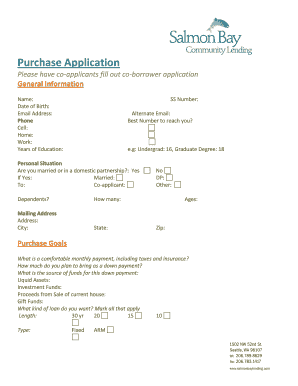

Please Have Co Applicants Fill Out Co Borrower Application Form

What is the co-borrower application?

The co-borrower application is a document that allows individuals to apply for a loan or mortgage together. This form is essential when multiple parties are involved in securing financing, as it outlines the financial responsibilities and obligations of each applicant. By having co-applicants fill out this application, lenders can assess the combined creditworthiness and financial stability of all parties involved, which can improve the chances of loan approval.

Steps to complete the co-borrower application

Completing the co-borrower application involves several key steps. First, each co-applicant should gather necessary personal and financial information, including Social Security numbers, income details, and employment history. Next, both parties need to fill out the application form accurately, ensuring that all required fields are completed. After completing the form, it's important to review the information for accuracy and consistency. Finally, both co-applicants should sign the document, confirming their agreement to the terms outlined in the application.

Required documents for the co-borrower application

When filling out the co-borrower application, specific documents are typically required from each applicant. Commonly needed documents include:

- Proof of identity, such as a driver's license or passport

- Recent pay stubs or proof of income

- Bank statements for the past few months

- Tax returns from the previous two years

- Details of any existing debts or financial obligations

Having these documents ready can streamline the application process and help ensure that all necessary information is provided to the lender.

Legal use of the co-borrower application

The co-borrower application serves a legal purpose in the lending process. It establishes the financial relationship between the co-applicants and the lender. By signing the application, all parties agree to the terms and conditions set forth by the lender, which may include repayment obligations and interest rates. It's essential for co-applicants to understand their legal responsibilities, as failure to meet these obligations can result in financial penalties or impact their credit scores.

How to obtain the co-borrower application

Obtaining the co-borrower application is a straightforward process. Typically, lenders provide this application form directly through their websites or in their offices. Prospective borrowers can also request the form from their loan officer or mortgage broker. Additionally, many financial institutions offer digital versions of the application that can be filled out and submitted online, making it convenient for co-applicants to complete the process together.

Examples of using the co-borrower application

The co-borrower application is commonly used in various scenarios, such as:

- Couples purchasing a home together

- Family members co-signing a loan for a relative

- Business partners seeking financing for a joint venture

These examples illustrate how the co-borrower application can facilitate access to financing by combining the financial resources and credit histories of multiple applicants.

Quick guide on how to complete please have co applicants fill out co borrower application

Complete [SKS] effortlessly on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any gadget using airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The easiest way to edit and eSign [SKS] seamlessly

- Search for [SKS] and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all information and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Please Have Co applicants Fill Out Co borrower Application

Create this form in 5 minutes!

How to create an eSignature for the please have co applicants fill out co borrower application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for co-applicants to fill out a co-borrower application using airSlate SignNow?

To ensure a smooth experience, please have co-applicants fill out the co-borrower application by accessing the document link sent to them via email. They can eSign directly on the platform, making it easy to finalize their information securely and quickly.

-

Are there any costs associated with using airSlate SignNow for co-borrower applications?

airSlate SignNow offers various pricing plans that cater to different business needs. Please have co-applicants fill out the co-borrower application, and you can conveniently manage multiple documents at no hidden costs with our transparent pricing.

-

What features does airSlate SignNow offer for managing co-borrower applications?

airSlate SignNow includes features such as document templates, real-time tracking, and secure storage. These functionalities ensure that each co-applicant can easily fill out the co-borrower application, enhancing the overall efficiency of your business processes.

-

How does airSlate SignNow ensure the security of co-borrower applications?

We prioritize security with features like encryption, secure access, and compliance with industry standards. When you ask, 'Please have co-applicants fill out the co-borrower application,' rest assured that their information will be protected throughout the process.

-

Can I integrate airSlate SignNow with other applications for co-borrower applications?

Yes, airSlate SignNow offers seamless integrations with numerous applications including CRM systems and document management tools. This way, once you have your co-applicants fill out the co-borrower application, the data can flow smoothly into your existing workflow.

-

What are the benefits of using airSlate SignNow for co-borrower applications?

Using airSlate SignNow simplifies the application process, reducing paperwork and saving time. By encouraging your co-applicants to fill out the co-borrower application, you’ll benefit from enhanced productivity and improved customer satisfaction with quick and easy eSigning.

-

How can I track the status of co-borrower applications in airSlate SignNow?

You can easily track the status of co-borrower applications within your airSlate SignNow dashboard. Once you have instructed your co-applicants to fill out the co-borrower application, you’ll receive real-time notifications and updates on their progress.

Get more for Please Have Co applicants Fill Out Co borrower Application

Find out other Please Have Co applicants Fill Out Co borrower Application

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online