Form MO PTS Property Tax Credit Schedule 2023-2026

What is the Form MO PTS Property Tax Credit Schedule

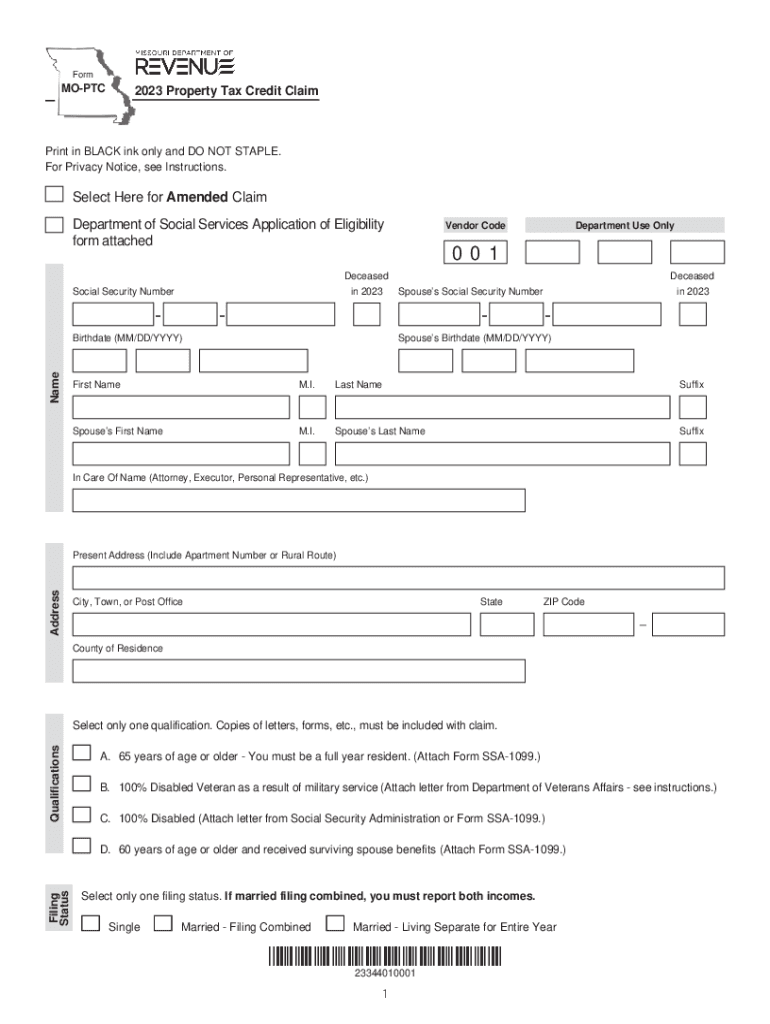

The Form MO PTS is a property tax credit schedule used in Missouri. This form allows eligible residents to claim a credit against their property taxes. It is specifically designed for individuals who meet certain criteria, such as age, disability status, or income limitations. The credit is intended to alleviate the financial burden of property taxes on qualifying homeowners and renters. Understanding the purpose of this form is essential for those looking to benefit from the property tax credit available in Missouri.

Eligibility Criteria for the Form MO PTS Property Tax Credit Schedule

To qualify for the Form MO PTS property tax credit, applicants must meet specific eligibility requirements. Generally, these include:

- Being a resident of Missouri.

- Being at least 65 years old, or being a person with a disability.

- Meeting income limits set by the state.

- Having paid property taxes on a primary residence.

It is important for applicants to review these criteria carefully to ensure they qualify before completing the form.

Steps to Complete the Form MO PTS Property Tax Credit Schedule

Completing the Form MO PTS involves a series of straightforward steps. Here’s a general outline of the process:

- Gather necessary documentation, including proof of income and property tax payments.

- Obtain the form from the Missouri Department of Revenue or download it online.

- Fill out the form accurately, providing all required personal and financial information.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either online or via mail.

Following these steps can help ensure that the application process goes smoothly and that applicants receive their credits in a timely manner.

How to Obtain the Form MO PTS Property Tax Credit Schedule

The Form MO PTS can be obtained through several methods. Residents can access the form by visiting the Missouri Department of Revenue's official website, where it is available for download. Additionally, physical copies of the form can be requested at local government offices or tax assistance centers. It is advisable to obtain the most current version of the form to ensure compliance with any updates or changes in the law.

Form Submission Methods for the MO PTS Property Tax Credit Schedule

Submitting the Form MO PTS can be done through multiple methods, making it accessible for all applicants. The available submission methods include:

- Online submission through the Missouri Department of Revenue's website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local government offices.

Choosing the right method depends on personal preference and convenience, but it is essential to ensure that the form is submitted by the deadline to avoid any penalties.

Key Elements of the Form MO PTS Property Tax Credit Schedule

Understanding the key elements of the Form MO PTS is crucial for successful completion. Important components of the form include:

- Personal information section, where applicants provide their name, address, and contact details.

- Income information, which requires disclosure of all sources of income to determine eligibility.

- Property tax payment details, where applicants must indicate the amount of property taxes paid during the year.

- Signature section, where the applicant must sign and date the form to certify its accuracy.

Each of these elements plays a vital role in the processing of the application and the determination of the credit amount.

Quick guide on how to complete form mo pts property tax credit schedule

Complete Form MO PTS Property Tax Credit Schedule effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Form MO PTS Property Tax Credit Schedule on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form MO PTS Property Tax Credit Schedule with ease

- Locate Form MO PTS Property Tax Credit Schedule and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Form MO PTS Property Tax Credit Schedule while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo pts property tax credit schedule

Create this form in 5 minutes!

How to create an eSignature for the form mo pts property tax credit schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo pts form 2023 and how does it work with airSlate SignNow?

The mo pts form 2023 is a specialized document designed for efficient processing of specific business needs. With airSlate SignNow, you can seamlessly eSign and manage your mo pts form 2023 online, ensuring that everything stays organized and compliant throughout the signing process.

-

How can airSlate SignNow help me complete the mo pts form 2023 faster?

AirSlate SignNow streamlines the completion of the mo pts form 2023 by allowing you to eSign documents in a matter of minutes. With features like templates and automated workflows, you can expedite your signing process and focus more on your business.

-

Are there any costs associated with using airSlate SignNow for the mo pts form 2023?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs when using the mo pts form 2023. You can choose a plan that suits your budget while enjoying the benefits of a cost-effective solution for document signing.

-

What are the benefits of using airSlate SignNow for the mo pts form 2023?

Using airSlate SignNow for the mo pts form 2023 provides numerous benefits, including enhanced security, ease of use, and quick turnaround times. This platform ensures that you can securely manage and sign your documents while maintaining compliance with industry standards.

-

Can I integrate airSlate SignNow with other software to manage the mo pts form 2023?

Absolutely! airSlate SignNow offers a range of integrations with popular software tools, allowing you to efficiently manage the mo pts form 2023 alongside your existing workflows. This flexibility ensures that you can maintain a seamless flow of information across platforms.

-

Is there a trial period for using airSlate SignNow for the mo pts form 2023?

Yes, airSlate SignNow provides a trial period for new users to explore the functionalities of the platform, including the management of the mo pts form 2023. This trial allows you to assess whether the platform meets your business needs before committing to a subscription.

-

How secure is airSlate SignNow when handling the mo pts form 2023?

AirSlate SignNow places a high priority on security, utilizing advanced encryption methods to protect your documents, including the mo pts form 2023. This robust security infrastructure ensures that all transactions and sensitive information remain confidential and secure.

Get more for Form MO PTS Property Tax Credit Schedule

Find out other Form MO PTS Property Tax Credit Schedule

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors