Withheld for Quarter Ending 930 2021-2026

What is the Withheld For Quarter Ending 930

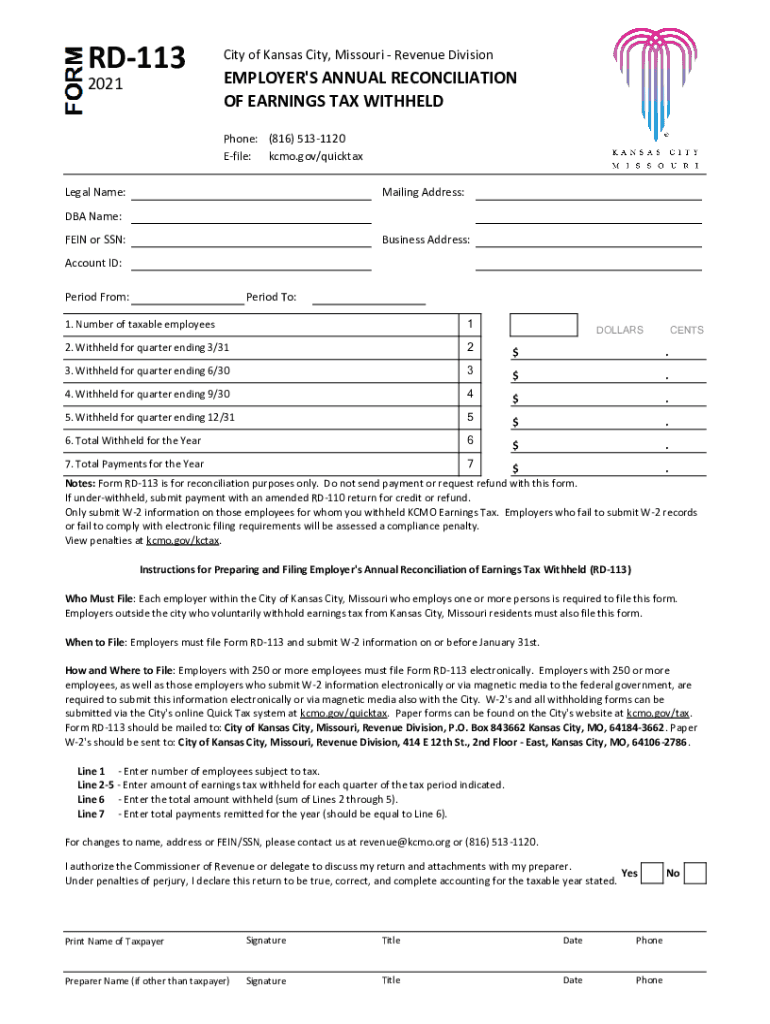

The Withheld For Quarter Ending 930 is a tax form used in the United States to report certain types of withheld income. This form is typically utilized by employers and businesses to summarize the amounts withheld from employee wages and other payments for federal income tax purposes. Understanding this form is crucial for both employers and employees to ensure compliance with tax regulations.

How to use the Withheld For Quarter Ending 930

Using the Withheld For Quarter Ending 930 involves accurately reporting the amounts withheld during the quarter. Employers must gather data on total wages paid and the corresponding federal income tax withheld. This information is then entered into the appropriate sections of the form. It is essential to double-check all entries for accuracy to avoid potential penalties or discrepancies with the IRS.

Steps to complete the Withheld For Quarter Ending 930

To complete the Withheld For Quarter Ending 930, follow these steps:

- Gather all relevant payroll records for the quarter.

- Calculate the total wages paid to employees.

- Determine the total federal income tax withheld from those wages.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors before submission.

- Submit the form to the IRS by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Withheld For Quarter Ending 930 are critical to ensure compliance. Typically, the form must be submitted by the last day of the month following the end of the quarter. For example, for the quarter ending September 30, the form should be filed by October 31. Staying aware of these deadlines helps avoid late fees and penalties.

Legal use of the Withheld For Quarter Ending 930

The legal use of the Withheld For Quarter Ending 930 is governed by IRS regulations. Employers are required to use this form to report withheld taxes accurately. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is important for businesses to understand their obligations under federal tax law to maintain legal compliance.

Who Issues the Form

The Withheld For Quarter Ending 930 is issued by the Internal Revenue Service (IRS). This form is part of the IRS's efforts to ensure that employers report withheld taxes correctly. Employers must obtain the latest version of the form directly from the IRS to ensure compliance with current regulations.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Withheld For Quarter Ending 930 can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is vital for employers to adhere to filing deadlines and ensure accuracy in reporting to mitigate these risks.

Quick guide on how to complete withheld for quarter ending 930

Effortlessly Prepare Withheld For Quarter Ending 930 on Any Device

Digital document management has gained signNow traction among organizations and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Withheld For Quarter Ending 930 across any platform with airSlate SignNow's Android or iOS applications and streamline any document-driven task today.

How to Modify and eSign Withheld For Quarter Ending 930 with Ease

- Obtain Withheld For Quarter Ending 930 and select Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information carefully and click on the Done button to save your changes.

- Select your preferred method to share your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Withheld For Quarter Ending 930 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withheld for quarter ending 930

Create this form in 5 minutes!

How to create an eSignature for the withheld for quarter ending 930

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'Withheld For Quarter Ending 930' mean in terms of document signing?

The term 'Withheld For Quarter Ending 930' refers to the retention of certain documents related to financial reporting. Using airSlate SignNow, businesses can eSign and securely store these documents, ensuring compliance and easy retrieval when needed.

-

How can airSlate SignNow help manage documents marked 'Withheld For Quarter Ending 930'?

airSlate SignNow offers a streamlined process for managing documents marked 'Withheld For Quarter Ending 930'. Our platform allows users to sign, send, and store these vital documents electronically, reducing paper usage and enhancing efficiency.

-

What are the pricing options for airSlate SignNow regarding the 'Withheld For Quarter Ending 930' feature?

airSlate SignNow provides competitive pricing plans that cater to businesses needing to manage documents like 'Withheld For Quarter Ending 930'. Each plan includes features tailored for easy eSigning and document management, ensuring you find an option that meets your budget.

-

Can airSlate SignNow integrate with other tools for 'Withheld For Quarter Ending 930' documentation?

Yes, airSlate SignNow seamlessly integrates with various popular applications, making it easy to manage 'Withheld For Quarter Ending 930' documents alongside your existing tools. This integration simplifies workflows and boosts productivity for teams.

-

What are the key benefits of using airSlate SignNow for documents 'Withheld For Quarter Ending 930'?

Using airSlate SignNow allows businesses to enhance efficiency and improve compliance when dealing with 'Withheld For Quarter Ending 930' documents. The platform simplifies the signing process, reduces turnaround times, and elevates the overall document management strategy.

-

Is airSlate SignNow suitable for small businesses handling 'Withheld For Quarter Ending 930'?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises managing 'Withheld For Quarter Ending 930' documents. Our user-friendly platform empowers small businesses to streamline their document signing process without extensive resources.

-

What features does airSlate SignNow offer for tracking 'Withheld For Quarter Ending 930' documents?

airSlate SignNow equips users with comprehensive tracking features for documents labeled 'Withheld For Quarter Ending 930'. You can monitor the status of each document, see who has signed, and receive notifications, allowing you to maintain control and visibility over your workflow.

Get more for Withheld For Quarter Ending 930

Find out other Withheld For Quarter Ending 930

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document