Request for Transfer or Conversion Form

What is the Request For Transfer Or Conversion Form

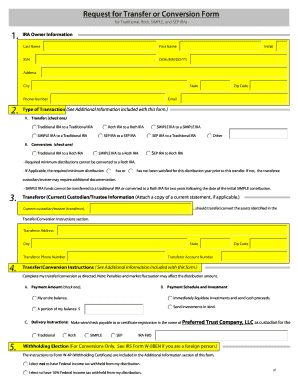

The Request For Transfer Or Conversion Form is a vital document used primarily in the context of transferring or converting assets, rights, or obligations between entities or individuals. This form is commonly utilized in various legal and financial scenarios, such as changing the ownership of property or converting business structures. It ensures that all parties involved have a clear understanding of the terms and conditions surrounding the transfer or conversion, providing a legal framework for the transaction.

How to use the Request For Transfer Or Conversion Form

Using the Request For Transfer Or Conversion Form involves several key steps. First, ensure that you have the correct version of the form, as requirements may vary by state or purpose. Next, fill out the form accurately, providing all necessary information such as the names of the parties involved, the specific assets or rights being transferred, and any relevant dates. After completing the form, review it for accuracy and completeness before submitting it according to the specified submission methods.

Steps to complete the Request For Transfer Or Conversion Form

Completing the Request For Transfer Or Conversion Form requires careful attention to detail. Follow these steps:

- Gather all necessary information, including personal identification and details about the assets or rights involved.

- Obtain the correct form from an official source or website.

- Fill in the required fields, ensuring that all information is accurate and up-to-date.

- Sign and date the form, if required, to validate the request.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Request For Transfer Or Conversion Form

The legal use of the Request For Transfer Or Conversion Form is crucial for ensuring compliance with applicable laws and regulations. This form serves as a formal record of the transaction, protecting the rights of all parties involved. It is essential to understand the legal implications of the transfer or conversion, including any potential liabilities or obligations that may arise. Consulting with a legal professional may be advisable to navigate complex situations effectively.

Required Documents

To successfully complete the Request For Transfer Or Conversion Form, certain documents may be required. These typically include:

- Proof of identity for all parties involved, such as a driver's license or passport.

- Documentation of the assets or rights being transferred, such as titles or contracts.

- Any prior agreements or forms related to the transaction that may provide context or additional information.

Form Submission Methods

Submitting the Request For Transfer Or Conversion Form can be done through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via a secure portal, if available.

- Mailing the completed form to the designated office or agency.

- Delivering the form in person to the appropriate location.

Quick guide on how to complete request for transfer or conversion form

Prepare [SKS] effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Request For Transfer Or Conversion Form

Create this form in 5 minutes!

How to create an eSignature for the request for transfer or conversion form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Request For Transfer Or Conversion Form?

The Request For Transfer Or Conversion Form is a document designed to facilitate the transfer or conversion of services or assets within your organization. Using airSlate SignNow, this form can be easily customized and sent for eSignature, streamlining the process and enhancing efficiency.

-

How can I access the Request For Transfer Or Conversion Form?

You can access the Request For Transfer Or Conversion Form directly through the airSlate SignNow platform. Once logged in, simply navigate to the templates section where you can find and customize the form to suit your specific business needs.

-

Is there a cost associated with using the Request For Transfer Or Conversion Form?

airSlate SignNow offers competitive pricing plans that allow you to utilize the Request For Transfer Or Conversion Form and other features. Our pricing is designed to be budget-friendly, making it accessible for businesses of all sizes without compromising on quality.

-

What features are included with the Request For Transfer Or Conversion Form?

The Request For Transfer Or Conversion Form comes with a range of features such as customizable templates, secure eSignature options, and automated workflows. These features ensure that you can manage your document processes efficiently while maintaining compliance and security.

-

Can I integrate the Request For Transfer Or Conversion Form with other applications?

Yes, the Request For Transfer Or Conversion Form can be seamlessly integrated with various applications such as CRMs, accounting software, and cloud storage platforms. This integration enhances your workflow and allows for a smoother document management process.

-

What are the benefits of using airSlate SignNow for the Request For Transfer Or Conversion Form?

Using airSlate SignNow for the Request For Transfer Or Conversion Form provides numerous benefits, including increased efficiency, reduced turnaround time, and improved accuracy in your documentation. Additionally, it enhances collaboration among team members, making the document process smoother.

-

Is the Request For Transfer Or Conversion Form legally binding?

Yes, documents signed via the Request For Transfer Or Conversion Form on airSlate SignNow are legally binding and comply with eSignature laws. This ensures that your agreements are both valid and enforceable, providing you with peace of mind in your transactions.

Get more for Request For Transfer Or Conversion Form

- Clinical decision making case studies in maternity and womens health pdf form

- Commercial account vehicle update form thruway ny

- Orbit tvet college brits campus brits form

- Orea form 270 emarketrealestate com

- Blm fission vs fusion research guide sheet teach nuclear teachnuclear form

- Request for wage adjustment dllr maryland form

- Le voyage perdu pdf form

- J woodrow counts scholarship deadline is arlington isd form

Find out other Request For Transfer Or Conversion Form

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe