Fillable Online Do You Have Less Than or Equal to $100,000 2020

Understanding the 2017 NPT Form

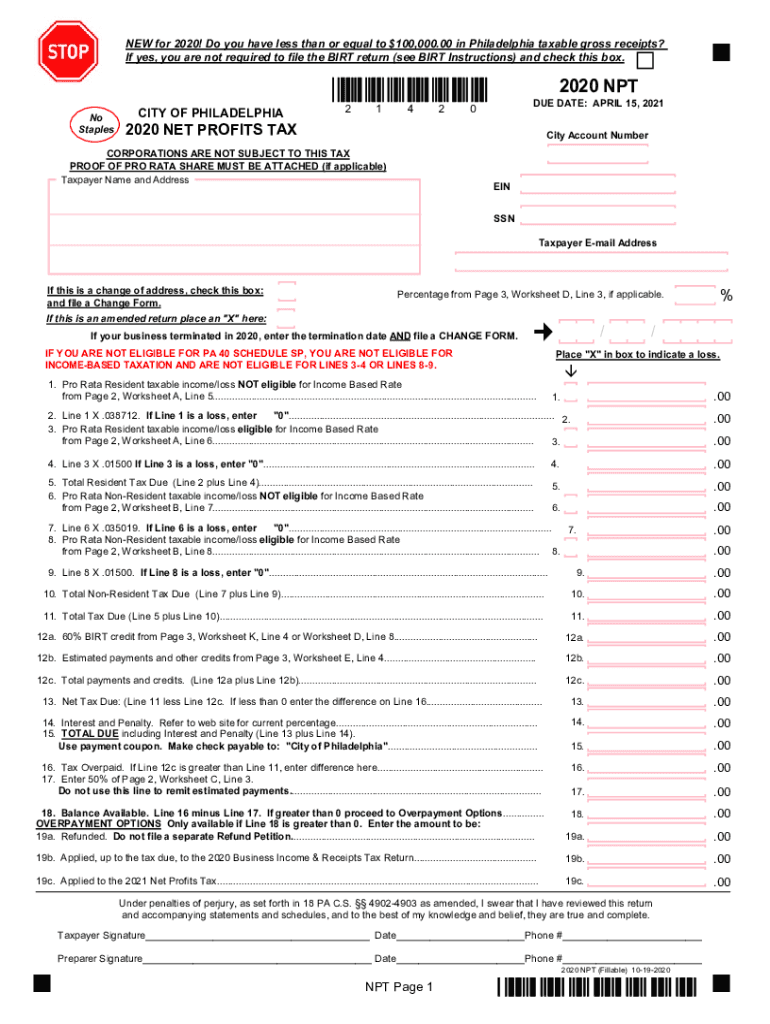

The 2017 NPT form, or Philadelphia Net Profits Tax form, is essential for individuals and businesses earning income within Philadelphia. This form is used to report net profits and calculate the corresponding tax owed to the city. It is crucial for compliance with local tax laws and ensures that all income generated within the city is accurately reported. The form must be completed with precise financial information to avoid penalties and ensure proper tax assessment.

Steps to Complete the 2017 NPT Form

Completing the 2017 NPT form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Calculate your net profits by subtracting allowable expenses from total income.

- Fill out the form accurately, ensuring all figures are correct and correspond to your financial records.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, following the guidelines provided by the Philadelphia Department of Revenue.

Filing Deadlines for the 2017 NPT Form

Timely filing of the 2017 NPT form is critical to avoid penalties. The deadline for submitting this form is typically April 15 of the following year, aligning with federal tax deadlines. If you are unable to meet this deadline, consider filing for an extension to avoid late fees. However, any taxes owed must still be paid by the original deadline to prevent interest accrual.

Required Documents for the 2017 NPT Form

To complete the 2017 NPT form, you will need several key documents:

- Profit and loss statements detailing income and expenses.

- Any relevant tax documents, such as W-2s or 1099s.

- Records of any deductions or credits you plan to claim.

- Previous year's tax returns for reference.

Legal Use of the 2017 NPT Form

Proper use of the 2017 NPT form is legally mandated for anyone conducting business or earning income within Philadelphia. Filing this form not only fulfills your legal obligations but also ensures that you are contributing to local services funded by the net profits tax. Accurate reporting is essential, as discrepancies can lead to audits or penalties from the city.

Penalties for Non-Compliance with the 2017 NPT Form

Failure to file the 2017 NPT form or inaccuracies in reporting can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid taxes.

- Potential audits by the Philadelphia Department of Revenue.

To avoid these consequences, ensure that your form is completed accurately and submitted on time.

Quick guide on how to complete fillable online do you have less than or equal to 100000

Effortlessly Set Up Fillable Online Do You Have Less Than Or Equal To $100,000 on Any Device

Managing documents online has become widely embraced by both companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it on the internet. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Fillable Online Do You Have Less Than Or Equal To $100,000 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign Fillable Online Do You Have Less Than Or Equal To $100,000 with Ease

- Obtain Fillable Online Do You Have Less Than Or Equal To $100,000 and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced paperwork, the hassle of searching for forms, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Fillable Online Do You Have Less Than Or Equal To $100,000 to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online do you have less than or equal to 100000

Create this form in 5 minutes!

How to create an eSignature for the fillable online do you have less than or equal to 100000

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the 2017 npt, and how does it relate to airSlate SignNow?

The 2017 npt refers to key industry standards that enhance safety and efficiency in document management. airSlate SignNow is designed to meet these standards, ensuring that businesses can securely send and eSign documents while remaining compliant with regulations established during the 2017 npt.

-

How does airSlate SignNow compare in pricing regarding the 2017 npt?

When considering solutions that comply with the 2017 npt, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our cost-effective solution helps organizations save time and money while maintaining compliance with critical standards.

-

What features does airSlate SignNow include to support the 2017 npt?

airSlate SignNow includes essential features such as secure eSigning, document tracking, and customizable templates that support the requirements of the 2017 npt. These features are designed to streamline processes while ensuring that your documents meet the highest standards for security and compliance.

-

Why should businesses choose airSlate SignNow for 2017 npt compliance?

Businesses should choose airSlate SignNow because it simplifies the eSigning process while adhering to 2017 npt compliance standards. This ensures that documents are processed quickly and securely, enhancing productivity without compromising on legal requirements.

-

Can airSlate SignNow integrate with other software to assist with 2017 npt compliance?

Yes, airSlate SignNow offers robust integrations with various software solutions, making it easy to maintain 2017 npt compliance across your organization's digital processes. This seamless integration ensures that your workflow remains efficient and compliant with industry regulations.

-

Is airSlate SignNow suitable for small businesses focusing on 2017 npt?

Absolutely! airSlate SignNow is tailored to meet the needs of small businesses looking for a reliable solution that aligns with the 2017 npt. Our user-friendly interface and affordable pricing make it an ideal choice for organizations aiming to enhance their document management practices better.

-

How can airSlate SignNow enhance my team's productivity while adhering to the 2017 npt?

By utilizing airSlate SignNow, teams can improve productivity through features such as instant eSigning and automated workflows, all while ensuring adherence to the 2017 npt. These tools allow team members to focus on key tasks without getting bogged down by complex document processes.

Get more for Fillable Online Do You Have Less Than Or Equal To $100,000

Find out other Fillable Online Do You Have Less Than Or Equal To $100,000

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT