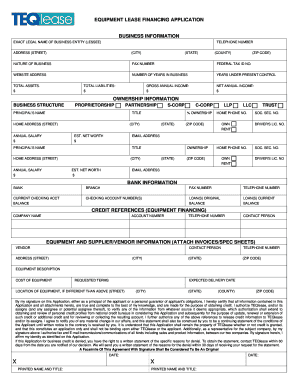

EQUIPMENT LEASE FINANCING APPLICATION BUSINESS Form

What is the Equipment Lease Financing Application Business

The Equipment Lease Financing Application Business is a formal document used by businesses to request financing for the acquisition of equipment. This application outlines the specific equipment being leased, the terms of the lease, and the financial details necessary for the lender to assess the request. It serves as a critical tool for businesses looking to manage cash flow while obtaining the necessary tools for operation without the upfront costs of purchasing equipment outright.

Key Elements of the Equipment Lease Financing Application Business

Understanding the key elements of the Equipment Lease Financing Application is essential for a successful submission. Key components typically include:

- Business Information: Name, address, and contact details of the business.

- Equipment Details: Description, cost, and intended use of the equipment being leased.

- Financial Information: Business financial statements, credit history, and revenue projections.

- Lease Terms: Proposed duration of the lease and payment schedule.

- Signature: Authorized signature of the business representative.

Steps to Complete the Equipment Lease Financing Application Business

Completing the Equipment Lease Financing Application involves several straightforward steps:

- Gather necessary business information and financial documents.

- Provide detailed descriptions of the equipment to be leased.

- Outline the proposed lease terms, including duration and payment structure.

- Review the application for accuracy and completeness.

- Obtain the necessary signatures from authorized personnel.

- Submit the application to the financing entity through the preferred method.

Eligibility Criteria

Eligibility for the Equipment Lease Financing Application varies by lender but generally includes the following criteria:

- Established business with a verifiable history.

- Positive credit score and financial standing.

- Ability to demonstrate the need for the equipment.

- Compliance with any specific lender requirements.

Application Process & Approval Time

The application process for the Equipment Lease Financing Application typically involves submitting the completed form along with supporting documents to the lender. The approval time can vary based on the lender's policies, but businesses can generally expect a response within a few days to a few weeks. Factors influencing approval time include the completeness of the application, the lender's workload, and the complexity of the financial situation.

Required Documents

When submitting the Equipment Lease Financing Application, businesses should prepare the following documents:

- Business financial statements, including balance sheets and income statements.

- Tax returns for the previous one to three years.

- Personal financial statements of the business owner(s).

- Details of the equipment to be financed, including quotes or invoices.

Quick guide on how to complete equipment lease financing application business

Prepare [SKS] effortlessly on any device

Digital document administration has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign [SKS] with no hassle

- Obtain [SKS] and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to retain your changes.

- Select your preferred method to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure top-notch communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to EQUIPMENT LEASE FINANCING APPLICATION BUSINESS

Create this form in 5 minutes!

How to create an eSignature for the equipment lease financing application business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an equipment lease financing application business?

An equipment lease financing application business allows companies to acquire and lease equipment without large upfront costs. These applications streamline the financing process, making it easier for businesses to manage cash flow while enjoying access to necessary tools and machinery.

-

How does the equipment lease financing application business work?

The equipment lease financing application business typically involves a simple online application where businesses can provide details about their financing needs. Once approved, the business can then select the equipment they need and finalize the lease terms for efficient resource management.

-

What are the benefits of using airSlate SignNow for my equipment lease financing application business?

Using airSlate SignNow enhances your equipment lease financing application business by streamlining document management and electronic signing. This tool not only saves time but also increases security and compliance, allowing faster transactions and better record-keeping.

-

Are there any costs associated with using the airSlate SignNow platform for my financing application?

Yes, airSlate SignNow offers a range of pricing plans designed to fit different business needs, including options for startups to large enterprises. Each plan includes features that cater to your equipment lease financing application business, ensuring that you only pay for what you need.

-

Is the airSlate SignNow platform customizable for my equipment lease financing business?

Absolutely! airSlate SignNow provides customizable templates and workflows that can be tailored specifically for your equipment lease financing application business. This flexibility allows you to adapt the platform according to your unique processes, enhancing efficiency.

-

What integrations does airSlate SignNow offer that benefit my equipment lease financing application business?

airSlate SignNow integrates seamlessly with various third-party applications like CRMs, accounting software, and project management tools. These integrations can empower your equipment lease financing application business by connecting all necessary workflows and processes in one place.

-

How can I ensure secure document handling for my equipment lease financing application business?

With airSlate SignNow, document security is prioritized through encrypted data storage and secure electronic signatures. This ensures that all agreements related to your equipment lease financing application business are safely handled and readily accessible when needed.

Get more for EQUIPMENT LEASE FINANCING APPLICATION BUSINESS

Find out other EQUIPMENT LEASE FINANCING APPLICATION BUSINESS

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free