Instructions for Form DTF 686 Tax Shelter Reportable 2024-2026

What is the DTF 686 Tax Shelter Reportable?

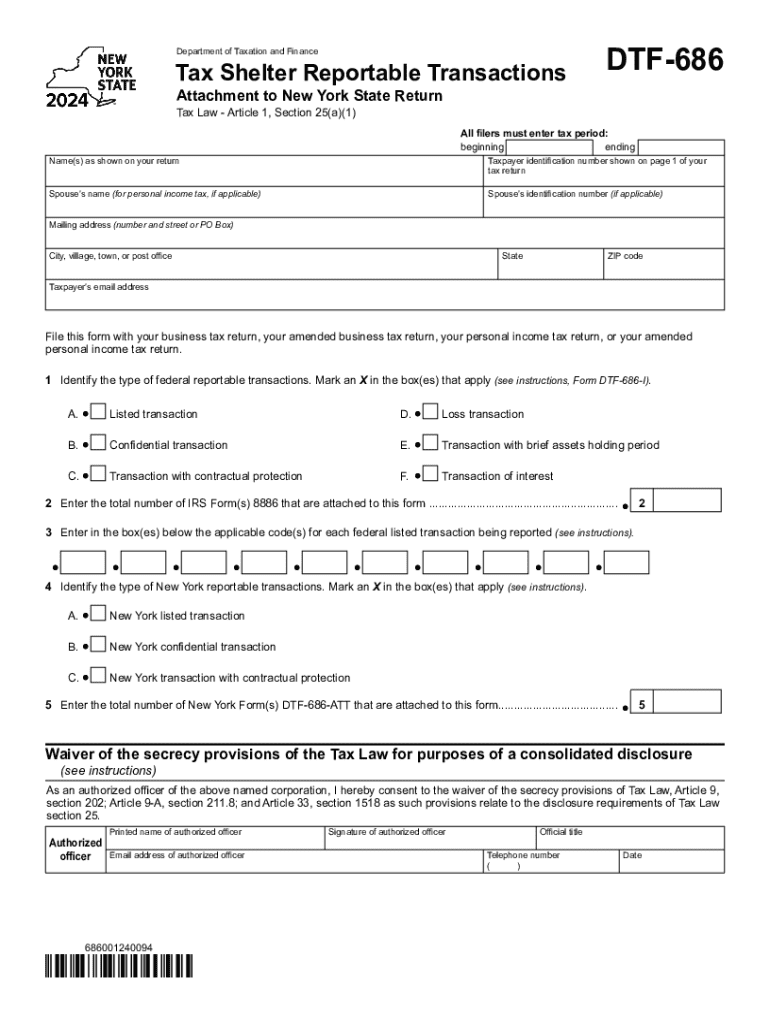

The DTF 686 form, officially known as the New York Tax Shelter Reportable form, is used by taxpayers to report certain transactions that may be considered tax shelter activities. This form is essential for ensuring compliance with New York State tax regulations, particularly for individuals and businesses involved in reportable transactions. Understanding the purpose of the DTF 686 is crucial for maintaining transparency and fulfilling legal obligations regarding tax reporting.

Steps to Complete the DTF 686 Tax Shelter Reportable

Completing the DTF 686 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the transactions being reported. This may include financial statements, contracts, and any correspondence related to the tax shelter activities. Next, fill out the form accurately, providing detailed information about each reportable transaction. Be sure to include the names of all parties involved, the nature of the transaction, and the amounts involved. After completing the form, review it thoroughly for any errors before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the DTF 686. Generally, the form must be submitted by the due date of the tax return for the year in which the reportable transaction occurred. For most taxpayers, this means the DTF 686 should be filed by April fifteenth of the following year. However, if an extension has been granted for the tax return, the same extension applies to the DTF 686. Keeping track of these dates is essential to avoid penalties and ensure compliance with state tax laws.

Required Documents for DTF 686 Submission

When preparing to submit the DTF 686, certain documents are required to support the information provided on the form. Taxpayers should include financial records that detail the reportable transactions, such as invoices, contracts, and any relevant correspondence. Additionally, any prior tax filings that relate to the transactions should be included. Having these documents organized and readily available will facilitate a smoother filing process and help substantiate the claims made on the DTF 686.

Penalties for Non-Compliance with DTF 686

Failure to file the DTF 686 or inaccuracies in reporting can lead to significant penalties. New York State imposes fines for non-compliance, which may include monetary penalties and interest on any unpaid taxes related to the reportable transactions. In severe cases, taxpayers may face further legal action. It is crucial to understand these potential consequences and ensure that all tax shelter activities are reported accurately and timely to avoid complications.

Eligibility Criteria for Filing DTF 686

Eligibility to file the DTF 686 is generally determined by the nature of the transactions being reported. Taxpayers involved in specific types of tax shelter transactions, as defined by New York State tax regulations, must file this form. This includes individuals and entities that have engaged in reportable transactions that meet the criteria outlined by the state. Understanding these eligibility requirements is vital for ensuring compliance and avoiding unnecessary penalties.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form dtf 686 tax shelter reportable

Create this form in 5 minutes!

How to create an eSignature for the instructions for form dtf 686 tax shelter reportable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny dtf 686 form and why is it important?

The ny dtf 686 form is a crucial document for businesses operating in New York, as it is used for various tax-related purposes. Understanding how to properly fill out and submit the ny dtf 686 can help ensure compliance with state regulations and avoid potential penalties.

-

How can airSlate SignNow help with the ny dtf 686 process?

airSlate SignNow streamlines the process of completing and eSigning the ny dtf 686 form. With its user-friendly interface, businesses can easily fill out the form, obtain necessary signatures, and securely send it, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for the ny dtf 686?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for handling the ny dtf 686. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need while accessing all essential features.

-

Are there any integrations available for the ny dtf 686 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing the efficiency of managing the ny dtf 686. Whether you use CRM systems, cloud storage, or other business tools, these integrations help streamline your workflow.

-

What features does airSlate SignNow offer for managing the ny dtf 686?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure cloud storage, all of which are beneficial for managing the ny dtf 686. These tools help ensure that your documents are completed accurately and on time.

-

Can I track the status of my ny dtf 686 submissions with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your ny dtf 686 submissions in real-time. You will receive notifications when documents are viewed, signed, or completed, giving you peace of mind throughout the process.

-

Is airSlate SignNow secure for handling sensitive ny dtf 686 information?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your ny dtf 686 information is protected. With advanced encryption and secure access controls, you can trust that your sensitive data remains confidential.

Get more for Instructions For Form DTF 686 Tax Shelter Reportable

Find out other Instructions For Form DTF 686 Tax Shelter Reportable

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal