Abl 900 Form 2017

What is the Abl 900 Form

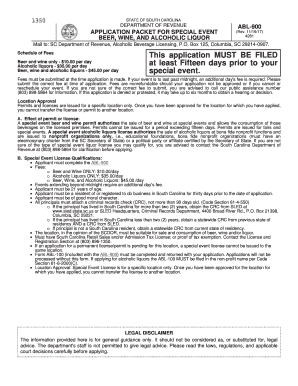

The Abl 900 form is a document used in South Carolina for specific tax-related purposes. It is designed to facilitate the reporting of certain financial information to the state authorities. This form is particularly relevant for individuals and businesses that need to comply with state tax regulations. Understanding its purpose is essential for accurate tax filing and compliance.

How to use the Abl 900 Form

Using the Abl 900 form involves several straightforward steps. First, gather all necessary financial documents and information required for completion. Next, access the form, which can typically be filled out online. Complete the form by entering the required details accurately. After filling it out, review the information for any errors before submitting it electronically or via mail, depending on your preference.

Steps to complete the Abl 900 Form

Completing the Abl 900 form involves a systematic approach:

- Access the form through the appropriate state website or platform.

- Fill in your personal and financial information as prompted.

- Ensure all required fields are completed to avoid delays.

- Review your entries for accuracy and completeness.

- Submit the form electronically or print it for mailing, as needed.

Legal use of the Abl 900 Form

The Abl 900 form holds legal significance in South Carolina tax law. It must be completed accurately to ensure compliance with state regulations. The form is recognized by the South Carolina Department of Revenue, and any discrepancies or errors can lead to penalties or delays in processing. Therefore, understanding the legal implications of the form is crucial for taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Abl 900 form are critical for compliance. Typically, taxpayers must submit this form by specific dates set by the South Carolina Department of Revenue. It is advisable to check the latest guidelines to ensure timely submission, as late filings may result in penalties or interest charges.

Who Issues the Form

The Abl 900 form is issued by the South Carolina Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. They provide the necessary forms and guidelines for taxpayers to fulfill their obligations accurately and on time.

Quick guide on how to complete sc abl 900 2017 2019 form

Your assistance manual on how to prepare your Abl 900 Form

If you’re curious about how to generate and submit your Abl 900 Form, here are a few concise guidelines to simplify tax processing.

To begin, you simply need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax documents effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and revisit to amend information as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to finalize your Abl 900 Form in no time:

- Establish your account and begin working on PDFs shortly.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your Abl 900 Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if needed).

- Examine your document and rectify any inaccuracies.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may increase return errors and delay refunds. Furthermore, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct sc abl 900 2017 2019 form

FAQs

-

How do I fill out the Rai Publication Scholarship Form 2019?

Rai Publication Scholarship Exam 2019- Rai Publication Scholarship Form 5th, 8th, 10th & 12th.Rai Publication Scholarship Examination 2019 is going to held in 2019 for various standards 5th, 8th, 10th & 12th in which interested candidates can apply for the following scholarship examination going to held in 2019. This scholarship exam is organized by the Rai Publication which will held only in Rajasthan in the year 2019. Students can apply for the following scholarship examination 2019 before the last date of application that is 15 January 2019. The exam will be conducted district wise in Rajasthan State by the Rai Publication before June 2019.Students of class 5th, 8th, 10th and 12th can fill online registration for Rai Publication scholarship exam 2019. Exam is held in February in all districts of Rajasthan. Open registration form using link given below.In the scholarship examination, the scholarship will be given to the 20 topper students from each standard of 5th, 8th, 10th & 12th on the basis of lottery which will be equally distributed among all 20 students. The declaration of the prize will be announced by July 2019.राय पब्लिकेशन छात्रव्रत्ति परीक्षा का आयोजन सत्र 2019 में किया जाएगा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए, इच्छुक अभ्यार्थी आवेदन कर सकते है इस छात्रव्रत्ति परीक्षा 2019 के लिए | यह छात्रव्रत्ति परीक्षा राजस्थान में राइ पब्लिकेशन के दवारा की जयगी सत्र 2019 में | इच्छुक अभ्यार्थी एक परीक्षा कर सकते है आखरी तारीख 15 जनवरी 2019 से पहले | यह परिखा राजस्थान छेत्र में जिला स्तर पर कराई जाएगी राइ पब्लिकेशन के दवारा जून 2019 से पहले |इस छात्रव्रत्ति परीक्षा में, छात्रव्रत्ति 20 विजेता छात्र छात्राओं दो दी जयेगी जिसमे हर कक्षा के 20 छात्र होंगे जिन्हे बराबरी में बाटा जयेगा। पुरस्कार की घोसणा जुलाई 2019 में की जयेगी |Rai Publication Scholarship Exam 2019 information :This scholarship examination is conducted for 5th, 8th, 10th & 12th standard for which interested candidates can apply which a great opportunity for the students. The exam syllabus will be based according to the standards of their exam which might help them in scoring in the Rai Publication Scholarship Examination 2019. The question in the exam will be multiple choice questions (MCQ’s) and there will be 100 multiple choice questions. To apply for the above scholarship students must have to fill the application form but the 15 January 2019.यह छात्रव्रत्ति परीक्षा कक्षा कक्षा 5वी , 8वी , 10वी एवं 12वी के लिए आयोजित है जिसमे इच्छुक अभ्यार्थी पंजीकरण करा सकते है जोकि छात्र छात्राओं के लिए एक बड़ा अवसर होगा | राय पब्लिकेशन छात्रव्रत्ति परीक्षा 2019 परीक्षा का पाठ्यक्रम कक्षा अनुसार ही होगा जोकि उन्हें प्राथम आने में सहयोग प्रदान करेगा | परीक्षा के प्रश्न-पत्र में सारे प्रश्न बहुविकल्पीय प्रश्न होंगे एवं प्रश्न-पत्र में कुल 100 प्रश्न दिए जायेंगे | इस छात्रव्रत्ति परीक्षा को देने क लिए अभयार्थियो को पहले पंजीकरण करना अनिवार्य होगा जोकि ऑनलाइन होगा जिसकी आखरी तारीख 15 जनवरी 2019 है |Distribution of Rai Publication Deskwork Scholarship Exam 2019:5th Class Topper Prize Money:- 4 Lakh Rupees8th Class Topper Prize Money:- 11 Lakh Rupees10th Class Topper Prize Money:- 51 Lakh Rupees12thClass Topper Prize Money:- 39 Lakh RupeesHow to fill Rai Publication Scholarship Form 2019 :Follow the above steps to register for the for Rai Publication Scholarship Examination 2019:Candidates can follow these below given instructions to apply for the scholarship exam of Rai Publication.The Rai Publication Scholarship application form is available in the news paper (Rajasthan Patrika.) You can also download it from this page. It also can be downloaded from the last page of your desk work.Application form is also given on the official website of Rai Publication: Rai Publication - Online Book Store for REET RPSC RAS SSC Constable Patwar 1st 2nd Grade TeacherNow fill the details correctly in the application form.Now send the application form to the head office of Rai Publication.Rai Publication Website Link Click HereHead Office Address of Rai PublicationShop No: -24 & 25, Bhagwan Das Market, Chaura Rasta, Jaipur, RajasthanPIN Code:- 302003Contact No.- 0141 232 1136Source : Rai Publication Scholarship Exam 2019

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

How do I fill out the IGNOU admission form for the B.Sc in physics 2019 July session?

Now-a-days admission in IGNOU is very easy. Everything is online now.. you have to visit IGNOU website for the same. Go to admission section and follow step by step process to fill online application form.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

Create this form in 5 minutes!

How to create an eSignature for the sc abl 900 2017 2019 form

How to generate an eSignature for the Sc Abl 900 2017 2019 Form in the online mode

How to create an eSignature for the Sc Abl 900 2017 2019 Form in Google Chrome

How to create an eSignature for putting it on the Sc Abl 900 2017 2019 Form in Gmail

How to create an electronic signature for the Sc Abl 900 2017 2019 Form from your smart phone

How to create an eSignature for the Sc Abl 900 2017 2019 Form on iOS devices

How to create an eSignature for the Sc Abl 900 2017 2019 Form on Android OS

People also ask

-

What is the Abl 900 Form used for in airSlate SignNow?

The Abl 900 Form is a crucial document used for specific business processes within airSlate SignNow. It allows users to efficiently capture signatures and manage document workflows. With this form, you can streamline approvals and ensure compliance, making it a vital tool for businesses.

-

How does airSlate SignNow facilitate the completion of the Abl 900 Form?

airSlate SignNow simplifies the completion of the Abl 900 Form by providing an intuitive interface for users to fill out and eSign documents. The platform enables seamless collaboration, allowing multiple parties to review and sign the form electronically. This process saves time and enhances efficiency in document management.

-

Is there a cost associated with using the Abl 900 Form in airSlate SignNow?

Using the Abl 900 Form in airSlate SignNow comes with various pricing plans tailored to different business needs. The platform offers a cost-effective solution that provides value through features like unlimited signing and document storage. You can choose a plan that best fits your budget and usage requirements.

-

What features does airSlate SignNow offer for the Abl 900 Form?

airSlate SignNow offers a range of features for the Abl 900 Form, including customizable templates, secure eSigning, and real-time tracking. These features ensure that you can manage your documents efficiently and securely while maintaining compliance with industry standards. The platform also supports various file formats for easy uploads.

-

Can the Abl 900 Form be integrated with other software?

Yes, the Abl 900 Form can be easily integrated with various software solutions through airSlate SignNow's robust API. This allows businesses to connect their existing systems, such as CRM and project management tools, for a seamless workflow. Integrations enhance productivity and streamline processes across different platforms.

-

What are the benefits of using the Abl 900 Form with airSlate SignNow?

The benefits of using the Abl 900 Form with airSlate SignNow include increased efficiency, enhanced security, and reduced paper usage. Businesses can save time by automating document workflows and ensuring that signatures are collected promptly. Additionally, the platform's compliance features help maintain regulatory standards.

-

How can I get support while using the Abl 900 Form in airSlate SignNow?

airSlate SignNow provides comprehensive support for users of the Abl 900 Form, including a detailed knowledge base, live chat, and email support. The support team is dedicated to helping you resolve any issues and maximize your use of the platform. You can also access tutorials and resources to enhance your experience.

Get more for Abl 900 Form

- Match roster form pdf oregon adult soccer association

- Rf employment application pdf research foundation of suny form

- Origins earth is born worksheet answers form

- Specialty medication prior authorization form peach state health plan

- Shoshone bannock tribes form

- Lccc transcripts form

- Sale non compete agreement template form

- Generator maintenance contract template form

Find out other Abl 900 Form

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF