Gift in Kind Form BO 80 02 Rev Auburn University Auburn

What is the Gift in Kind Form BO 80 02 Rev Auburn University Auburn

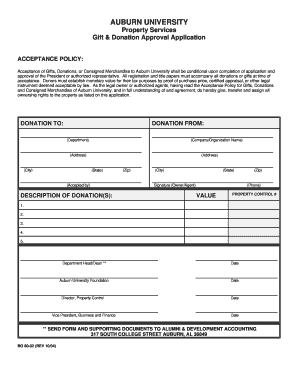

The Gift in Kind Form BO 80 02 Rev is a specific document used by Auburn University to facilitate the donation of non-cash gifts. This form is essential for documenting the details of the donation, ensuring that both the donor and the university have a clear record of the transaction. It serves as an official acknowledgment of the gift, which can be important for tax purposes and for the university's accounting records.

How to use the Gift in Kind Form BO 80 02 Rev Auburn University Auburn

To effectively use the Gift in Kind Form BO 80 02 Rev, donors should first obtain the form from the Auburn University website or relevant department. Once in possession of the form, the donor should fill out the required fields, including their contact information, a description of the gift, and its estimated value. After completing the form, it should be submitted to the designated office at Auburn University for processing. This ensures that the gift is properly recorded and acknowledged.

Steps to complete the Gift in Kind Form BO 80 02 Rev Auburn University Auburn

Completing the Gift in Kind Form involves several key steps:

- Obtain the form from the Auburn University website or the appropriate department.

- Provide your personal information, including name, address, and contact details.

- Describe the gift being donated, including its condition and any relevant specifications.

- Estimate the value of the gift based on fair market value.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed form to the designated office at Auburn University.

Legal use of the Gift in Kind Form BO 80 02 Rev Auburn University Auburn

The legal use of the Gift in Kind Form is critical for both the donor and Auburn University. This form acts as a legal document that provides evidence of the donation, which can be important for tax deductions. Donors should ensure that the information provided is accurate and truthful, as any discrepancies may lead to legal issues or penalties. Auburn University also relies on this form to maintain compliance with regulations governing charitable donations.

Key elements of the Gift in Kind Form BO 80 02 Rev Auburn University Auburn

Key elements of the Gift in Kind Form include:

- Donor's contact information.

- Description of the donated item, including its condition and intended use.

- Estimated value of the gift.

- Signature of the donor to validate the information.

- Date of the donation.

Examples of using the Gift in Kind Form BO 80 02 Rev Auburn University Auburn

Examples of using the Gift in Kind Form include donating equipment, art, or supplies to Auburn University. For instance, a local business might donate computers for student use, while an artist may contribute a sculpture for display on campus. In each case, the form is completed to document the specifics of the donation, ensuring proper recognition and compliance with university policies.

Quick guide on how to complete gift in kind form bo 80 02 rev auburn university auburn

Complete [SKS] effortlessly on any device

Digital document management has gained traction among both corporations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without obstacles. Handle [SKS] on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gift in kind form bo 80 02 rev auburn university auburn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Gift in Kind Form BO 80 02 Rev Auburn University Auburn used for?

The Gift in Kind Form BO 80 02 Rev Auburn University Auburn is used to formally document non-cash contributions to the university. This form helps ensure that all gifts are properly recorded and acknowledged, providing both the donor and the university with essential tax documentation.

-

How can I obtain the Gift in Kind Form BO 80 02 Rev Auburn University Auburn?

You can easily download the Gift in Kind Form BO 80 02 Rev Auburn University Auburn from Auburn University's official website. By visiting the relevant section on their site, you will find the form available for download or online filling, streamlining the process for donors.

-

Are there any fees associated with the Gift in Kind Form BO 80 02 Rev Auburn University Auburn?

There are no fees associated with submitting the Gift in Kind Form BO 80 02 Rev Auburn University Auburn. However, it’s important to keep in mind any valuation costs for the donated items, as that may influence tax deductions for the donor.

-

What are the benefits of using the Gift in Kind Form BO 80 02 Rev Auburn University Auburn?

Using the Gift in Kind Form BO 80 02 Rev Auburn University Auburn offers several benefits, including proper documentation of your donations and eligibility for potential tax deductions. It also ensures that Auburn University can utilize your gift effectively to support various programs.

-

Can I submit the Gift in Kind Form BO 80 02 Rev Auburn University Auburn electronically?

Yes, the Gift in Kind Form BO 80 02 Rev Auburn University Auburn can typically be submitted electronically through specific channels outlined by the university. This feature makes the process faster and more convenient for both donors and university staff.

-

What types of gifts can be documented with the Gift in Kind Form BO 80 02 Rev Auburn University Auburn?

A wide variety of gifts can be documented using the Gift in Kind Form BO 80 02 Rev Auburn University Auburn, including equipment, art, supplies, and services. Each item must be evaluated for its fair market value to ensure accurate record-keeping and potential tax benefits.

-

How does airSlate SignNow enhance the use of the Gift in Kind Form BO 80 02 Rev Auburn University Auburn?

airSlate SignNow provides an efficient way to manage and eSign the Gift in Kind Form BO 80 02 Rev Auburn University Auburn. Its easy-to-use interface makes it simple for donors to complete and submit their forms online securely.

Get more for Gift in Kind Form BO 80 02 Rev Auburn University Auburn

- Rgh dbp initial parent intake form rochestergeneral

- 10 things you need to know about income annuity new york life form

- Consent form southern tier healthlink

- Nys medication consent form

- Seneca county ems patient care report date senecadps form

- Medical history form planned parenthood plannedparenthood

- Patient questionnaire hospital for special surgery hss form

- Required new york state school health examination form required new york state health examination form no 31 for african road

Find out other Gift in Kind Form BO 80 02 Rev Auburn University Auburn

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy