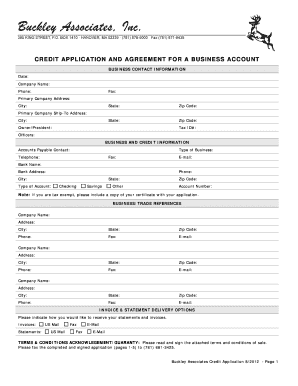

CREDIT APPLICATION and AGREEMENT for a BUSINESS ACCOUNT Form

What is the CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT

The CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT is a formal document that businesses complete to apply for credit with financial institutions. This document outlines the terms and conditions under which credit will be extended, including the responsibilities of both the lender and the borrower. It typically requires detailed information about the business, such as its legal structure, financial history, and creditworthiness. Understanding this form is essential for businesses seeking to establish or expand their credit lines, as it serves as a binding agreement once signed.

Key elements of the CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT

This form contains several critical components that businesses must be aware of:

- Business Information: Basic details such as the business name, address, and type of entity (e.g., LLC, corporation).

- Financial Information: This section typically includes income statements, balance sheets, and other financial documents that demonstrate the business's financial health.

- Credit History: Information regarding past credit usage, including any outstanding debts, payment history, and credit scores.

- Terms of Agreement: The specific terms under which credit is granted, including interest rates, repayment schedules, and any fees associated with the credit.

- Signature Section: A designated area for authorized representatives of the business to sign, indicating their agreement to the terms outlined in the document.

Steps to complete the CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT

Completing the CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT involves several steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary documentation, including financial statements and personal information of the business owners.

- Fill Out the Form: Carefully complete each section of the application, ensuring that all information is accurate and up-to-date.

- Review the Terms: Thoroughly read the terms and conditions outlined in the agreement to understand the obligations and rights of both parties.

- Obtain Necessary Signatures: Ensure that all required signatures are obtained from authorized representatives of the business.

- Submit the Application: Send the completed form to the financial institution as instructed, whether online or via mail.

Eligibility Criteria

To qualify for a business credit account, certain eligibility criteria must be met. These often include:

- Business Structure: The business must be a legally recognized entity, such as a corporation, LLC, or partnership.

- Creditworthiness: The business should have a satisfactory credit history, which may include a minimum credit score requirement.

- Financial Stability: Financial statements should demonstrate the ability to repay the credit extended.

- Time in Business: Many lenders prefer businesses that have been operational for a certain period, often at least two years.

Legal use of the CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT

The legal use of this form is crucial for both the lender and the borrower. It serves as a binding contract that outlines the terms of the credit agreement. Businesses must ensure that they comply with all applicable laws and regulations when completing and submitting this form. Misrepresentation or failure to disclose relevant information can lead to legal repercussions, including denial of credit or future liability for debts incurred. It is advisable to consult with a legal professional if there are any uncertainties regarding the implications of the agreement.

How to use the CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT

Using the CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT effectively involves understanding its purpose and following the correct procedures:

- Identify the Need: Determine why the business requires credit and how it will be used.

- Choose the Right Lender: Research various financial institutions to find one that offers favorable terms for your business type.

- Complete the Application: Fill out the application accurately, providing all requested information and documentation.

- Submit and Follow Up: After submission, follow up with the lender to confirm receipt and inquire about the approval timeline.

Quick guide on how to complete credit application and agreement for a business account

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the suitable form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document organization needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT

Create this form in 5 minutes!

How to create an eSignature for the credit application and agreement for a business account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT?

A CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT is a document that outlines the terms under which a business can obtain credit from a financial institution. It typically includes the business's financial history and agreement terms for repayment. This document is crucial for establishing trust between the lender and the business.

-

How can airSlate SignNow help with the CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT?

airSlate SignNow streamlines the process of completing a CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT by allowing users to eSign documents quickly and securely. With our platform, you can track document status, send reminders, and ensure that all parties have signed in a timely manner, making the process efficient.

-

What features does airSlate SignNow offer for managing business credit agreements?

airSlate SignNow offers features such as templates for the CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT, customizable workflows, and integration with popular CRM systems. These features help businesses manage their credit agreements more effectively and ensure compliance with organizational policies.

-

Are there any costs associated with using airSlate SignNow for my business credit application?

Yes, airSlate SignNow offers several pricing plans that cater to different business sizes and needs. Choosing a plan allows you to access features specifically designed for managing the CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT, ensuring that you get the best solution for your budget.

-

Can I integrate airSlate SignNow with other software for my business?

Absolutely! airSlate SignNow integrates seamlessly with various software systems, enhancing your overall workflow when handling a CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT. Whether you're using CRM, accounting, or document management systems, integration can enhance efficiency and collaboration among teams.

-

How secure is airSlate SignNow for handling sensitive credit application documents?

Security is a top priority for airSlate SignNow. We employ advanced encryption and authentication methods to protect your CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT and ensure that sensitive information remains confidential. Our platform complies with the latest industry regulations to safeguard your data.

-

What are the benefits of using airSlate SignNow for credit applications?

Using airSlate SignNow for your CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT offers several benefits, including faster processing times, reduced paper usage, and improved accuracy. By streamlining the eSigning process, your business can focus more on growth rather than paperwork.

Get more for CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT

- Steven stone and wrap fee programs form

- Xilinx pg077 logicore ip 3gpp lte channel estimator v1 1 product guide this core implements channel estimation functionality to form

- Fillable online georgia final waiver and release upon final form

- Current sample pre renovation form

- Telc c2 prfung modelltest pdf form

- Social security form ssa 1945 san francisco state university

- Personal data questionnaire pdf dnr wi form

- Notice 703 form

Find out other CREDIT APPLICATION AND AGREEMENT FOR A BUSINESS ACCOUNT

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document