City of Philadelphia NET PROFITS TAX 2018

What is the City Of Philadelphia NET PROFITS TAX

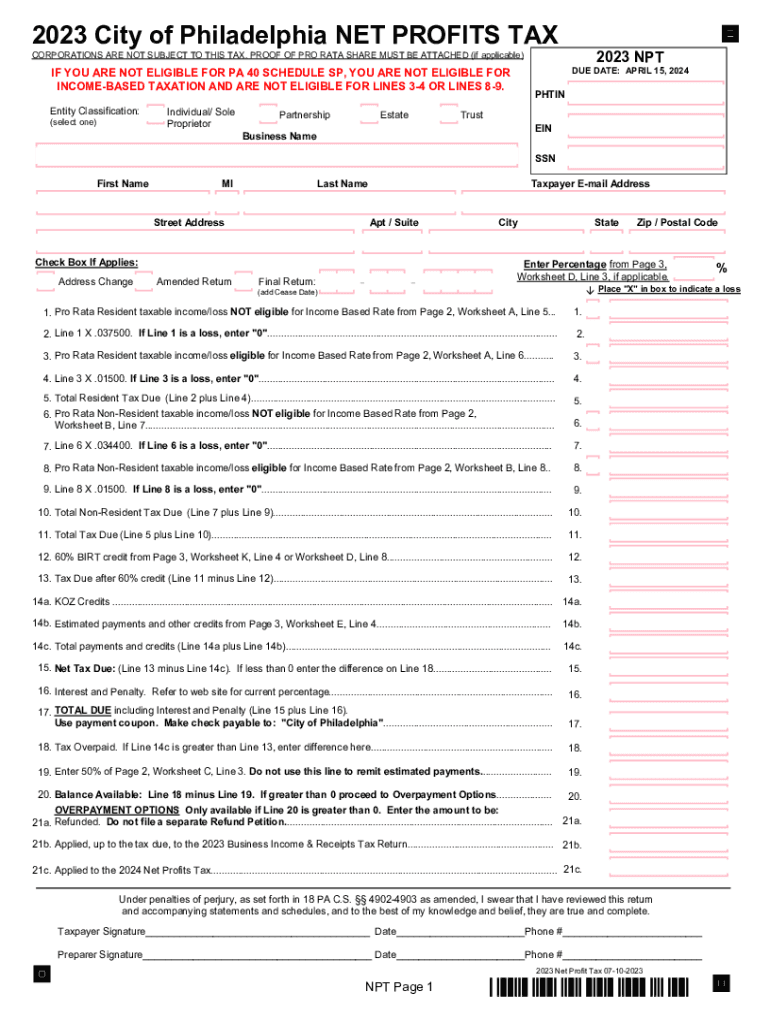

The City of Philadelphia Net Profits Tax is a tax imposed on businesses operating within the city. This tax applies to the net income earned by various business entities, including corporations, partnerships, and sole proprietorships. The tax is designed to generate revenue for the city and is based on the profits generated from business activities conducted within Philadelphia. Understanding this tax is crucial for compliance and effective financial planning for businesses in the area.

How to use the City Of Philadelphia NET PROFITS TAX

Using the City of Philadelphia Net Profits Tax involves several steps, including calculating your taxable income, determining the tax rate applicable to your business type, and filing the appropriate forms. Businesses must accurately report their net profits and ensure they meet the filing deadlines to avoid penalties. It's essential to keep detailed records of all income and expenses to support the figures reported on your tax return.

Steps to complete the City Of Philadelphia NET PROFITS TAX

Completing the City of Philadelphia Net Profits Tax requires a systematic approach:

- Gather all financial documents, including income statements and expense reports.

- Calculate your total net income by subtracting allowable business expenses from gross income.

- Determine the applicable tax rate based on your business structure.

- Fill out the required tax forms accurately, ensuring all information is complete.

- Submit the forms by the designated filing deadline, either online or via mail.

Required Documents

To file the City of Philadelphia Net Profits Tax, businesses must prepare specific documents, including:

- Income statements detailing gross receipts and net profits.

- Expense reports that itemize allowable deductions.

- Previous tax returns, if applicable, for reference.

- Any additional documentation requested by the Philadelphia Department of Revenue.

Filing Deadlines / Important Dates

Being aware of filing deadlines for the City of Philadelphia Net Profits Tax is essential to avoid late fees and penalties. Typically, the tax return is due on the fifteenth day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. It's advisable to check for any updates or changes to these deadlines annually.

Penalties for Non-Compliance

Failure to comply with the City of Philadelphia Net Profits Tax regulations can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest charges on unpaid taxes.

- Potential legal action for continued non-compliance.

Businesses should ensure timely and accurate filings to avoid these consequences.

Quick guide on how to complete city of philadelphia net profits tax 708828097

Complete City Of Philadelphia NET PROFITS TAX effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to easily find the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents swiftly without any hurdles. Manage City Of Philadelphia NET PROFITS TAX on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign City Of Philadelphia NET PROFITS TAX with ease

- Find City Of Philadelphia NET PROFITS TAX and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign City Of Philadelphia NET PROFITS TAX while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city of philadelphia net profits tax 708828097

Create this form in 5 minutes!

How to create an eSignature for the city of philadelphia net profits tax 708828097

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the City Of Philadelphia NET PROFITS TAX and how does it affect businesses?

The City Of Philadelphia NET PROFITS TAX is a local tax imposed on the net income of businesses operating within the city. It is crucial for business owners to understand this tax as it directly impacts their overall profitability and compliance requirements. Ensuring proper tax reporting and payment is essential for maintaining good standing with the city.

-

How can airSlate SignNow assist with documentation for City Of Philadelphia NET PROFITS TAX?

airSlate SignNow provides an efficient digital solution for preparing and signing necessary documents for the City Of Philadelphia NET PROFITS TAX. With user-friendly features, businesses can easily create and eSign tax forms, ensuring all paperwork is accurately completed and submitted on time, which helps streamline the tax filing process.

-

Are there any costs associated with using airSlate SignNow for City Of Philadelphia NET PROFITS TAX documentation?

Using airSlate SignNow comes with various pricing plans designed to accommodate different business needs. While there may be subscription fees associated with the service, the efficiency and accuracy it brings to managing City Of Philadelphia NET PROFITS TAX documentation can lead to time and cost savings over time.

-

What features does airSlate SignNow offer for managing tax documents related to City Of Philadelphia NET PROFITS TAX?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning capabilities that are perfect for managing City Of Philadelphia NET PROFITS TAX documents. These tools help businesses organize their tax-related paperwork more effectively and ensure compliance with filing deadlines.

-

Can I integrate airSlate SignNow with accounting software for my City Of Philadelphia NET PROFITS TAX needs?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions, making it easier to manage your City Of Philadelphia NET PROFITS TAX documentation. This integration allows for better tracking of income and expenses, ensuring more accurate and efficient tax reporting.

-

What are the benefits of using airSlate SignNow for handling City Of Philadelphia NET PROFITS TAX forms?

Using airSlate SignNow provides several benefits, including increased efficiency in document handling, enhanced security for sensitive tax information, and reduced risk of errors. These advantages help ensure that businesses remain compliant with the City Of Philadelphia NET PROFITS TAX requirements while saving time in their daily operations.

-

Is airSlate SignNow suitable for small businesses dealing with City Of Philadelphia NET PROFITS TAX?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses navigating the City Of Philadelphia NET PROFITS TAX. Its cost-effective nature and user-friendly interface make it an ideal choice for small businesses looking to simplify their tax documentation processes.

Get more for City Of Philadelphia NET PROFITS TAX

Find out other City Of Philadelphia NET PROFITS TAX

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online