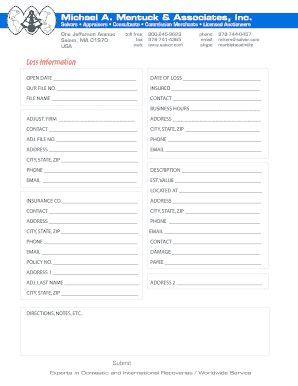

Loss Information

What is the Loss Information

The Loss Information form is a crucial document used to report various types of losses, including financial, property, or business-related losses. This form helps individuals and businesses accurately communicate their losses to relevant authorities, ensuring compliance with legal and tax obligations. It is essential for those who wish to claim deductions or credits related to losses incurred during a specific period.

How to use the Loss Information

Using the Loss Information form involves several key steps. First, gather all relevant documentation that supports your claim, such as receipts, invoices, or financial statements. Next, fill out the form accurately, ensuring that all required fields are completed. It is important to provide detailed descriptions of the losses and any associated costs. Once completed, submit the form according to the specified submission methods, which may include online, mail, or in-person options.

Steps to complete the Loss Information

Completing the Loss Information form requires careful attention to detail. Follow these steps to ensure accuracy:

- Collect all necessary documents related to your losses.

- Fill out personal information, including your name, address, and taxpayer identification number.

- Detail the nature of the losses, including dates and amounts.

- Review the form for completeness and accuracy.

- Submit the form through the appropriate channels.

Legal use of the Loss Information

The Loss Information form is used legally to substantiate claims for tax deductions or credits. It is important to ensure that the information provided is truthful and accurate, as false claims can lead to penalties or legal repercussions. Understanding the legal implications of reporting losses can help individuals and businesses navigate their obligations effectively.

Key elements of the Loss Information

Key elements of the Loss Information form include:

- Identification of the taxpayer or business entity.

- Detailed descriptions of the losses incurred.

- Dates and amounts associated with each loss.

- Supporting documentation to validate the claims.

Filing Deadlines / Important Dates

Filing deadlines for the Loss Information form vary depending on the type of loss and the taxpayer's situation. It is crucial to be aware of these deadlines to avoid penalties. Generally, forms should be filed by the tax return due date for the year in which the losses occurred. Keeping track of important dates ensures compliance and maximizes potential deductions.

Quick guide on how to complete loss information

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

The Easiest Way to Edit and Electronically Sign [SKS]

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes moments and bears the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loss information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Loss Information in the context of eSigning with airSlate SignNow?

Loss Information refers to the relevant data collected during the eSigning process that can impact transaction outcomes. With airSlate SignNow, businesses can effectively manage and track Loss Information to ensure all parties are informed and documents are securely processed.

-

How does airSlate SignNow help manage Loss Information?

airSlate SignNow offers built-in features that assist in tracking and managing Loss Information efficiently. Users can directly access vital data about document statuses, signature completion, and any discrepancies, ensuring a transparent and organized workflow.

-

Is there a pricing plan for businesses focused on managing Loss Information?

Yes, airSlate SignNow provides flexible pricing plans tailored for businesses needing to manage Loss Information effectively. With options to scale based on your team's size and document volume, you can choose a plan that aligns with your specific requirements and budget.

-

What features does airSlate SignNow offer to enhance the handling of Loss Information?

airSlate SignNow includes features such as document tracking, real-time notifications, and detailed analytics to enhance the handling of Loss Information. These tools help businesses stay updated on all critical aspects of their documents and prevent potential issues.

-

Can I integrate airSlate SignNow with other tools for better Loss Information management?

Absolutely! airSlate SignNow offers seamless integrations with numerous third-party applications. This capability allows users to consolidate Loss Information management within their existing systems, enhancing overall operational efficiency.

-

What are the benefits of using airSlate SignNow for Loss Information?

Using airSlate SignNow for Loss Information provides businesses with enhanced security, reduced paperwork, and a more streamlined workflow. This not only safeguards sensitive information but also increases productivity, enabling teams to focus on core business objectives.

-

Does airSlate SignNow provide customer support for Loss Information queries?

Yes, airSlate SignNow offers comprehensive customer support to assist with any queries related to Loss Information. Their dedicated support team is available to help users navigate challenges and make the most out of their eSigning experience.

Get more for Loss Information

Find out other Loss Information

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe