Extension of Time to File PA Department of Revenue 2023

Understanding the Missouri MO 60 Form

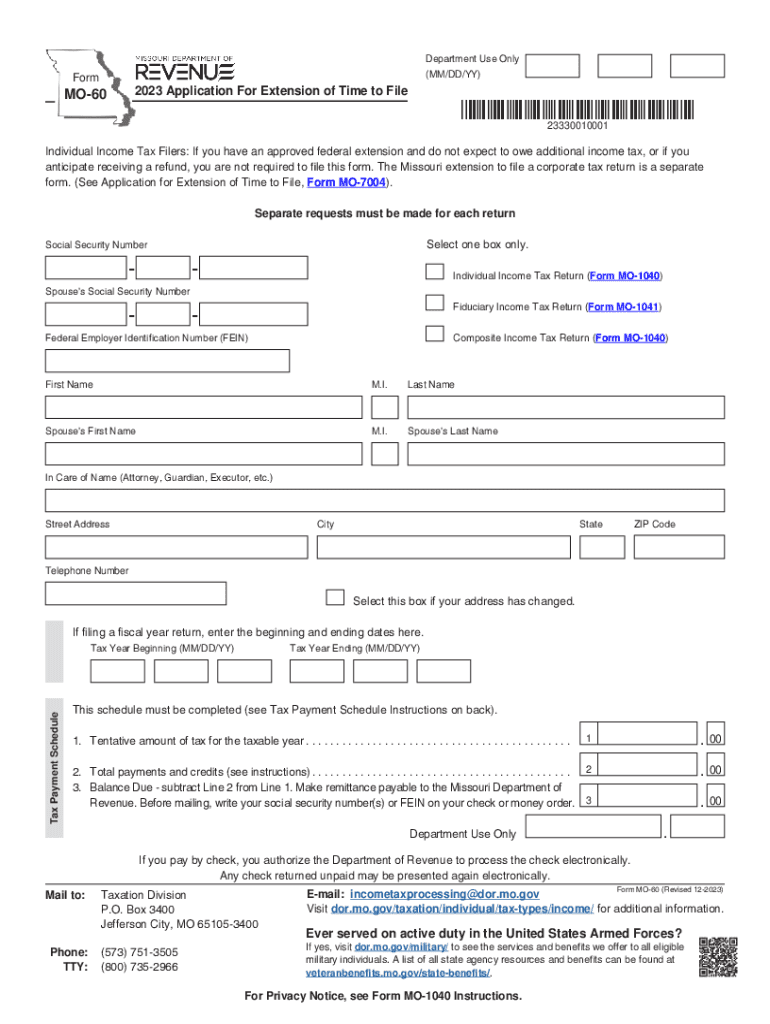

The Missouri MO 60 form is an essential document for taxpayers seeking an extension of time to file their state income tax returns. This form allows individuals and businesses to request additional time to complete their tax filings without incurring penalties. The MO 60 is particularly useful for those who may need more time due to complex financial situations or unforeseen circumstances. Understanding the specifics of this form is crucial for ensuring compliance with Missouri tax regulations.

Eligibility Criteria for the MO 60 Extension

To qualify for the Missouri MO 60 extension, taxpayers must meet certain eligibility criteria. Generally, any individual or entity that is required to file a Missouri income tax return can apply for this extension. It is important to note that while the extension provides more time to file, it does not extend the time to pay any taxes owed. Therefore, taxpayers should estimate their tax liability and pay any amounts due by the original filing deadline to avoid penalties and interest.

Steps to Complete the MO 60 Form

Completing the Missouri MO 60 form involves several straightforward steps:

- Obtain the MO 60 form from the Missouri Department of Revenue website or through authorized channels.

- Provide your personal information, including your name, address, and Social Security number or Federal Employer Identification Number.

- Indicate the reason for requesting the extension, ensuring you provide a valid justification.

- Sign and date the form to certify that the information is accurate.

- Submit the completed form to the Missouri Department of Revenue by the original filing deadline.

Filing Deadlines for the MO 60 Form

It is essential to be aware of the filing deadlines associated with the Missouri MO 60 form. Typically, the form must be submitted by the original due date of the tax return, which is usually April 15 for individual taxpayers. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Timely submission of the MO 60 is critical to avoid penalties and ensure that you receive the additional time to file your return.

Form Submission Methods for the MO 60

The Missouri MO 60 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Missouri Department of Revenue's e-filing system.

- Mailing the completed form to the appropriate address provided on the form.

- In-person submission at designated Missouri Department of Revenue offices.

Choosing the most convenient submission method can help ensure that the form is filed on time.

Penalties for Non-Compliance with the MO 60

Failure to file the Missouri MO 60 form by the deadline can result in penalties. Taxpayers who do not submit the form on time may face late filing penalties, which can accumulate over time. Additionally, any unpaid taxes may incur interest charges. It is important to adhere to the deadlines and requirements associated with the MO 60 to avoid unnecessary financial consequences.

Quick guide on how to complete extension of time to file pa department of revenue

Easily Prepare Extension Of Time To File PA Department Of Revenue on Any Device

Managing documents online has become increasingly preferred by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Extension Of Time To File PA Department Of Revenue on any device using the airSlate SignNow applications for Android or iOS, and streamline your document-related tasks today.

The Easiest Way to Modify and eSign Extension Of Time To File PA Department Of Revenue Effortlessly

- Obtain Extension Of Time To File PA Department Of Revenue and select Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive data with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign Extension Of Time To File PA Department Of Revenue to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct extension of time to file pa department of revenue

Create this form in 5 minutes!

How to create an eSignature for the extension of time to file pa department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form mo 60 2023 and why is it important?

The form mo 60 2023 is a crucial document for businesses and individuals in Missouri, often required for various regulatory and compliance purposes. Understanding how to complete and submit the form mo 60 2023 correctly is essential to avoid any legal complications.

-

How can airSlate SignNow help me with the form mo 60 2023?

airSlate SignNow streamlines the eSigning process, allowing you to fill out and send the form mo 60 2023 quickly and efficiently. With features like templates and in-app guidance, you can ensure accurate completion and timely submission.

-

Is there a cost associated with using airSlate SignNow for the form mo 60 2023?

Yes, while airSlate SignNow offers a free trial, pricing plans are available that cater to various business needs. Investing in airSlate SignNow for handling the form mo 60 2023 can save you time and reduce errors.

-

What features does airSlate SignNow offer for completing the form mo 60 2023?

airSlate SignNow provides features such as document templates, in-app editing, and real-time collaboration, which can enhance your experience when working with the form mo 60 2023. Additionally, its user-friendly interface simplifies the eSigning process.

-

Can I integrate airSlate SignNow with other applications for managing the form mo 60 2023?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the form mo 60 2023 alongside your other business tools. This integration helps you maintain workflow efficiency and data consistency.

-

What are the benefits of using airSlate SignNow for the form mo 60 2023?

Using airSlate SignNow for the form mo 60 2023 offers numerous benefits, including reduced turnaround times, improved accuracy, and enhanced compliance with legal standards. These advantages can lead to increased productivity for your business.

-

Is it secure to send the form mo 60 2023 through airSlate SignNow?

Yes, airSlate SignNow employs robust security measures to protect all documents and data, including the form mo 60 2023. You can trust that your information remains confidential and secure throughout the eSigning process.

Get more for Extension Of Time To File PA Department Of Revenue

- Vacine register for vaccine colorado form

- Shining star award nomination form larimer county co larimer co

- Columbine parks pass form

- Colorado grievance form

- Co holding food form

- Arch ii rocky hill pdf documents form

- State of connecticut change to retiree direct deposit form

- Ct wartime medal application form

Find out other Extension Of Time To File PA Department Of Revenue

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement