Pa Form Rev 545 2017-2026

What is the Pa Form Rev 545

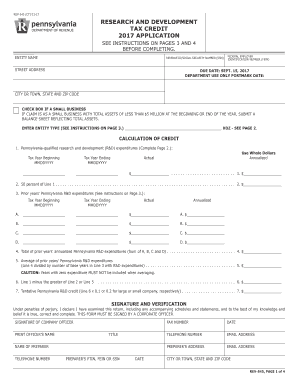

The Pa Form Rev 545 is a tax document utilized by businesses in Pennsylvania to apply for various tax credits. This form is specifically designed to facilitate claims related to the Pennsylvania Research and Development Tax Credit. It allows eligible businesses to receive financial benefits for qualifying research activities conducted within the state. Understanding the purpose and requirements of this form is essential for businesses seeking to optimize their tax obligations.

Steps to complete the Pa Form Rev 545

Completing the Pa Form Rev 545 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation that supports your claim for the research credit. This may include financial statements, project descriptions, and any relevant supporting materials. Next, fill out the form carefully, providing detailed information about your business and the research activities conducted. Be sure to double-check all entries for accuracy. Once completed, you can submit the form electronically or via mail, depending on your preference.

Eligibility Criteria

To qualify for the Pennsylvania Research and Development Tax Credit, businesses must meet specific eligibility criteria outlined by the state. Generally, eligible entities include corporations, partnerships, and limited liability companies engaged in qualified research activities. The research must be conducted within Pennsylvania, and the expenses claimed must be directly related to the development or improvement of products, processes, or software. It is crucial to review the eligibility requirements thoroughly to ensure compliance before submitting the Pa Form Rev 545.

Legal use of the Pa Form Rev 545

The legal use of the Pa Form Rev 545 is governed by Pennsylvania tax regulations. Businesses must ensure that their claims are substantiated by adequate documentation and that they adhere to all relevant state laws. Misuse of the form, such as filing inaccurate claims or failing to provide necessary supporting documents, can lead to penalties or denial of the credit. Understanding the legal implications of the form is essential for businesses to protect themselves and ensure compliance with state tax laws.

Form Submission Methods

The Pa Form Rev 545 can be submitted through various methods, providing flexibility for businesses. Options include online submission through the Pennsylvania Department of Revenue's e-filing system, mailing a physical copy to the appropriate tax office, or delivering it in person. Each method has its own set of guidelines and requirements, so it is important to choose the one that best suits your business's needs while ensuring timely submission.

Key elements of the Pa Form Rev 545

Understanding the key elements of the Pa Form Rev 545 is critical for successful completion. The form typically includes sections for business identification, details of the research activities, and a breakdown of eligible expenses. Additionally, it may require the inclusion of supporting documentation to substantiate the claims made. Familiarizing yourself with these elements can help streamline the completion process and enhance the likelihood of approval for the tax credit.

Quick guide on how to complete rev 545 formpdffillercom 2017 2019 399220584

Your assistance manual on how to prepare your Pa Form Rev 545

If you’re wondering how to finalize and submit your Pa Form Rev 545, here are some concise instructions on how to simplify tax processing.

Initially, you just need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, create, and complete your tax documents with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, returning to amend information as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow the steps below to achieve your Pa Form Rev 545 in minutes:

- Create your account and start processing PDFs in no time.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to open your Pa Form Rev 545 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if required).

- Review your document and rectify any mistakes.

- Save modifications, print your copy, submit it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in hard copy can lead to more errors and delays in refunds. It is essential to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct rev 545 formpdffillercom 2017 2019 399220584

FAQs

-

How should I fill my preferences in the NEET 2017 for the AIR quota? Should I fill the private medical college options? I have scored 545 marks in UR.

Congratulations for such good marks in NEET,buT don't feel disheartened you will defeanety get a seat in govt. Medical collage through state quota.Coming back to your 1st question, here I am giving general trend followed by most students over past few years :Delhi university medical collagesVMMC Delhi and other Ipu collageGrant medical collageTNMC MUMBAIIMS bhuKgmu lucknowRg kar mc kolkataAll these collages that I have mentioned are some of the best collages you can get through AIQ.But at 545 you can try for collages which are located in various state capitals bcoz in State capitals collages have better infrastructure and facilities as compared with those that are located in periferal cities.Here the prefrence order I would like to suggest you (priority wise)Top 10 govt collagesCollage in metro citiesCollages in state capitalsCollage near to your home cityYes you can try for private collages but I think you have fair chances of getting govt. Collage thru state quota if you are not from some highly competitive states like Delhi, haryana and kerala.Thanks

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

What should I do if I filled out the FAFSA application for 2018-2019 instead of 2017-2018?

Speak with the financial aid office at the college if your choice to make sure that this is actually a problem.

Create this form in 5 minutes!

How to create an eSignature for the rev 545 formpdffillercom 2017 2019 399220584

How to generate an electronic signature for the Rev 545 Formpdffillercom 2017 2019 399220584 online

How to generate an eSignature for your Rev 545 Formpdffillercom 2017 2019 399220584 in Google Chrome

How to create an eSignature for putting it on the Rev 545 Formpdffillercom 2017 2019 399220584 in Gmail

How to make an eSignature for the Rev 545 Formpdffillercom 2017 2019 399220584 straight from your smart phone

How to create an electronic signature for the Rev 545 Formpdffillercom 2017 2019 399220584 on iOS

How to make an electronic signature for the Rev 545 Formpdffillercom 2017 2019 399220584 on Android OS

People also ask

-

What is the Pennsylvania form credit and how can airSlate SignNow help?

The Pennsylvania form credit is a tax benefit that can help businesses in Pennsylvania reduce their tax liability. airSlate SignNow simplifies the process of completing and eSigning these forms, ensuring that your documentation is accurate and compliant.

-

How much does airSlate SignNow cost for using Pennsylvania forms?

airSlate SignNow offers a variety of pricing plans to suit different business needs. You can choose a plan that best fits your requirements for managing Pennsylvania form credit and accessing all essential features without breaking the bank.

-

What features does airSlate SignNow offer for Pennsylvania form credit?

AirSlate SignNow provides features specifically designed to assist with Pennsylvania form credit, including customizable templates, automatic reminders, and secure electronic signatures. These tools not only enhance efficiency but also help ensure compliance with Pennsylvania regulations.

-

Is airSlate SignNow user-friendly for managing Pennsylvania form credit?

Yes, airSlate SignNow is designed with user experience in mind, making it incredibly easy to manage Pennsylvania form credit. Its intuitive interface enables users of all skill levels to complete and eSign forms quickly and efficiently.

-

Can I integrate airSlate SignNow with other software for Pennsylvania form credit management?

Absolutely! airSlate SignNow integrates seamlessly with various applications and platforms to enhance your Pennsylvania form credit management. This includes popular CRMs, cloud storage solutions, and more, allowing for a more streamlined workflow.

-

What are the benefits of using airSlate SignNow for Pennsylvania form credit?

Using airSlate SignNow to manage Pennsylvania form credit can save time, reduce paperwork, and eliminate the risk of errors. Additionally, the ability to eSign documents securely helps ensure that your submissions are processed efficiently.

-

How secure is airSlate SignNow when handling Pennsylvania form credit?

airSlate SignNow prioritizes security, implementing advanced encryption and compliance protocols to protect your Pennsylvania form credit information. You can trust that your documents and sensitive data are safeguarded throughout the eSigning process.

Get more for Pa Form Rev 545

Find out other Pa Form Rev 545

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document