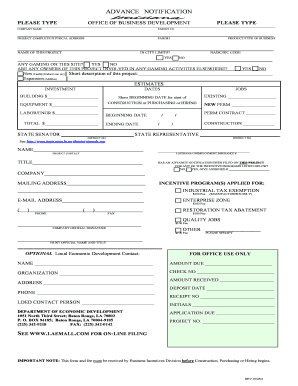

Restoration Tax Abatement Program Form

What is the Restoration Tax Abatement Program

The Restoration Tax Abatement Program is a financial incentive offered by various state and local governments in the United States. It aims to encourage the rehabilitation and restoration of residential and commercial properties. By providing tax reductions or exemptions, the program helps property owners offset the costs associated with restoring older or historically significant buildings. This initiative not only promotes preservation but also revitalizes communities by enhancing property values and attracting new investments.

Eligibility Criteria

To qualify for the Restoration Tax Abatement Program, property owners must meet specific eligibility requirements, which can vary by location. Generally, the following criteria apply:

- The property must be located in a designated area eligible for the program.

- The property should be at least a certain age, often over fifty years, to qualify as a historic or older building.

- Restoration work must adhere to local preservation standards and guidelines.

- The property owner must apply for the program before beginning any restoration activities.

How to obtain the Restoration Tax Abatement Program

Obtaining benefits from the Restoration Tax Abatement Program involves several steps. Property owners should start by researching the specific requirements and guidelines set by their local government or housing authority. The general process includes:

- Completing an application form, which may require detailed information about the property and the proposed restoration work.

- Submitting the application along with any required documentation, such as architectural plans or proof of property ownership.

- Awaiting approval from the local governing body, which may involve a review process to ensure compliance with preservation standards.

Steps to complete the Restoration Tax Abatement Program

Completing the Restoration Tax Abatement Program involves a structured approach to ensure all requirements are met. Here are the essential steps:

- Research local eligibility criteria and guidelines for the program.

- Prepare the necessary documentation, including the application form and supporting materials.

- Submit the application to the appropriate local authority.

- Complete the restoration work according to approved plans and guidelines.

- File for the tax abatement after the completion of the restoration, providing any additional documentation required.

Required Documents

When applying for the Restoration Tax Abatement Program, property owners must gather and submit several key documents. These typically include:

- A completed application form specific to the program.

- Proof of property ownership, such as a deed or title.

- Architectural plans or specifications detailing the proposed restoration work.

- Photographs of the property before restoration.

- Any additional documentation requested by the local authority.

Key elements of the Restoration Tax Abatement Program

Understanding the key elements of the Restoration Tax Abatement Program is crucial for property owners. Important aspects include:

- The duration of the tax abatement, which can vary from a few years to several decades.

- The percentage of tax reduction or exemption offered, which is often based on the cost of restoration.

- Compliance requirements, including adherence to local preservation standards and periodic inspections.

- The potential for increased property value and marketability after restoration.

Quick guide on how to complete restoration tax abatement program

Effortlessly Complete [SKS] on Any Gadget

Digital document administration has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The Easiest Method to Alter and eSign [SKS] Without Stress

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with specialized tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign [SKS] while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Restoration Tax Abatement Program

Create this form in 5 minutes!

How to create an eSignature for the restoration tax abatement program

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Restoration Tax Abatement Program?

The Restoration Tax Abatement Program is a financial incentive designed to encourage property renovation and restoration in designated areas. This program allows property owners to reduce their property taxes for a set period, providing substantial savings while enhancing the community's aesthetic value. Understanding how this program works can be critical for your financial planning.

-

How can the Restoration Tax Abatement Program benefit my business?

By participating in the Restoration Tax Abatement Program, businesses can signNowly lower their tax liabilities, allowing for reinvestment into their properties or operations. This financial relief boosts cash flow and can lead to increased profitability and growth. It's an opportunity for businesses to enhance their physical spaces without the heavy financial burden.

-

What are the eligibility criteria for the Restoration Tax Abatement Program?

Eligibility for the Restoration Tax Abatement Program typically requires that your property meets specific criteria such as location, type of improvements, and adherence to local regulations. It often applies to historic properties or those located in designated revitalization areas. Checking with local authorities is advisable to ensure your property qualifies.

-

How does airSlate SignNow facilitate the application process for the Restoration Tax Abatement Program?

airSlate SignNow simplifies the application process for the Restoration Tax Abatement Program by providing an intuitive platform for sending and eSigning required documents. With streamlined workflows and secure document handling, you can complete your applications swiftly and efficiently. This eliminates paperwork hassles, allowing you to focus on your property enhancements.

-

Are there any costs associated with applying for the Restoration Tax Abatement Program?

While there may be negligible administrative costs involved in the application for the Restoration Tax Abatement Program, many of the benefits far outweigh these expenses. Utilizing airSlate SignNow can help reduce costs associated with document preparation and submission. Always check with local authorities for any specific fees related to your area.

-

Can the Restoration Tax Abatement Program lead to increased property value?

Absolutely! The Restoration Tax Abatement Program encourages property enhancements that can signNowly increase the market value of your property. By investing in renovations while benefiting from tax savings, you can create a more appealing asset that attracts buyers and tenants alike, ultimately enhancing your investment portfolio.

-

What features does airSlate SignNow offer to support the Restoration Tax Abatement Program?

airSlate SignNow provides features such as electronic signatures, customizable document templates, and secure storage solutions to support the Restoration Tax Abatement Program application process. These tools ensure that you can manage the necessary paperwork with ease and confidence. Effortless collaboration enhances efficiency for you and your team.

Get more for Restoration Tax Abatement Program

- Voice lessons nancy dean pdf answer key form

- Tax credits overpayment dispute form

- Pdf the ayushman bharat pradhan mantri jan arogya yojana form

- Property auction notice auctioneerindia com form

- Tdcj form rrp 120

- Mrampc user id application minnesota department of health health state mn form

- Irregular verbs worksheet super teacher form

- Adult vaccine administration record minnesota dept of health health state mn form

Find out other Restoration Tax Abatement Program

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF