IllinoisDepartmentofRevenue Use Your Mouse or Tab Key to Move through the Fields Tax Illinois Form

Understanding the Illinois Department of Revenue Tax Form

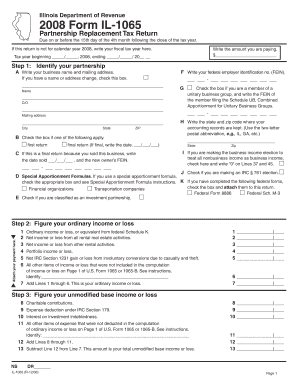

The Illinois Department of Revenue Tax Form is a crucial document for individuals and businesses in Illinois to report their income and calculate their tax obligations. This form is designed to help taxpayers accurately declare their earnings and claim any applicable deductions or credits. Understanding the specific requirements and sections of the form is essential to ensure compliance with state tax laws.

Steps to Complete the Illinois Department of Revenue Tax Form

Completing the Illinois Department of Revenue Tax Form involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts.

- Carefully read the instructions provided with the form to understand what information is required.

- Use your mouse or the tab key to navigate through the fields of the form, ensuring you fill in each section accurately.

- Double-check all entries for accuracy and completeness before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Required Documents for the Illinois Department of Revenue Tax Form

To successfully complete the Illinois Department of Revenue Tax Form, it is important to have the following documents on hand:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as business-related costs or charitable contributions.

- Any prior year tax returns that may provide useful information.

Legal Considerations for the Illinois Department of Revenue Tax Form

Filing the Illinois Department of Revenue Tax Form is not only a civic duty but also a legal requirement. Failure to file or inaccuracies in the form can lead to penalties, including fines and interest on unpaid taxes. It is essential to ensure that all information is truthful and complete to avoid legal repercussions.

Form Submission Methods

Taxpayers have several options for submitting the Illinois Department of Revenue Tax Form:

- Online submission through the Illinois Department of Revenue website.

- Mailing a printed version of the form to the appropriate address.

- In-person submission at designated tax offices, if necessary.

Examples of Using the Illinois Department of Revenue Tax Form

Understanding practical scenarios can help clarify how to use the Illinois Department of Revenue Tax Form. For instance, a self-employed individual may need to report income from multiple clients, while a retiree may focus on pension income and Social Security benefits. Each situation requires careful attention to the specific sections of the form relevant to that taxpayer's circumstances.

Quick guide on how to complete illinoisdepartmentofrevenue use your mouse or tab key to move through the fields tax illinois

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing for proper form acquisition and secure online storage. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without any delays. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS and enhance your document-related processes today.

The optimal method to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, frustrating form searches, or errors that necessitate the printing of new copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Modify and electronically sign [SKS] and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IllinoisDepartmentofRevenue Use Your Mouse Or Tab Key To Move Through The Fields Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the illinoisdepartmentofrevenue use your mouse or tab key to move through the fields tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for managing IllinoisDepartmentofRevenue documents?

airSlate SignNow provides various features to streamline document management, particularly for IllinoisDepartmentofRevenue forms. Users can easily eSign, send, and track documents, ensuring compliance with tax regulations. The platform allows you to use your mouse or tab key to move through the fields, making it user-friendly for filling out Tax Illinois forms.

-

How does airSlate SignNow ensure the security of IllinoisDepartmentofRevenue documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive IllinoisDepartmentofRevenue documents. The platform employs advanced encryption protocols to protect your data and ensure that only authorized users can access it. This way, you can confidently manage your Tax Illinois forms without compromising security.

-

What are the pricing plans available for airSlate SignNow services?

airSlate SignNow offers a variety of pricing plans to fit different business needs, including options suitable for those requiring IllinoisDepartmentofRevenue document management. Plans typically include essential features such as eSigning and document templates. You can choose a plan that best suits your budget and the frequency of use for Tax Illinois documents.

-

Can I integrate airSlate SignNow with other applications for Tax Illinois management?

Yes, airSlate SignNow seamlessly integrates with various applications, making it convenient to manage your IllinoisDepartmentofRevenue workflows. You can connect it to CRM systems, cloud storage services, and other business tools to enhance your document management processes. This integration capability simplifies handling your Tax Illinois forms effectively.

-

Is there a mobile application for airSlate SignNow to manage IllinoisDepartmentofRevenue documents?

Absolutely! airSlate SignNow offers a mobile application that allows users to manage their IllinoisDepartmentofRevenue documents on the go. With the app, you can eSign, send, and track your Tax Illinois forms right from your smartphone or tablet, ensuring that you can work efficiently wherever you are.

-

How can airSlate SignNow help with compliance regarding IllinoisDepartmentofRevenue?

airSlate SignNow aids compliance with IllinoisDepartmentofRevenue regulations by providing templates that are tailored for Tax Illinois forms. Users can fill out these templates using their mouse or tab key to navigate with ease. This structured approach helps ensure that your documents are accurate and compliant with state requirements.

-

What customer support options are available for airSlate SignNow users?

airSlate SignNow offers robust customer support options, including live chat, email, and a comprehensive help center. If you encounter any issues while managing your IllinoisDepartmentofRevenue documents, the support team is ready to assist. This ensures that you can resolve any questions or concerns related to Tax Illinois effectively.

Get more for IllinoisDepartmentofRevenue Use Your Mouse Or Tab Key To Move Through The Fields Tax Illinois

Find out other IllinoisDepartmentofRevenue Use Your Mouse Or Tab Key To Move Through The Fields Tax Illinois

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe