Fillable Online DEX 93 PA Department of Revenue PA Gov 2018

Understanding the Fillable Online DEX 93 Form

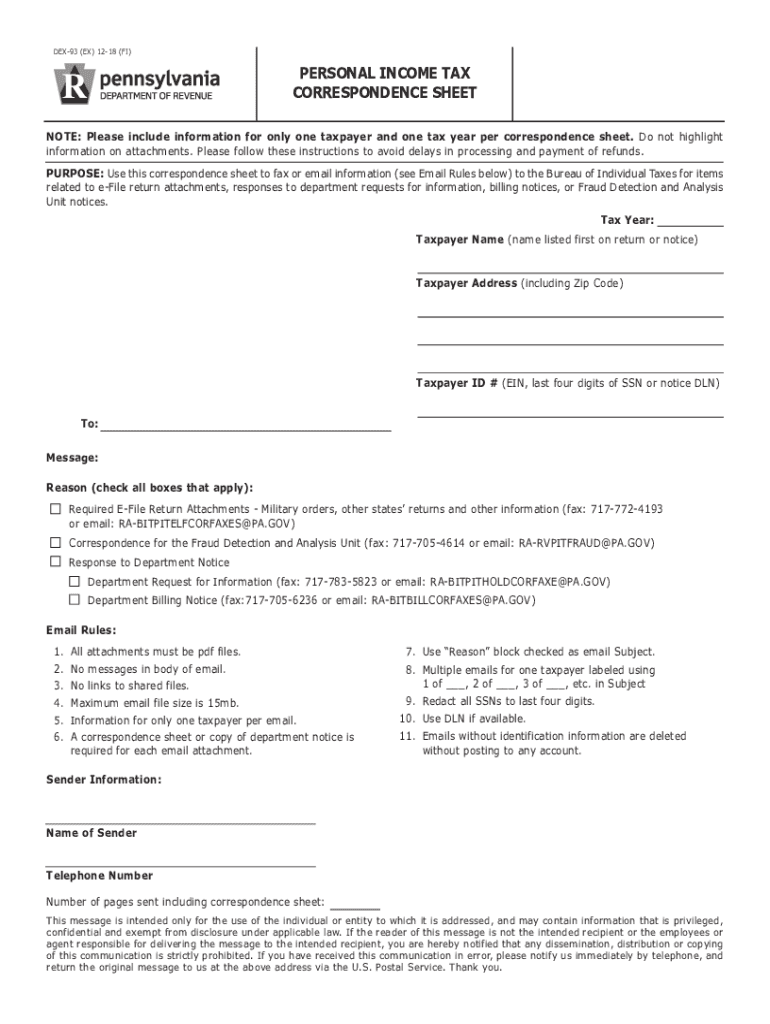

The Fillable Online DEX 93 form is a crucial document used by taxpayers in Pennsylvania to report specific tax information. This form is designed to facilitate the accurate reporting of income and tax liabilities, ensuring compliance with state regulations. Users can fill out the DEX 93 electronically, which streamlines the process and reduces the risk of errors associated with manual entry. The form is available on the Pennsylvania Department of Revenue's official website, making it accessible for all residents and businesses in the state.

Steps to Complete the Fillable Online DEX 93 Form

Completing the Fillable Online DEX 93 form involves several straightforward steps:

- Access the form through the Pennsylvania Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding your income sources and any applicable deductions.

- Review the information for accuracy before submitting.

- Submit the form electronically or print it for mailing, depending on your preference.

Following these steps helps ensure that your tax information is reported correctly and submitted on time.

Legal Use of the Fillable Online DEX 93 Form

The Fillable Online DEX 93 form is legally recognized as a valid document for tax reporting purposes in Pennsylvania. When completed and submitted according to the guidelines set forth by the Pennsylvania Department of Revenue, the form fulfills all legal requirements for tax compliance. It is essential for taxpayers to ensure that all information provided is accurate and truthful to avoid potential penalties or legal issues.

Filing Deadlines for the DEX 93 Form

Timely filing of the DEX 93 form is critical for compliance with Pennsylvania tax laws. The filing deadline typically aligns with the federal tax deadline, which is usually April 15. However, it is advisable to check the Pennsylvania Department of Revenue's website for any updates or changes to the deadlines. Filing on time helps avoid penalties and ensures that taxpayers remain in good standing with the state.

Form Submission Methods for the DEX 93

Taxpayers have several options for submitting the DEX 93 form:

- Online Submission: The most efficient method, allowing for immediate processing.

- Mail: Print the completed form and send it to the designated address provided on the form.

- In-Person: Some taxpayers may choose to submit the form directly at local tax offices, although this option may vary by location.

Choosing the right submission method can help ensure that your tax information is processed promptly and accurately.

Examples of Using the Fillable Online DEX 93 Form

Taxpayers may encounter various scenarios where the DEX 93 form is applicable:

- Individuals reporting income from self-employment.

- Residents claiming deductions for education expenses.

- Taxpayers who need to report income from rental properties.

Understanding these examples can help taxpayers recognize when to utilize the DEX 93 form effectively.

Quick guide on how to complete fillable online dex 93 pa department of revenue pagov

Easily Prepare Fillable Online DEX 93 PA Department Of Revenue PA gov on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Fillable Online DEX 93 PA Department Of Revenue PA gov on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The Easiest Way to Modify and Electronically Sign Fillable Online DEX 93 PA Department Of Revenue PA gov

- Obtain Fillable Online DEX 93 PA Department Of Revenue PA gov and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or mask sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Fillable Online DEX 93 PA Department Of Revenue PA gov to ensure effective communication at every step of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online dex 93 pa department of revenue pagov

Create this form in 5 minutes!

How to create an eSignature for the fillable online dex 93 pa department of revenue pagov

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

How does airSlate SignNow help with taxes tax documents?

airSlate SignNow streamlines the process of sending and eSigning taxes tax documents, making it easier for individuals and businesses to handle important paperwork efficiently. Our platform allows users to create templates specifically for taxes tax forms, ensuring that all necessary fields are completed accurately, reducing errors and saving time.

-

What features does airSlate SignNow offer for managing taxes tax forms?

With airSlate SignNow, you can utilize features such as customizable templates, automated reminders, and secure cloud storage for all your taxes tax documents. These features simplify the workflow, allowing you to manage multiple forms effortlessly and keep track of deadlines without hassle.

-

Is there a cost associated with using airSlate SignNow for taxes tax eSigning?

Yes, airSlate SignNow offers various pricing plans designed to meet different business needs. Our plans are cost-effective and provide great value for managing taxes tax documents, ensuring businesses can save money while getting reliable eSignature solutions.

-

What are the benefits of using airSlate SignNow for taxes tax management?

Using airSlate SignNow for taxes tax management increases efficiency and accuracy. The platform reduces physical paperwork, speeds up the signing process, and enhances collaboration among team members, allowing for quicker submission of taxes tax documents.

-

Can airSlate SignNow integrate with other software for taxes tax purposes?

Absolutely! airSlate SignNow provides seamless integrations with various software tools, making it easier to manage your taxes tax workflows. Whether you use accounting software or CRM systems, our platform can connect with them to enhance your overall efficiency.

-

How secure is airSlate SignNow for handling taxes tax documents?

airSlate SignNow prioritizes security, ensuring that all taxes tax documents are stored and transmitted securely. With features like advanced encryption and user authentication, you can trust that your sensitive tax information remains confidential and protected.

-

What types of businesses can benefit from airSlate SignNow for taxes tax management?

airSlate SignNow is suitable for all types of businesses, from freelancers to large corporations. Any organization dealing with taxes tax forms can benefit from our platform's ease of use, efficiency, and ability to manage documents securely.

Get more for Fillable Online DEX 93 PA Department Of Revenue PA gov

Find out other Fillable Online DEX 93 PA Department Of Revenue PA gov

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free