TRADITIONAL IRARoth IRA Rollover Certification Form

What is the TRADITIONAL IRARoth IRA Rollover Certification Form

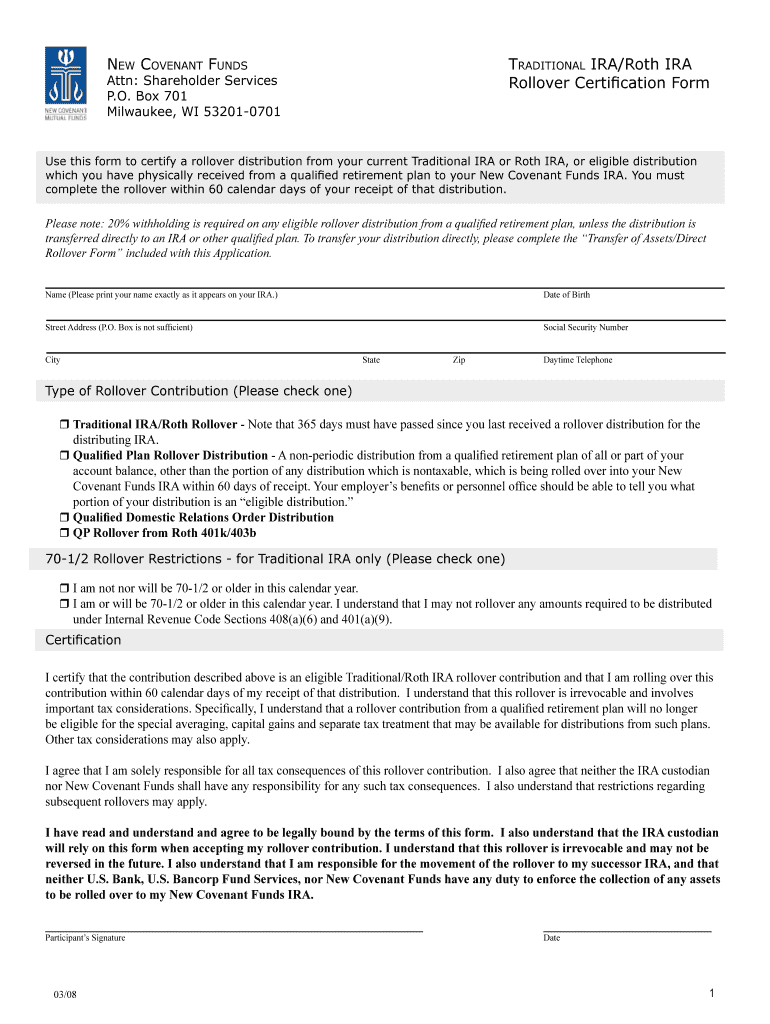

The TRADITIONAL IRARoth IRA Rollover Certification Form is a crucial document used in the process of transferring funds from a traditional IRA to a Roth IRA. This form certifies that the rollover meets IRS requirements, ensuring that the funds are eligible for tax-free growth and withdrawals in the future. It serves as a declaration that the individual is aware of the tax implications and rules surrounding the conversion, including the potential tax liabilities incurred during the rollover process.

How to use the TRADITIONAL IRARoth IRA Rollover Certification Form

To effectively use the TRADITIONAL IRARoth IRA Rollover Certification Form, individuals must first gather necessary information regarding their traditional IRA and the Roth IRA they wish to convert to. This includes account numbers, the financial institutions involved, and the amount to be rolled over. After completing the form, it should be submitted to the financial institution managing the Roth IRA. This institution will process the rollover and ensure compliance with IRS regulations.

Steps to complete the TRADITIONAL IRARoth IRA Rollover Certification Form

Completing the TRADITIONAL IRARoth IRA Rollover Certification Form involves several key steps:

- Gather all relevant account information, including the traditional IRA and Roth IRA details.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form to the financial institution managing the Roth IRA.

- Keep a copy of the submitted form for your records.

Key elements of the TRADITIONAL IRARoth IRA Rollover Certification Form

The TRADITIONAL IRARoth IRA Rollover Certification Form contains several key elements that are essential for a successful rollover. These include:

- Personal Information: Includes the account holder's name, address, and Social Security number.

- Account Details: Information about the traditional IRA and Roth IRA accounts.

- Rollover Amount: The specific amount being rolled over from the traditional IRA to the Roth IRA.

- Certification Statement: A declaration confirming the understanding of tax implications and compliance with IRS rules.

IRS Guidelines

The IRS provides specific guidelines regarding the rollover from a traditional IRA to a Roth IRA. These guidelines outline the eligibility criteria, tax implications, and reporting requirements for individuals. It is crucial to adhere to these guidelines to avoid penalties and ensure the rollover is executed correctly. Understanding these regulations can help individuals make informed decisions regarding their retirement savings and tax strategies.

Eligibility Criteria

To successfully complete a rollover from a traditional IRA to a Roth IRA using the TRADITIONAL IRARoth IRA Rollover Certification Form, individuals must meet certain eligibility criteria. Generally, there are no income limits for conversions, but individuals should consider their current tax bracket, as the amount rolled over will be subject to income tax in the year of the conversion. Additionally, individuals must have an existing traditional IRA and a Roth IRA to facilitate the rollover.

Quick guide on how to complete traditional iraroth ira rollover certification form

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, edit, and electronically sign your documents quickly and efficiently. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The easiest way to edit and eSign [SKS] without any hassle

- Obtain [SKS] and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to preserve your updates.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Edit and eSign [SKS] and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to TRADITIONAL IRARoth IRA Rollover Certification Form

Create this form in 5 minutes!

How to create an eSignature for the traditional iraroth ira rollover certification form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TRADITIONAL IRARoth IRA Rollover Certification Form?

The TRADITIONAL IRARoth IRA Rollover Certification Form is an essential document that facilitates the transfer of funds from a Traditional IRA to a Roth IRA. This form ensures compliance with IRS regulations and helps clients maintain accurate records during the rollover process.

-

How can I obtain the TRADITIONAL IRARoth IRA Rollover Certification Form?

You can easily obtain the TRADITIONAL IRARoth IRA Rollover Certification Form through airSlate SignNow's user-friendly platform. Simply navigate to our forms section, and you will find the certification form ready for use, streamlining your rollover process.

-

What are the benefits of using airSlate SignNow for this certification form?

Using airSlate SignNow to complete the TRADITIONAL IRARoth IRA Rollover Certification Form offers several benefits, including a faster turnaround time and enhanced security for your documents. Additionally, our platform provides easy eSigning features that simplify the entire process.

-

Is there a cost associated with using the TRADITIONAL IRARoth IRA Rollover Certification Form on airSlate SignNow?

Yes, while airSlate SignNow offers competitive pricing, the use of the TRADITIONAL IRARoth IRA Rollover Certification Form is included in our subscription plans. This cost-effective solution provides invaluable features at a reasonable price.

-

Can I integrate airSlate SignNow with other financial software for processing this form?

Absolutely! airSlate SignNow offers multiple integrations with various financial software. This allows you to seamlessly manage the TRADITIONAL IRARoth IRA Rollover Certification Form alongside your existing financial tools.

-

How secure is my information when using the TRADITIONAL IRARoth IRA Rollover Certification Form?

Your security is our priority. When using the TRADITIONAL IRARoth IRA Rollover Certification Form on airSlate SignNow, all your documents are encrypted, and we comply with industry standards to keep your data safe throughout the eSigning process.

-

Can I track the status of my TRADITIONAL IRARoth IRA Rollover Certification Form?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your TRADITIONAL IRARoth IRA Rollover Certification Form in real-time. You will receive notifications when the form is viewed and completed by all parties involved.

Get more for TRADITIONAL IRARoth IRA Rollover Certification Form

- Prescription drug claim form procare rx

- Jd cl 28 form

- Chapman piloting seamanship pdf form

- Caloptima prior bauthorization formb caloptima

- Shc d 08 superior court form

- Exercise 1 jesus friendship circles judson press form

- Arizona superior court forms fillable

- Missions gifts remittance form baptist state convention of ncbaptist

Find out other TRADITIONAL IRARoth IRA Rollover Certification Form

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free