliation, Rev and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Produce your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to preserve your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors necessitating the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form G 49, Annual General ExciseUse Tax Return & Reconciliation, Rev and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form g 49 annual general exciseuse tax return reconciliation rev

Create this form in 5 minutes!

How to create an eSignature for the form g 49 annual general exciseuse tax return reconciliation rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is g 49 online and how does it work with airSlate SignNow?

g 49 online is a feature within airSlate SignNow that allows users to seamlessly eSign and manage documents over the internet. This tool simplifies the signing process, making it quick and efficient for businesses. With airSlate SignNow, you can streamline documentation with just a few clicks.

-

What are the pricing plans for g 49 online?

airSlate SignNow offers competitive pricing plans for g 49 online, including monthly and annual subscriptions at various levels. These plans are designed to accommodate businesses of all sizes, ensuring that everyone can benefit from eSigning solutions. You can visit our pricing page for more details and to find the best plan for your needs.

-

What features does g 49 online offer?

g 49 online includes features such as document templates, team sharing functionalities, and real-time tracking of document status. Users can also enjoy customizable workflows and integration with various applications to enhance productivity. These features make airSlate SignNow a powerful tool for managing eSignatures.

-

What are the benefits of using g 49 online for my business?

Using g 49 online provides multiple benefits including improved efficiency, reduced paperwork, and faster turnaround times on contracts and agreements. It also enhances customer satisfaction by allowing them to sign documents anytime, anywhere. Businesses can save time and resources by adopting this modern eSignature solution.

-

Can I integrate g 49 online with other applications?

Yes, g 49 online integrates seamlessly with various applications such as Google Drive, Salesforce, and Microsoft Office. This interoperability helps businesses maintain their existing workflows while enjoying the benefits of airSlate SignNow’s eSigning features. Integrations are simple to set up, allowing for a smooth transition.

-

Is g 49 online secure for signing sensitive documents?

Absolutely, g 49 online prioritizes security, employing encryption and comprehensive security protocols to protect your sensitive documents. This ensures that all signed agreements are stored safely and that the signing process is tamper-proof. Using airSlate SignNow provides peace of mind when dealing with confidential information.

-

How can I start using g 49 online?

Getting started with g 49 online is easy—simply sign up for an account on the airSlate SignNow website. Once your account is set up, you can begin uploading documents, creating templates, and inviting signers. Enjoy the user-friendly interface that makes the entire process straightforward.

Get more for Form G 49, Annual General ExciseUse Tax Return & Reconciliation, Rev

Find out other Form G 49, Annual General ExciseUse Tax Return & Reconciliation, Rev

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online