The Health Care Flexible Spending Account HCFSA Program and the Dependent Care Assistance Program DeCAP Are Divisions of the off Form

Overview of the Health Care Flexible Spending Account (HCFSA) Program and Dependent Care Assistance Program (DeCAP)

The Health Care Flexible Spending Account (HCFSA) Program and the Dependent Care Assistance Program (DeCAP) are essential components of the Office of Labor Relations' Tax Favored Benefits Program at Hunter College, CUNY. These programs are designed to provide financial relief to employees by allowing them to set aside pre-tax dollars for eligible health care and dependent care expenses. The HCFSA enables employees to pay for a variety of medical expenses, while DeCAP assists with costs associated with child care or care for dependents. Both programs aim to enhance the overall financial well-being of employees and their families.

Using the HCFSA and DeCAP Programs

To utilize the HCFSA and DeCAP programs effectively, employees must first enroll during the designated open enrollment period. Once enrolled, participants can contribute a portion of their salary to these accounts before taxes are deducted. It is important to keep track of eligible expenses, as funds can only be used for qualified medical or dependent care costs. Employees can submit claims for reimbursement through the program's designated process, which typically involves providing receipts and documentation of the expenses incurred.

Obtaining Information about HCFSA and DeCAP

Employees seeking information about the HCFSA and DeCAP programs can access resources through the Office of Labor Relations at Hunter College. Detailed program descriptions, eligibility criteria, and enrollment instructions are often provided in employee handbooks or on official college websites. Additionally, employees may contact the benefits office directly for personalized assistance or clarification regarding their specific situations.

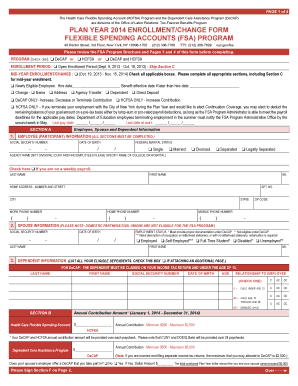

Steps to Complete Enrollment in HCFSA and DeCAP

Completing the enrollment process for the HCFSA and DeCAP programs involves several key steps:

- Review the program details and eligibility requirements.

- Determine the amount to contribute to each account based on anticipated expenses.

- Complete the enrollment form during the open enrollment period.

- Submit the enrollment form to the Office of Labor Relations.

- Retain confirmation of enrollment for personal records.

Following these steps ensures that employees are correctly enrolled and can take full advantage of the tax benefits offered by these programs.

Legal Considerations for HCFSA and DeCAP

Both the HCFSA and DeCAP programs are governed by specific legal guidelines set forth by the Internal Revenue Service (IRS). Employees must adhere to these regulations to ensure compliance and avoid potential penalties. For instance, contributions to these accounts must not exceed annual limits established by the IRS, and funds must be used for qualified expenses. Understanding these legal requirements is crucial for participants to maximize their benefits while remaining compliant with tax laws.

Eligibility Criteria for HCFSA and DeCAP

Eligibility for the HCFSA and DeCAP programs typically requires that employees be active participants in the benefits program at Hunter College. Specific criteria may include employment status, length of service, and participation in other benefit plans. Employees should review the eligibility requirements carefully to confirm their qualification for these valuable financial assistance programs.

Application Process and Approval Timeline

The application process for the HCFSA and DeCAP programs is straightforward. After completing the enrollment form, employees submit it to the Office of Labor Relations. Once submitted, the approval timeline may vary, but employees can generally expect to receive confirmation of their enrollment within a few weeks. It is advisable to follow up with the benefits office if confirmation is not received within the expected timeframe.

Quick guide on how to complete the health care flexible spending account hcfsa program and the dependent care assistance program decap are divisions of the

Complete [SKS] effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents promptly without any holdups. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize signNow parts of the documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Alter and eSign [SKS] and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the health care flexible spending account hcfsa program and the dependent care assistance program decap are divisions of the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Health Care Flexible Spending Account (HCFSA) Program?

The Health Care Flexible Spending Account (HCFSA) Program is designed to help employees set aside pre-tax dollars for eligible medical expenses. It is part of The Health Care Flexible Spending Account HCFSA Program And The Dependent Care Assistance Program DeCAP Are Divisions Of The Office Of Labor Relations' Tax Favored Benefits Program Hr Hunter Cuny. This program can signNowly reduce your taxable income while providing necessary funds for healthcare needs.

-

How does the Dependent Care Assistance Program (DeCAP) work?

The Dependent Care Assistance Program (DeCAP) allows employees to pay for dependent care expenses with pre-tax dollars, making it a valuable resource for working parents. As part of The Health Care Flexible Spending Account HCFSA Program And The Dependent Care Assistance Program DeCAP Are Divisions Of The Office Of Labor Relations' Tax Favored Benefits Program Hr Hunter Cuny, DeCAP can help ease the financial burden of childcare costs and make it easier for you to work without worry.

-

What are the eligibility requirements for these programs?

To participate in The Health Care Flexible Spending Account HCFSA Program And The Dependent Care Assistance Program DeCAP Are Divisions Of The Office Of Labor Relations' Tax Favored Benefits Program Hr Hunter Cuny, employees must meet specific eligibility criteria set by their employer. Typically, employees must be enrolled in a company benefits program and may need to provide proof of dependent care expenses or valid medical costs to access these benefits.

-

What types of expenses are covered under HCFSA?

The Health Care Flexible Spending Account HCFSA Program can cover a wide range of qualified medical expenses, including copays, deductibles, and prescription medications. It is a part of The Health Care Flexible Spending Account HCFSA Program And The Dependent Care Assistance Program DeCAP Are Divisions Of The Office Of Labor Relations' Tax Favored Benefits Program Hr Hunter Cuny, aimed at maximizing your healthcare budget. Understanding covered expenses ensures you utilize your account effectively.

-

How can I enroll in the HCFSA and DeCAP programs?

Enrollment in The Health Care Flexible Spending Account HCFSA Program And The Dependent Care Assistance Program DeCAP Are Divisions Of The Office Of Labor Relations' Tax Favored Benefits Program Hr Hunter Cuny typically occurs during the annual benefits enrollment period. Employees should check with their HR department for specific enrollment instructions and any necessary documentation. Timely enrollment ensures you can take full advantage of the program benefits.

-

Are there any contribution limits for HCFSA and DeCAP?

Yes, there are annual contribution limits for both the HCFSA and DeCAP programs as outlined by the IRS, which may change yearly. The Health Care Flexible Spending Account HCFSA Program And The Dependent Care Assistance Program DeCAP Are Divisions Of The Office Of Labor Relations' Tax Favored Benefits Program Hr Hunter Cuny follows these guidelines to comply with tax regulations while providing maximum benefit potential. It's important to stay informed about these limits to plan your contributions effectively.

-

What are the tax advantages of using HCFSA and DeCAP?

Using The Health Care Flexible Spending Account HCFSA Program And The Dependent Care Assistance Program DeCAP Are Divisions Of The Office Of Labor Relations' Tax Favored Benefits Program Hr Hunter Cuny offers signNow tax advantages, as contributions are made with pre-tax dollars. This reduces your taxable income, potentially lowering your overall tax liability. By leveraging these programs, you can save money on necessary expenses while complying with tax regulations.

Get more for The Health Care Flexible Spending Account HCFSA Program And The Dependent Care Assistance Program DeCAP Are Divisions Of The Off

- Fefc worship team application faith evangelical church form

- Conference request form

- Consent in tagalog form

- Employment application spanish version form

- Dilation bands a new form of localized failure in granular media

- The techniques and process of ascertaining cost is called as form

- New patient registration form physical therapy

- Irs tax return transcript southern crescent technical college sctech form

Find out other The Health Care Flexible Spending Account HCFSA Program And The Dependent Care Assistance Program DeCAP Are Divisions Of The Off

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online