Form ST 930596Certification of Tax Status of Information or Tax Ny

What is the Form ST 930596 Certification Of Tax Status Of Information Or Tax Ny

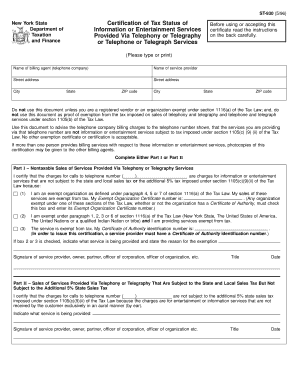

The Form ST 930596, known as the Certification of Tax Status of Information or Tax NY, is a document used primarily for tax purposes in New York. This form is essential for individuals and businesses to certify their tax status, ensuring compliance with state tax regulations. It provides necessary information regarding the taxpayer's status, which may include details about exemptions, deductions, or other tax-related information required by the New York State Department of Taxation and Finance.

How to use the Form ST 930596 Certification Of Tax Status Of Information Or Tax Ny

Using the Form ST 930596 involves several key steps. First, identify the specific purpose for which the form is needed, such as applying for a tax exemption or confirming tax status for a business entity. Next, gather all required documentation, including identification numbers and any relevant financial information. Complete the form by filling in the necessary fields accurately. Once filled out, the form can be submitted according to the instructions provided, either online, by mail, or in person, depending on the specific requirements of the New York State Department of Taxation and Finance.

Steps to complete the Form ST 930596 Certification Of Tax Status Of Information Or Tax Ny

Completing the Form ST 930596 involves a systematic approach:

- Begin by downloading the form from the official New York State Department of Taxation and Finance website.

- Read the instructions carefully to understand the requirements and necessary information.

- Fill in your personal or business information, ensuring accuracy in all entries.

- Provide any required supporting documentation that verifies your tax status.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, ensuring it is sent to the correct address or online portal.

Key elements of the Form ST 930596 Certification Of Tax Status Of Information Or Tax Ny

The Form ST 930596 includes several critical elements that must be accurately completed. Key components typically include:

- Taxpayer Identification: This includes your name, address, and tax identification number.

- Tax Status Declaration: A section where you declare your current tax status, including any exemptions.

- Supporting Documentation: A checklist of documents that may need to accompany the form, such as proof of income or prior tax returns.

- Signature Section: A space for the taxpayer's signature, confirming the accuracy of the information provided.

Legal use of the Form ST 930596 Certification Of Tax Status Of Information Or Tax Ny

The legal use of the Form ST 930596 is crucial for maintaining compliance with New York tax laws. This form serves as an official declaration of a taxpayer's status and is often required for various transactions, such as applying for loans, grants, or business licenses. Failing to use the form correctly or providing false information can lead to legal repercussions, including fines or penalties from the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST 930596 can vary based on the specific tax year and the taxpayer's circumstances. It is important to stay informed about any changes in deadlines announced by the New York State Department of Taxation and Finance. Generally, forms should be submitted by the end of the tax year or as specified in correspondence from the tax authority. Missing these deadlines may result in penalties or delays in processing your tax status.

Quick guide on how to complete form st 930596certification of tax status of information or tax ny

Effortlessly prepare [SKS] on any device

Managing documents online has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to edit and electronically sign [SKS] without difficulty

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or hide sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and electronically sign [SKS] to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form ST 930596Certification Of Tax Status Of Information Or Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form st 930596certification of tax status of information or tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ST 930596Certification Of Tax Status Of Information Or Tax Ny?

Form ST 930596Certification Of Tax Status Of Information Or Tax Ny is a document required by businesses to signNow their tax status. It ensures compliance with New York tax regulations and can be crucial for various transactions. Utilizing airSlate SignNow, you can easily prepare and send this form for electronic signatures.

-

How can airSlate SignNow help with Form ST 930596Certification Of Tax Status Of Information Or Tax Ny?

airSlate SignNow simplifies the process of completing and eSigning Form ST 930596Certification Of Tax Status Of Information Or Tax Ny. Our platform allows you to create, edit, and share documents quickly, ensuring that you remain compliant with state regulations. This efficient workflow saves time and reduces the risk of errors when filing your tax status.

-

Is there a cost associated with using airSlate SignNow for Form ST 930596Certification Of Tax Status Of Information Or Tax Ny?

Yes, airSlate SignNow provides various pricing plans to suit different business needs. Our plans are designed to be cost-effective while offering robust features to streamline processes, including handling Form ST 930596Certification Of Tax Status Of Information Or Tax Ny. You can choose a plan that fits your budget and business requirements.

-

What features does airSlate SignNow offer for managing Form ST 930596Certification Of Tax Status Of Information Or Tax Ny?

With airSlate SignNow, you gain access to an intuitive interface, templates for Form ST 930596Certification Of Tax Status Of Information Or Tax Ny, and the ability to track document status in real-time. Our platform also offers advanced security features, ensuring your sensitive information is protected while seamlessly managing your tax documents.

-

Can airSlate SignNow integrate with other software to manage Form ST 930596Certification Of Tax Status Of Information Or Tax Ny?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including CRM systems and cloud storage services. This connectivity simplifies the management of documents, making it easier to handle Form ST 930596Certification Of Tax Status Of Information Or Tax Ny alongside your other business tools.

-

What are the benefits of using airSlate SignNow for Form ST 930596Certification Of Tax Status Of Information Or Tax Ny?

Using airSlate SignNow for Form ST 930596Certification Of Tax Status Of Information Or Tax Ny offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our solution allows you to streamline the signing process and ensure that your tax compliance needs are met quickly and accurately. Experience a hassle-free way of handling your forms.

-

How secure is airSlate SignNow when handling Form ST 930596Certification Of Tax Status Of Information Or Tax Ny?

airSlate SignNow prioritizes security by employing encryption technologies and maintaining compliance with industry standards. When you manage Form ST 930596Certification Of Tax Status Of Information Or Tax Ny on our platform, you can rest assured that your personal and financial information is protected. We implement measures to ensure safe transactions and document handling.

Get more for Form ST 930596Certification Of Tax Status Of Information Or Tax Ny

- Turboprop version 40 colorado center for astrodynamics research form

- The fostering geometric thinking toolkit form

- Bandera isd school supply list form

- Notice of receipt 100086885 form

- Illness policy for parents form

- Mycigna comformsonline reimbursement request

- Pre trial memorandum pdf family law self help center form

- Fimco manure spreader form

Find out other Form ST 930596Certification Of Tax Status Of Information Or Tax Ny

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself