Federal Worksheet Fill Out and Auto Calculatecomplete Form 2023-2026

Understanding the dex 93 form

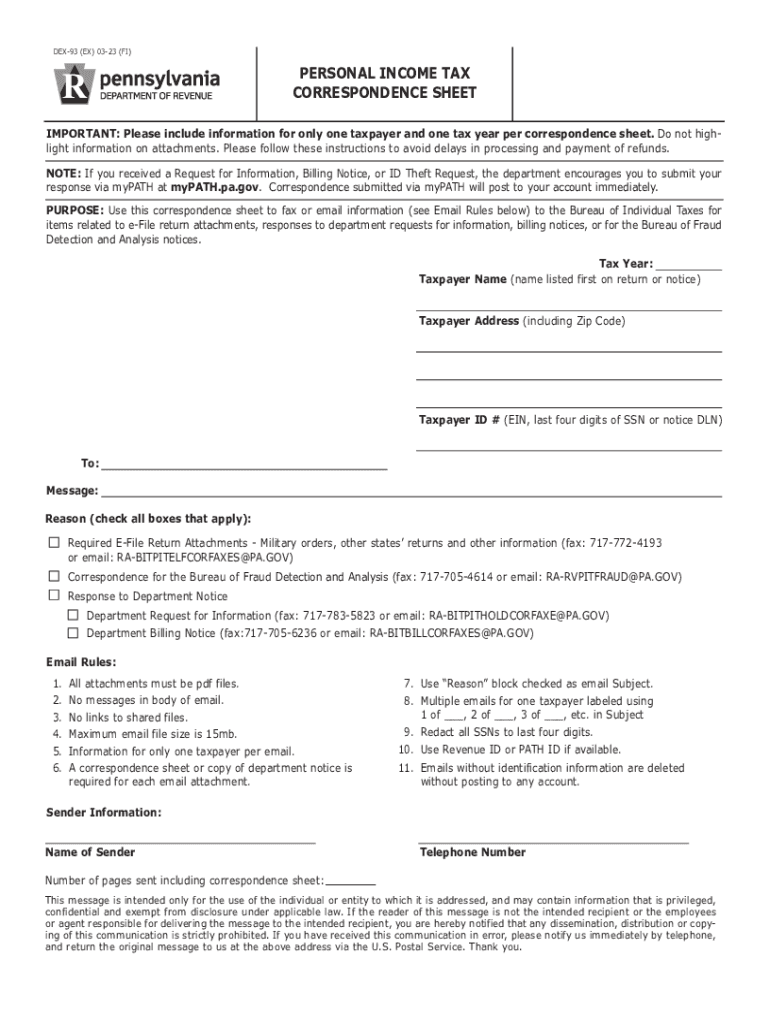

The dex 93 form, also known as the Pennsylvania DEX-93, is a document used for reporting personal income tax in the state of Pennsylvania. It serves as a key tool for taxpayers to accurately report their income and calculate their tax obligations. This form is essential for individuals and businesses alike, ensuring compliance with state tax regulations.

Steps to complete the dex 93 form

Filling out the dex 93 form involves several important steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Calculate your deductions and credits based on the guidelines provided in the form.

- Review your calculations to ensure accuracy before submission.

Legal use of the dex 93 form

The dex 93 form is legally required for Pennsylvania residents and businesses to report their income tax. Failing to file this form can result in penalties and interest on unpaid taxes. It is important to ensure that all information provided is truthful and accurate to avoid legal repercussions.

Filing deadlines for the dex 93 form

Taxpayers must be aware of the filing deadlines associated with the dex 93 form. Typically, the form is due on April 15 of each year for individuals. Extensions may be available, but it is essential to file any requests for extensions before the original deadline to avoid penalties.

Required documents for the dex 93 form

To complete the dex 93 form, several documents are required:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year’s tax return for reference

Form submission methods for the dex 93 form

The dex 93 form can be submitted through various methods, including:

- Online submission through the Pennsylvania Department of Revenue’s website

- Mailing a paper copy of the completed form to the appropriate address

- In-person delivery at designated tax offices

Common taxpayer scenarios for the dex 93 form

Different taxpayer scenarios may affect how the dex 93 form is completed:

- Self-employed individuals may need to report additional income and expenses.

- Retired individuals might have different income sources, such as pensions or Social Security.

- Students may qualify for specific deductions or credits based on their educational expenses.

Quick guide on how to complete federal worksheet fill out and auto calculatecomplete form

Effortlessly Prepare Federal Worksheet Fill Out And Auto Calculatecomplete Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without delays. Handle Federal Worksheet Fill Out And Auto Calculatecomplete Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Federal Worksheet Fill Out And Auto Calculatecomplete Form Seamlessly

- Locate Federal Worksheet Fill Out And Auto Calculatecomplete Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as an ink signature.

- Review the details and then click on the Done button to save your updates.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your preference. Modify and eSign Federal Worksheet Fill Out And Auto Calculatecomplete Form while ensuring excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal worksheet fill out and auto calculatecomplete form

Create this form in 5 minutes!

How to create an eSignature for the federal worksheet fill out and auto calculatecomplete form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dex 93 form and how can airSlate SignNow help with it?

The dex 93 form is a document commonly used for specific administrative purposes. With airSlate SignNow, businesses can easily eSign and send the dex 93 form, streamlining the entire process while ensuring compliance and security.

-

Is there a cost associated with using airSlate SignNow for the dex 93 form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. You can use our service to manage the dex 93 form cost-effectively while enjoying all the essential features for document signing and management.

-

What features does airSlate SignNow provide for handling the dex 93 form?

AirSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning options. These features make it easy to manage the dex 93 form efficiently and improve overall document handling processes.

-

Can I integrate airSlate SignNow with other applications for the dex 93 form?

Absolutely! airSlate SignNow offers integrations with popular applications such as Google Workspace and Salesforce. This allows you to seamlessly manage and eSign the dex 93 form within your existing workflow.

-

How does airSlate SignNow ensure the security of the dex 93 form?

AirSlate SignNow prioritizes security by implementing advanced encryption methods and secure cloud storage. This ensures that any dex 93 form handled through our platform is protected against unauthorized access and data bsignNowes.

-

What are the benefits of using airSlate SignNow for the dex 93 form?

Using airSlate SignNow for the dex 93 form allows for faster processing times and reduced paperwork. Businesses can enhance their efficiency and accuracy in document handling, leading to an overall improved operational workflow.

-

Is airSlate SignNow user-friendly for completing the dex 93 form?

Yes, airSlate SignNow is designed with user experience in mind. Its intuitive interface makes it easy for anyone to navigate and complete the dex 93 form without the need for extensive training or technical expertise.

Get more for Federal Worksheet Fill Out And Auto Calculatecomplete Form

Find out other Federal Worksheet Fill Out And Auto Calculatecomplete Form

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation