Arizona Form352Credit for Contributions to Qualify 2022

What is the Arizona Form 352 Credit for Contributions

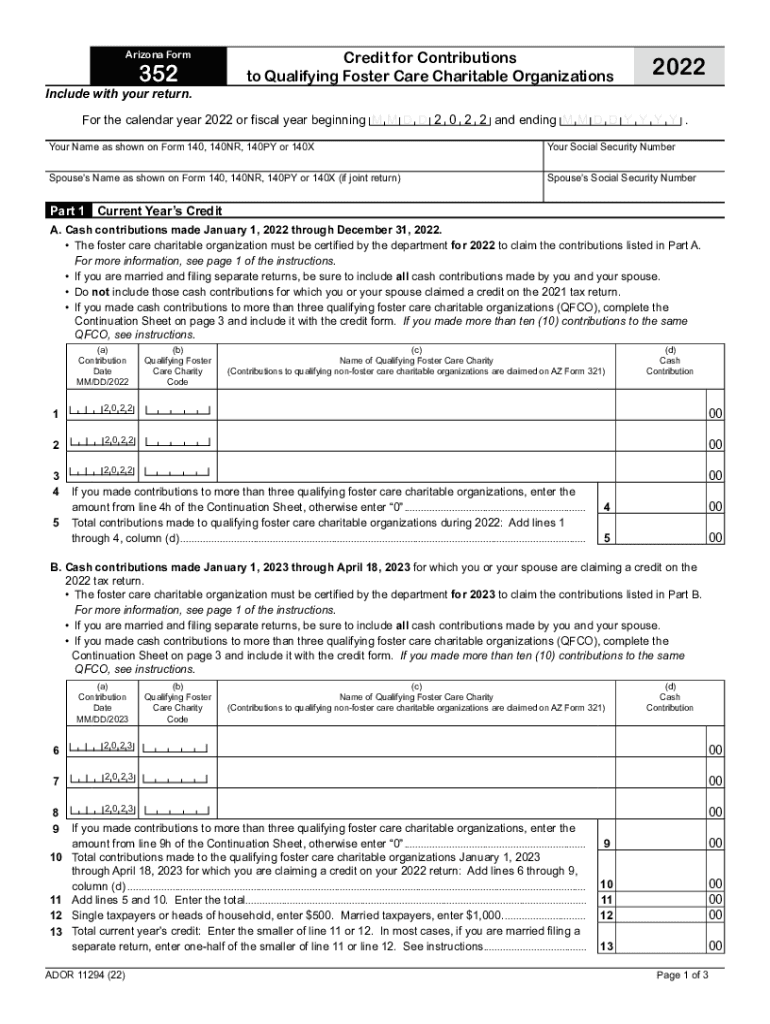

The Arizona Form 352 is a tax form used by individuals and businesses to claim a tax credit for contributions made to qualifying charitable organizations in Arizona. This credit allows taxpayers to receive a dollar-for-dollar reduction in their state tax liability, encouraging philanthropic efforts within the state. The contributions must be made to organizations that are recognized as qualifying charities under Arizona law, which typically include schools, nonprofit organizations, and other entities that provide community services.

Eligibility Criteria for the Arizona Form 352

To qualify for the Arizona Form 352 credit, taxpayers must meet specific eligibility criteria. Individuals must have made contributions to qualifying charities during the tax year. The contributions can be cash donations or in-kind gifts, but they must be documented properly. Additionally, the taxpayer must be a resident of Arizona and must file an Arizona state tax return. There are also limits on the amount that can be claimed based on filing status, so it is important to review these limits to maximize the benefits of the credit.

Steps to Complete the Arizona Form 352

Completing the Arizona Form 352 involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts and records of contributions made to qualifying charities. Next, fill out the form with your personal information, including your Social Security number and address. Then, report the total amount of contributions made during the tax year. Finally, review the form for accuracy and submit it along with your Arizona state tax return. It is advisable to keep copies of all submitted documents for your records.

How to Obtain the Arizona Form 352

The Arizona Form 352 can be obtained through the Arizona Department of Revenue's website or by visiting local tax offices. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax preparation software programs include the form, allowing for easier electronic filing. Ensure that you are using the most current version of the form to avoid any issues during the filing process.

Key Elements of the Arizona Form 352

Several key elements are essential when completing the Arizona Form 352. These include the taxpayer's identification information, the details of the qualifying contributions, and the calculation of the credit amount. Taxpayers must also provide information about the charities to which they contributed, including the name, address, and tax identification number of each organization. Accurate record-keeping is crucial to substantiate claims made on the form.

Filing Deadlines for the Arizona Form 352

The filing deadline for the Arizona Form 352 typically aligns with the state tax return deadline, which is usually April 15th of each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should ensure that they submit the form along with their state tax return by this deadline to avoid penalties and to ensure they receive the tax credit for their contributions.

Legal Use of the Arizona Form 352

The Arizona Form 352 is legally recognized as a means for taxpayers to claim a credit for charitable contributions. It is important to use the form in accordance with Arizona tax laws and regulations. Filing the form accurately and on time not only helps taxpayers benefit from the credit but also supports the charitable organizations that rely on contributions for their operations. Misrepresentation or fraudulent claims can lead to penalties, so it is essential to adhere to all legal requirements when using this form.

Quick guide on how to complete arizona form352credit for contributionsto qualify

Effortlessly prepare Arizona Form352Credit For Contributions To Qualify on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Arizona Form352Credit For Contributions To Qualify on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Easily modify and electronically sign Arizona Form352Credit For Contributions To Qualify

- Find Arizona Form352Credit For Contributions To Qualify and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your updates.

- Choose your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Arizona Form352Credit For Contributions To Qualify and guarantee excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form352credit for contributionsto qualify

Create this form in 5 minutes!

How to create an eSignature for the arizona form352credit for contributionsto qualify

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the az form 352 and how can it be used with airSlate SignNow?

The az form 352 is an official document used by certain Arizona agencies. With airSlate SignNow, users can easily upload, fill out, and eSign the az form 352, streamlining the workflow and ensuring compliance. Whether you're in real estate or government services, airSlate SignNow simplifies the process of handling the az form 352.

-

What are the pricing options for using airSlate SignNow with az form 352?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to essential features for handling the az form 352 efficiently, including secure eSigning and document management. For precise pricing, please visit the airSlate SignNow website or contact our sales team.

-

What features does airSlate SignNow offer for managing the az form 352?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These tools are specifically beneficial for managing the az form 352, ensuring you can easily edit, send, and sign the document online. Additionally, notifications are sent to keep all parties informed.

-

How can airSlate SignNow benefit businesses that frequently use az form 352?

Businesses that often deal with the az form 352 will find airSlate SignNow invaluable for improving efficiency. The platform reduces the time spent on paperwork through its user-friendly interface and electronic signature capabilities. This not only accelerates processing but also enhances security and compliance with state regulations.

-

Are there integrations available for using az form 352 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your document workflow when using the az form 352. Whether you use CRM systems, cloud storage, or accounting software, these integrations simplify the process of sending and managing documents. You can easily connect your favorite tools to streamline operations.

-

Is it possible to store the az form 352 securely with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents. The az form 352 can be stored securely in the cloud, with encryption and access controls to protect sensitive information. This ensures that only authorized individuals can access or modify your documents.

-

How user-friendly is airSlate SignNow for completing the az form 352?

airSlate SignNow is designed with user experience in mind, making the completion of the az form 352 straightforward. The intuitive interface means that users can quickly fill out and eSign documents, regardless of their technical skills. With simple navigation, you can streamline your document processes effectively.

Get more for Arizona Form352Credit For Contributions To Qualify

- Letter landlord tenant 497318622 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497318623 form

- New hampshire letter form

- Letter from tenant to landlord containing notice that doors are broken and demand repair new hampshire form

- Nh letter demand form

- Letter from tenant to landlord with demand that landlord repair plumbing problem new hampshire form

- New hampshire letter 497318628 form

- New hampshire letter 497318629 form

Find out other Arizona Form352Credit For Contributions To Qualify

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template