Form G 49, Annual General ExciseUse Tax Hawaii Gov 2019

What is the Form G-49?

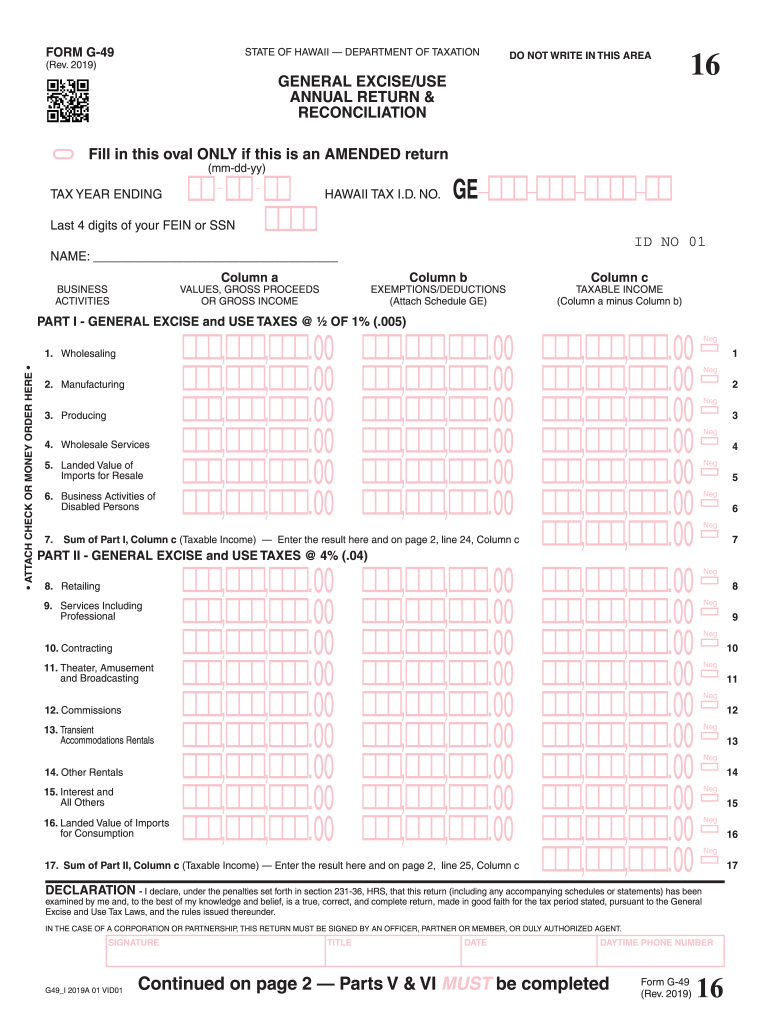

The Form G-49, also known as the Annual General Excise/Use Tax Return, is a tax form used in Hawaii for reporting general excise taxes. This form is essential for businesses operating in Hawaii, as it helps ensure compliance with state tax regulations. The G-49 is typically filed annually and covers the gross income from business activities, allowing the state to assess the appropriate tax amount owed. Understanding this form is crucial for maintaining good standing with the Hawaii Department of Taxation.

Steps to Complete the Form G-49

Completing the Form G-49 involves several key steps that ensure accurate reporting of your business income. First, gather all necessary financial records, including sales receipts and expense reports. Next, enter your total gross income from business activities in the appropriate section of the form. Be sure to include any deductions or exemptions that apply to your situation. After filling out all sections, review the form for accuracy before submitting it to avoid penalties. Finally, ensure you keep a copy of the completed form for your records.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Form G-49 to avoid late fees and penalties. The due date for filing the G-49 is typically the last day of the month following the end of the tax year. For businesses operating on a calendar year, this means the form is due by January thirty-first of the following year. Keeping track of these deadlines ensures timely compliance with Hawaii tax laws.

Legal Use of the Form G-49

The legal use of the Form G-49 is governed by Hawaii state tax regulations. To be considered valid, the form must be completed accurately and submitted on time. The information provided must reflect true and correct figures, as any discrepancies can lead to audits or penalties. Utilizing electronic filing methods can enhance security and ensure compliance with legal standards, making it easier for businesses to manage their tax obligations.

Key Elements of the Form G-49

Understanding the key elements of the Form G-49 is vital for accurate completion. The form typically includes sections for reporting gross income, deductions, and the calculation of the tax owed. It may also require information about the business type and any applicable exemptions. Familiarizing yourself with these elements can streamline the filing process and help avoid common mistakes.

Form Submission Methods

The Form G-49 can be submitted through various methods, including online filing, mail, or in-person submission at designated tax offices. Online filing is often the most efficient option, allowing for quicker processing and confirmation of receipt. For those who prefer traditional methods, mailing the completed form is also acceptable, but it is advisable to send it via certified mail to ensure delivery. In-person submissions can be made at local tax offices, providing an opportunity to ask questions or seek assistance if needed.

Quick guide on how to complete form g 49 annual general exciseuse tax hawaiigov

Prepare Form G 49, Annual General ExciseUse Tax Hawaii gov effortlessly on any device

The management of online documents has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the needed forms and securely store them online. airSlate SignNow equips you with all the necessary tools to generate, edit, and electronically sign your documents promptly without interruptions. Handle Form G 49, Annual General ExciseUse Tax Hawaii gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest method to alter and electronically sign Form G 49, Annual General ExciseUse Tax Hawaii gov effortlessly

- Locate Form G 49, Annual General ExciseUse Tax Hawaii gov and then click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that necessitate reprinting new document versions. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form G 49, Annual General ExciseUse Tax Hawaii gov and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form g 49 annual general exciseuse tax hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the form g 49 annual general exciseuse tax hawaiigov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is g 49 in the context of airSlate SignNow?

The term 'g 49' refers to a specific feature offered by airSlate SignNow that enhances document management and electronic signature processes. This feature allows users to efficiently handle contracts and agreements, streamlining workflows for businesses of all sizes.

-

How does airSlate SignNow's g 49 feature benefit my business?

The g 49 feature simplifies the signing and management of important documents, reducing turnaround time and improving efficiency. By using airSlate SignNow, businesses can eliminate the need for paper documents, resulting in cost savings and a more environmentally friendly approach to business operations.

-

What pricing plans are available for airSlate SignNow with g 49?

airSlate SignNow offers a variety of pricing plans suitable for different business needs, including options that highlight the advantages of g 49. These plans are designed to be cost-effective, providing excellent return on investment for businesses looking to utilize advanced document management features.

-

Can I integrate g 49 with other tools I currently use?

Yes, airSlate SignNow's g 49 is designed to seamlessly integrate with a variety of popular business applications. This capability ensures that you can maintain your existing workflow while enhancing your document signing process with airSlate SignNow's powerful features.

-

Is g 49 user-friendly for all types of users?

Absolutely! The g 49 feature within airSlate SignNow is crafted with user experience in mind, making it accessible for both tech-savvy employees and those less familiar with technology. This ensures that anyone in your organization can easily adopt and utilize the solution without extensive training.

-

What types of documents can be signed using g 49?

With g 49, airSlate SignNow allows users to electronically sign a wide array of documents, including contracts, agreements, and forms. This versatility makes it an excellent choice for various industries, from real estate to healthcare, ensuring compliance and security during the signing process.

-

How does g 49 ensure the security of documents?

Security is a top priority for airSlate SignNow's g 49 feature, which uses advanced encryption technology to protect sensitive information. This assurance allows businesses to confidently manage and send documents electronically while maintaining compliance with industry regulations and standards.

Get more for Form G 49, Annual General ExciseUse Tax Hawaii gov

- Notice of intent to enforce forfeiture provisions of contact for deed virginia form

- Final notice of forfeiture and request to vacate property under contract for deed virginia form

- Buyers request for accounting from seller under contract for deed virginia form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed virginia form

- Va notice form

- Virginia seller form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497427933 form

- Contract for deed sellers annual accounting statement virginia form

Find out other Form G 49, Annual General ExciseUse Tax Hawaii gov

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple