Pennsylvania Form DEX 93 Personal Income Tax

What is the Pennsylvania Form DEX 93 Personal Income Tax

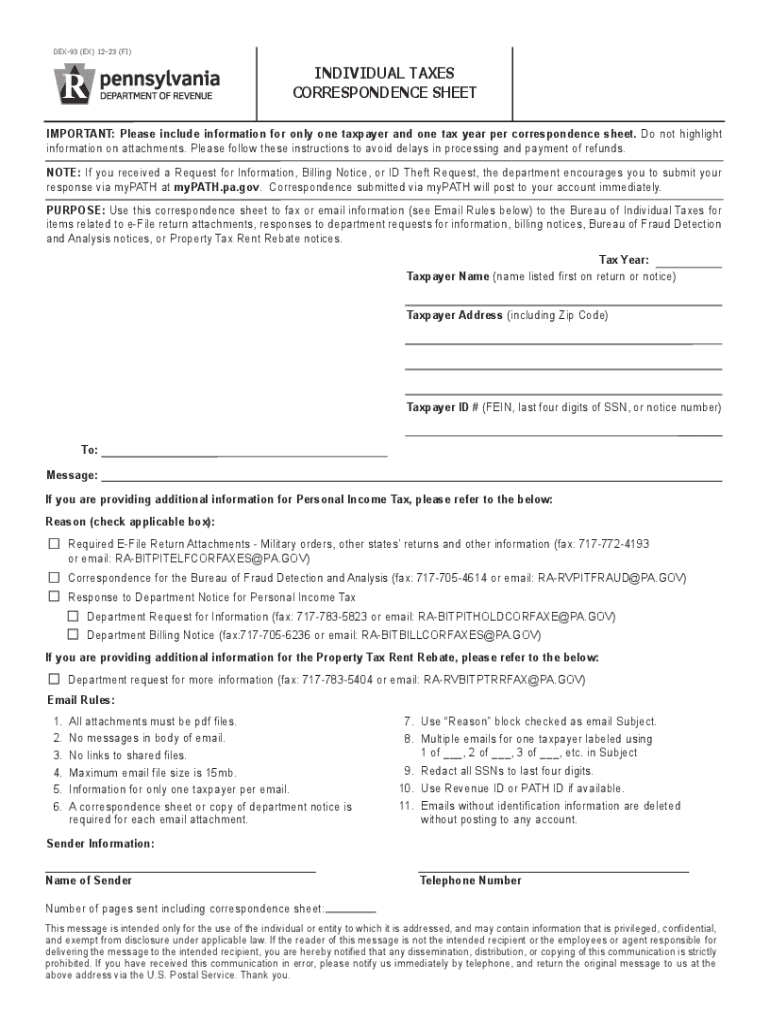

The Pennsylvania Form DEX 93 is a crucial document used for personal income tax purposes within the state. This form is specifically designed for taxpayers who need to report their income, deductions, and tax liabilities to the Pennsylvania Department of Revenue. The DEX 93 form is essential for ensuring compliance with state tax laws and helps in accurately calculating the amount of tax owed or any potential refund due to the taxpayer.

How to use the Pennsylvania Form DEX 93 Personal Income Tax

Using the Pennsylvania Form DEX 93 involves several steps to ensure accurate reporting. Taxpayers must first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Once the relevant information is collected, individuals can begin filling out the form by entering their personal details, income sources, and applicable deductions. It is important to follow the instructions provided with the form carefully to avoid errors that could lead to delays in processing or penalties.

Steps to complete the Pennsylvania Form DEX 93 Personal Income Tax

Completing the Pennsylvania Form DEX 93 can be broken down into a series of straightforward steps:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Apply any eligible deductions and credits according to state guidelines.

- Calculate your total tax liability or refund based on the information provided.

- Review the completed form for accuracy before submission.

Key elements of the Pennsylvania Form DEX 93 Personal Income Tax

The Pennsylvania Form DEX 93 includes several key elements that are essential for proper tax reporting. These elements typically consist of:

- Personal identification information of the taxpayer.

- Details of all income sources, including wages, interest, and dividends.

- Applicable deductions, such as those for education or medical expenses.

- Tax credits that may reduce the overall tax liability.

- Signature and date to validate the information provided.

Form Submission Methods

Taxpayers can submit the Pennsylvania Form DEX 93 through various methods, ensuring flexibility and convenience. The available submission methods include:

- Online submission through the Pennsylvania Department of Revenue's e-filing system.

- Mailing a printed copy of the completed form to the appropriate state address.

- In-person submission at designated tax offices, if preferred.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Pennsylvania Form DEX 93 can result in significant penalties. These may include:

- Fines for late filing or underpayment of taxes.

- Interest on any unpaid tax amounts.

- Potential legal action for persistent non-compliance.

Quick guide on how to complete pennsylvania form dex 93 personal income tax

Prepare Pennsylvania Form DEX 93 Personal Income Tax effortlessly on any device

Managing documents online has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it digitally. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Handle Pennsylvania Form DEX 93 Personal Income Tax on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Pennsylvania Form DEX 93 Personal Income Tax with ease

- Locate Pennsylvania Form DEX 93 Personal Income Tax and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Select relevant sections of the documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Decide how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Pennsylvania Form DEX 93 Personal Income Tax and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pennsylvania form dex 93 personal income tax

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania form dex 93 personal income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA Dex93 form and how does airSlate SignNow help in its completion?

The PA Dex93 form is a document used in various administrative processes. With airSlate SignNow, you can easily fill out and eSign the PA Dex93 form online, ensuring a streamlined and efficient way to handle your paperwork. This user-friendly platform minimizes errors and simplifies the submission process.

-

How much does it cost to use airSlate SignNow for the PA Dex93 form?

airSlate SignNow offers competitive pricing plans to accommodate different business needs. You can choose from various subscription options that provide access to features tailored for efficiently managing the PA Dex93 form. Start with a free trial to explore all functionalities before committing to a plan.

-

What features does airSlate SignNow offer for managing the PA Dex93 form?

AirSlate SignNow offers a host of features including customizable templates, real-time collaboration, and secure eSigning for the PA Dex93 form. These tools enhance productivity, allowing multiple users to work on documents seamlessly. Additionally, you can track document status and receive notifications when actions are required.

-

Is airSlate SignNow mobile-friendly for handling the PA Dex93 form?

Yes, airSlate SignNow is completely mobile-friendly, allowing you to access and manage the PA Dex93 form from any device. The mobile application ensures that you can eSign and send documents on the go without any hassle. This flexibility supports busy professionals who need to complete important paperwork anytime, anywhere.

-

Can I integrate airSlate SignNow with other applications to manage the PA Dex93 form?

Absolutely! airSlate SignNow supports integration with various applications, including CRM systems, cloud storage, and productivity tools, enhancing your workflow for the PA Dex93 form. These integrations ensure that you can seamlessly connect documents across platforms, saving time and reducing manual efforts.

-

How secure is my data when using airSlate SignNow for the PA Dex93 form?

Data security is a top priority for airSlate SignNow. Your information for the PA Dex93 form is protected with advanced encryption and compliance with industry standards. You can trust that your documents are safe during transmission and storage.

-

What are the benefits of using airSlate SignNow for the PA Dex93 form compared to traditional methods?

Using airSlate SignNow for the PA Dex93 form simplifies the signing process, reduces turnaround time, and minimizes paper waste. You can easily track the progress and status of the form, which traditional methods often lack. This digital approach saves you time and increases efficiency in handling important documents.

Get more for Pennsylvania Form DEX 93 Personal Income Tax

- Information needed in liew of online diploma application for

- Off campus agreement federal work study program university of form

- Nacs desk copy request form

- Common application for fellowship in regional form

- Immunization exemption request form 480419359

- Vanderbilt background check authorization and release form divinity vanderbilt

- Business idea worksheet form

- Authorized withdrawal form

Find out other Pennsylvania Form DEX 93 Personal Income Tax

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word