Ultimate Guide to the Arizona Foster Care Tax Credit 2023-2026

Understanding the Arizona Foster Care Tax Credit

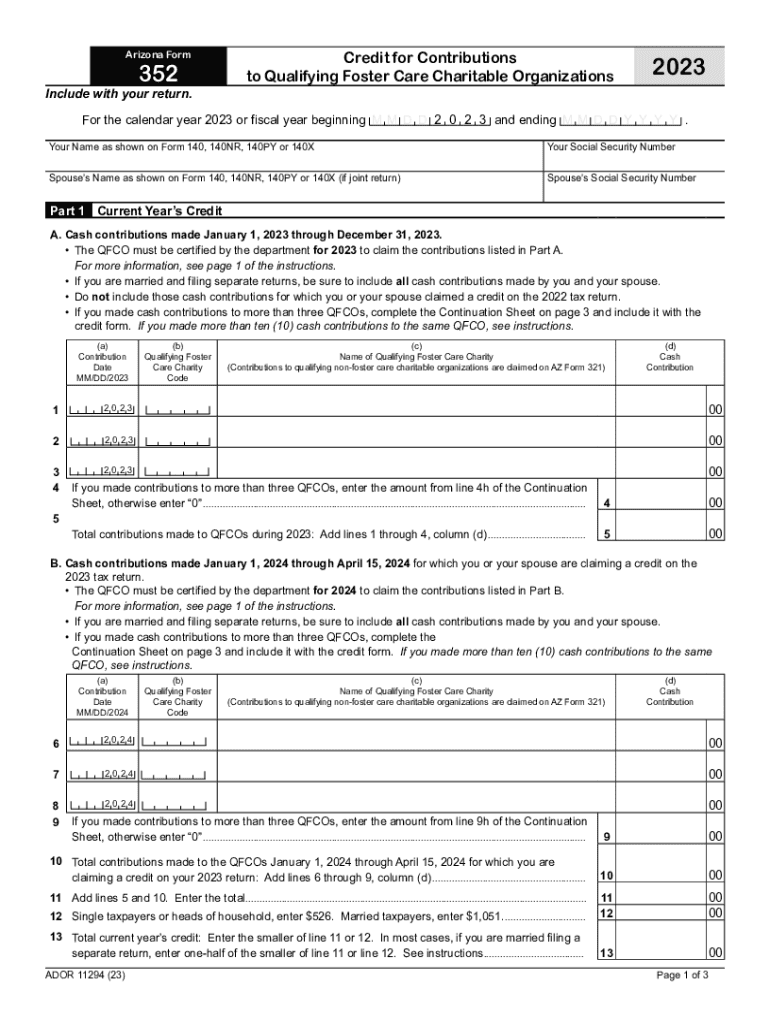

The 2023 form 352 is essential for individuals and organizations looking to take advantage of the Arizona Foster Care Tax Credit. This credit is designed to encourage support for foster care by providing tax benefits to those who contribute to qualifying foster care organizations. The credit can significantly reduce the amount of state tax owed, making it an attractive option for taxpayers interested in supporting foster care initiatives.

Eligibility Criteria for the Arizona Foster Care Tax Credit

To qualify for the Arizona Foster Care Tax Credit, taxpayers must meet specific criteria. Individuals must contribute to a qualifying charitable organization that provides foster care services. The organization must be certified by the Arizona Department of Revenue. Contributions can include cash donations or property donations, but it is essential to ensure that the organization is recognized under the state guidelines. Taxpayers should also be aware of the maximum credit limits and ensure they do not exceed these amounts.

Steps to Complete the 2023 Form 352

Filling out the 2023 form 352 involves several straightforward steps:

- Gather necessary documentation, including proof of contributions to qualifying organizations.

- Complete the form by providing personal information, including your Social Security number and filing status.

- Detail the contributions made, including the name and address of the organization, along with the amount donated.

- Calculate the credit amount based on your contributions and the applicable limits.

- Review the form for accuracy before submission.

Required Documents for Filing

When preparing to file the 2023 form 352, taxpayers should collect the following documents:

- Receipts or acknowledgment letters from the qualifying foster care organizations.

- A completed copy of the 2023 form 352.

- Any additional documentation that supports the contributions made during the tax year.

Filing Deadlines for the 2023 Form 352

It is crucial to be aware of the filing deadlines for the 2023 form 352. Typically, the form must be submitted by the same deadline as your state income tax return. For most taxpayers, this is April 15. However, if you file for an extension, ensure that the form is submitted by the extended deadline to avoid penalties.

Form Submission Methods

The 2023 form 352 can be submitted through various methods, ensuring convenience for taxpayers:

- Online submission through the Arizona Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate address provided by the state.

- In-person submission at designated state tax offices.

Quick guide on how to complete ultimate guide to the arizona foster care tax credit

Easily Prepare Ultimate Guide To The Arizona Foster Care Tax Credit on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Ultimate Guide To The Arizona Foster Care Tax Credit on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign Ultimate Guide To The Arizona Foster Care Tax Credit Effortlessly

- Obtain Ultimate Guide To The Arizona Foster Care Tax Credit and click on Get Form to get started.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your updates.

- Decide how you wish to share your form, whether via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Edit and eSign Ultimate Guide To The Arizona Foster Care Tax Credit to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ultimate guide to the arizona foster care tax credit

Create this form in 5 minutes!

How to create an eSignature for the ultimate guide to the arizona foster care tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'arizona 352 edit' feature in airSlate SignNow?

The 'arizona 352 edit' feature in airSlate SignNow allows users to customize document fields easily, ensuring that all edits align perfectly with your requirements. This function enhances operational efficiency by minimizing the time spent on document management. It's particularly beneficial for businesses dealing with numerous contracts and agreements needing alterations.

-

How much does airSlate SignNow cost for the 'arizona 352 edit' functionality?

airSlate SignNow offers competitive pricing plans that include the 'arizona 352 edit' functionality. We provide several options tailored to fit different business sizes and needs, making it a cost-effective solution for document management. You can explore our pricing page for detailed information on plans and features.

-

What are the benefits of using airSlate SignNow for 'arizona 352 edit'?

Using airSlate SignNow for 'arizona 352 edit' streamlines your document editing processes, making it signNowly faster and more reliable. This leads to improved accuracy in your documents, and enhances collaboration among team members. Additionally, it reduces the administrative burden of managing document modifications.

-

Can I integrate airSlate SignNow with other tools while using 'arizona 352 edit'?

Absolutely! airSlate SignNow supports a variety of integrations, allowing you to link the 'arizona 352 edit' capability with other essential tools in your workflow. This flexibility ensures that you can maintain your preferred software systems without any disruptions. Integrations enhance productivity by creating a seamless document management experience.

-

Is there a mobile app for airSlate SignNow's 'arizona 352 edit' feature?

Yes, airSlate SignNow provides a mobile app that includes the 'arizona 352 edit' feature, allowing you to edit documents on-the-go. This mobility means you can manage and sign documents anytime, anywhere, without being tied to a desktop. The user-friendly design makes it easy to navigate and utilize the editing features.

-

How secure is the 'arizona 352 edit' feature in airSlate SignNow?

The 'arizona 352 edit' feature in airSlate SignNow is designed with top-notch security protocols to ensure your documents remain safe. We utilize encryption technologies and secure access to protect sensitive information. You can trust that your document edits and data are handled with the utmost security and confidentiality.

-

Can I use the 'arizona 352 edit' feature for multiple document types?

Yes, the 'arizona 352 edit' feature in airSlate SignNow is versatile and can be applied to multiple document types including contracts, agreements, and legal forms. This flexibility makes it suitable for various industries, enhancing its utility for all types of businesses. You can easily switch between document types without compromising on editing functionality.

Get more for Ultimate Guide To The Arizona Foster Care Tax Credit

- Your fingerprint cards must include form

- H1028 proof employment form

- Prescription refill request form template

- Texas standard prior authorization request form for health care services texas standard prior authorization request form for

- Diabetes log 2 uintah form

- Allows you to name another person to make health care form

- Health appraisal form viewmont elementary school viewmontelementary

- Chapter 2 worksheet the nursing assistant 1 list 6 rules that bb form

Find out other Ultimate Guide To The Arizona Foster Care Tax Credit

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy