Form DTF 686 Tax Shelter Reportable Transactions Attachement to New York State Return Tax Year 2023

Understanding the DTF 686 Tax Shelter Reportable Transactions Form

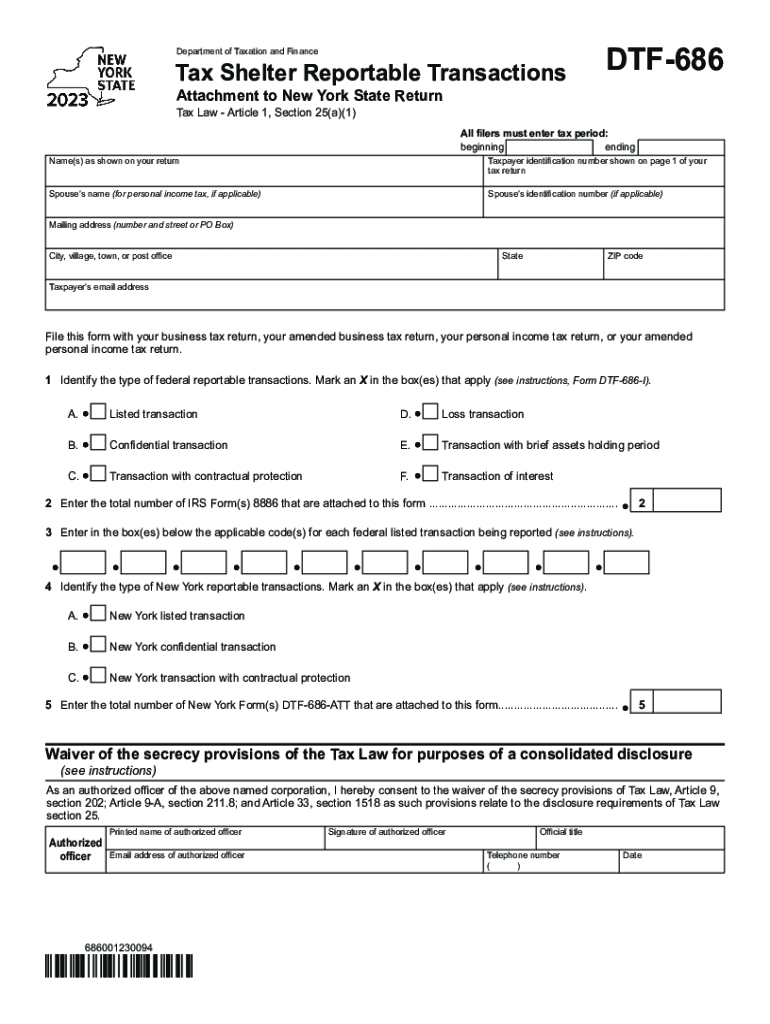

The DTF 686 form serves as a crucial attachment for New York State tax returns, specifically designed for reporting tax shelter transactions. This form is essential for taxpayers who have engaged in reportable transactions that may provide tax benefits. By accurately completing this form, individuals and businesses can ensure compliance with New York State tax regulations, avoiding potential penalties associated with non-disclosure.

Steps to Complete the DTF 686 Form

Completing the DTF 686 form involves several key steps that require careful attention to detail. First, gather all necessary documentation related to the tax shelter transactions you are reporting. This includes records of income, expenses, and any relevant agreements. Next, accurately fill out each section of the form, ensuring that all information reflects your financial activity for the tax year. It is important to double-check your entries for accuracy, as errors can lead to complications during the filing process. Finally, attach the completed form to your New York State tax return before submission.

Obtaining the DTF 686 Form

Taxpayers can easily obtain the DTF 686 form through the New York State Department of Taxation and Finance website. The form is available in a downloadable format, allowing users to print and complete it at their convenience. Additionally, tax professionals may provide the form as part of their services, ensuring that clients have access to the necessary documentation for reporting tax shelter transactions.

Key Elements of the DTF 686 Form

Several key elements must be included when completing the DTF 686 form. These include your personal identification information, details about the tax shelter transaction, and any relevant financial figures. The form also requires a description of the transaction and its purpose, as well as the names of all parties involved. Providing comprehensive and accurate information is vital for compliance and to avoid future audits or penalties.

Legal Considerations for the DTF 686 Form

Understanding the legal implications of the DTF 686 form is essential for taxpayers. The form is mandated by New York State law, requiring disclosure of specific transactions that could affect tax liabilities. Failure to file this form when required can result in significant penalties, including fines and interest on unpaid taxes. It is advisable to consult with a tax professional to ensure that all legal obligations are met and that the form is filed correctly.

Filing Deadlines for the DTF 686 Form

Timely submission of the DTF 686 form is critical to avoid penalties. The form must be filed alongside your New York State tax return by the established deadline, typically April fifteenth for individual taxpayers. However, if you are unable to meet this deadline, you may request an extension for your tax return, which also extends the filing period for the DTF 686 form. Always check for any updates or changes to deadlines that may occur in a given tax year.

Quick guide on how to complete form dtf 686 tax shelter reportable transactions attachement to new york state return tax year

Prepare Form DTF 686 Tax Shelter Reportable Transactions Attachement To New York State Return Tax Year effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed files, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Form DTF 686 Tax Shelter Reportable Transactions Attachement To New York State Return Tax Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Form DTF 686 Tax Shelter Reportable Transactions Attachement To New York State Return Tax Year with ease

- Obtain Form DTF 686 Tax Shelter Reportable Transactions Attachement To New York State Return Tax Year and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Form DTF 686 Tax Shelter Reportable Transactions Attachement To New York State Return Tax Year and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form dtf 686 tax shelter reportable transactions attachement to new york state return tax year

Create this form in 5 minutes!

How to create an eSignature for the form dtf 686 tax shelter reportable transactions attachement to new york state return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DTF 686 and how does it work?

The DTF 686 is a powerful eSignature solution within the airSlate SignNow platform. It allows businesses to securely sign documents electronically, streamline workflows, and enhance collaboration. With its user-friendly interface, the DTF 686 simplifies the signing process for both senders and recipients, ensuring a seamless experience.

-

What are the key features of the DTF 686?

The DTF 686 offers several key features, including customizable templates, multi-party signing, and real-time tracking of document status. Additionally, it supports various file formats and integrates with other popular applications to facilitate document management. These features make the DTF 686 an essential tool for businesses looking to increase efficiency.

-

How much does the DTF 686 cost?

Pricing for the DTF 686 varies depending on the specific plan you choose. airSlate SignNow offers flexible pricing options suitable for businesses of all sizes, ensuring a cost-effective solution. For detailed pricing information, visit our website or contact our sales team.

-

What are the benefits of using the DTF 686 for my business?

Utilizing the DTF 686 can signNowly enhance your business operations by reducing the time and cost associated with traditional document signing. It also increases document security and compliance with legal standards. Overall, the DTF 686 helps foster a more productive workplace by minimizing manual processes.

-

Can the DTF 686 integrate with other software?

Yes, the DTF 686 is designed to integrate seamlessly with various third-party applications and platforms. This allows users to connect their existing workflows with the airSlate SignNow platform. Such integrations help ensure that your document management and signing processes remain cohesive and efficient.

-

Is the DTF 686 user-friendly for non-technical individuals?

Absolutely! The DTF 686 is built with user-friendliness in mind, making it accessible for individuals without a technical background. The intuitive interface simplifies the eSigning process, allowing anyone to create, send, and manage documents easily.

-

What types of documents can I send with the DTF 686?

With the DTF 686, you can send a wide variety of documents for electronic signatures, including contracts, agreements, and forms. This versatility makes it suitable for various industries and use cases. Whatever your document needs, the DTF 686 provides an efficient solution.

Get more for Form DTF 686 Tax Shelter Reportable Transactions Attachement To New York State Return Tax Year

- Appointment cancellation form southland urology

- An update on the use of immunoglobulin for the treatment of form

- Application amp admission information

- Distribution of excess hsa contribution form healthequity

- Patient info emergcy contact form

- Ivy tech community college of indiana health information

- Related medical conditionsfood allergy research form

- Alabama form k rcc

Find out other Form DTF 686 Tax Shelter Reportable Transactions Attachement To New York State Return Tax Year

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed