Research and Development Tax Credit Application REV 545 FormsPublications 2016

What is the Research And Development Tax Credit Application REV 545 FormsPublications

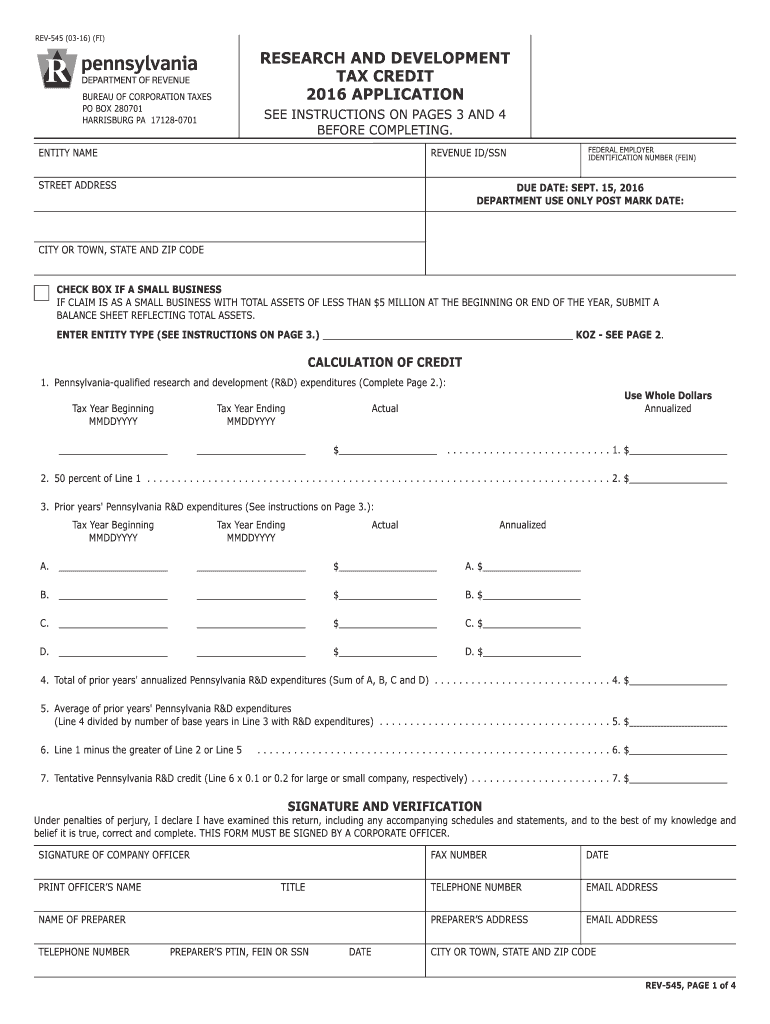

The Research And Development Tax Credit Application REV 545 FormsPublications is a crucial document for businesses seeking to claim tax credits related to research and development activities. This form is designed to help organizations report eligible expenses accurately and efficiently. It outlines the necessary information required by the IRS to assess the validity of the credit. Understanding this form is essential for companies aiming to leverage tax incentives that support innovation and development efforts.

Steps to complete the Research And Development Tax Credit Application REV 545 FormsPublications

Completing the Research And Development Tax Credit Application REV 545 FormsPublications involves several key steps:

- Gather necessary documentation, including financial records and project descriptions.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign the form electronically using a compliant eSignature solution.

- Submit the completed form to the IRS by the specified deadline.

Following these steps can help ensure that your application is processed smoothly and efficiently.

Eligibility Criteria

To qualify for the Research And Development Tax Credit, businesses must meet specific eligibility criteria. Generally, eligible activities include:

- Developing or improving products, processes, or software.

- Conducting experimental or laboratory research.

- Utilizing qualified research expenses, such as wages and supplies.

Understanding these criteria is vital for businesses to determine their eligibility for the tax credit.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the Research And Development Tax Credit Application REV 545 FormsPublications. These guidelines detail the types of activities that qualify, the documentation required, and the procedures for filing. Businesses should familiarize themselves with these guidelines to ensure compliance and maximize their potential tax benefits. Regular updates from the IRS may also affect eligibility and filing requirements, making it essential to stay informed.

Required Documents

When completing the Research And Development Tax Credit Application REV 545 FormsPublications, specific documents are necessary to support your claims. These may include:

- Financial statements detailing research expenditures.

- Project descriptions outlining the nature of the research.

- Payroll records for employees involved in research activities.

Having these documents readily available can streamline the application process and enhance the credibility of your submission.

Form Submission Methods

The Research And Development Tax Credit Application REV 545 FormsPublications can be submitted through various methods, including:

- Online submission via the IRS e-file system.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices.

Each method has its own set of advantages, and businesses should choose the one that best fits their needs and ensures timely processing.

Quick guide on how to complete 2016 research and development tax credit application rev 545 formspublications

Your assistance manual on how to prepare your Research And Development Tax Credit Application REV 545 FormsPublications

If you’re looking to understand how to complete and submit your Research And Development Tax Credit Application REV 545 FormsPublications, here are a few brief instructions on how to simplify tax processing.

To begin, all you need to do is create your airSlate SignNow account to revolutionize your document handling online. airSlate SignNow is a highly user-friendly and robust document management solution that allows you to edit, draft, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify details as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to complete your Research And Development Tax Credit Application REV 545 FormsPublications within minutes:

- Create your account and start editing PDFs in moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Select Get form to open your Research And Development Tax Credit Application REV 545 FormsPublications in our editor.

- Input the necessary fields with your information (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if needed).

- Examine your document and rectify any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that paper submissions can lead to increased errors and delay refunds. Importantly, before you e-file your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2016 research and development tax credit application rev 545 formspublications

FAQs

-

How do you fill out the "Employer Activity" box in the ISB PGP Pro application? Would you need to do a deep research about your company and fill it out?

I don't think so.You may want to go to the website of the company to understand what it's doing to make money.Eg: Tata motors is a car manufacturer, Air India is an airliner, Microsoft is a software developer, Oyo rooms is an internet hotel aggregator, BCG is a consulting company and ISB is a business school.I hope this helps.Wish you all the best.

-

Is there a step by step guide as to how a united kingdom startup can benefit from research and development tax credits without having to hire an expensive accountant?

Depends if by “expensive” you only mean “up front cost”.We’re a UK based cyber security start-up (CyberSparta) and are working with a specialist R&D Tax Credit company on a simple no-win-no-fee basis. Works for us even though they will receive a tidy back-end fee if/when we successfully claim.We figured it woulda) save us a LOT of timeb) minimise any potential dispute with HMRCc) maximise the amount of claim we can achieveFeel free to signNow out if you have any specific queries/want more details of the process we went through.

Create this form in 5 minutes!

How to create an eSignature for the 2016 research and development tax credit application rev 545 formspublications

How to generate an eSignature for your 2016 Research And Development Tax Credit Application Rev 545 Formspublications online

How to create an eSignature for your 2016 Research And Development Tax Credit Application Rev 545 Formspublications in Google Chrome

How to make an eSignature for putting it on the 2016 Research And Development Tax Credit Application Rev 545 Formspublications in Gmail

How to create an electronic signature for the 2016 Research And Development Tax Credit Application Rev 545 Formspublications right from your smartphone

How to create an electronic signature for the 2016 Research And Development Tax Credit Application Rev 545 Formspublications on iOS

How to create an electronic signature for the 2016 Research And Development Tax Credit Application Rev 545 Formspublications on Android OS

People also ask

-

What is the Research And Development Tax Credit Application REV 545 FormsPublications?

The Research And Development Tax Credit Application REV 545 FormsPublications is a documentation process that allows businesses to claim tax credits for their research and development activities. It provides essential guidelines and forms necessary to ensure compliance with state regulations while maximizing tax benefits.

-

How can airSlate SignNow assist with the Research And Development Tax Credit Application REV 545 FormsPublications?

airSlate SignNow streamlines the process of completing and submitting the Research And Development Tax Credit Application REV 545 FormsPublications by allowing users to eSign necessary documents effortlessly. This reduces paperwork and facilitates a smoother application process for your tax credits.

-

What features does airSlate SignNow offer for managing the Research And Development Tax Credit Application REV 545 FormsPublications?

airSlate SignNow offers features like document template creation, easy-to-access mobile signing, secure cloud storage, and real-time tracking. These features enhance efficiency and ensure that all forms related to the Research And Development Tax Credit Application REV 545 FormsPublications are handled promptly and securely.

-

Is airSlate SignNow a cost-effective solution for handling the Research And Development Tax Credit Application REV 545 FormsPublications?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By using our platform to manage the Research And Development Tax Credit Application REV 545 FormsPublications, you can save on paper costs and administrative hours, maximizing your potential tax credits.

-

Can I integrate airSlate SignNow with other tools for the Research And Development Tax Credit Application REV 545 FormsPublications?

Absolutely! airSlate SignNow integrates seamlessly with many popular business tools, enhancing your workflow for the Research And Development Tax Credit Application REV 545 FormsPublications. Whether you use CRM systems or financial software, airSlate SignNow can fit into your existing processes for greater efficiency.

-

What are the benefits of using airSlate SignNow for the Research And Development Tax Credit Application REV 545 FormsPublications?

By utilizing airSlate SignNow for your Research And Development Tax Credit Application REV 545 FormsPublications, you gain improved organization, faster processing times, and enhanced security measures. This leads to a more streamlined experience, ensuring you can focus on your business while we handle your documentation needs.

-

Are there any specific requirements for completing the Research And Development Tax Credit Application REV 545 FormsPublications?

Yes, there are specific requirements that businesses must meet when completing the Research And Development Tax Credit Application REV 545 FormsPublications. These include maintaining accurate records of R&D activities, expenses incurred, and aligning with guidelines set by tax authorities to qualify for credits.

Get more for Research And Development Tax Credit Application REV 545 FormsPublications

Find out other Research And Development Tax Credit Application REV 545 FormsPublications

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document