No Employer Refund for Tax Payments Made on Employee's 2022

Understanding the No Employer Refund for Tax Payments Made on Employee's Behalf

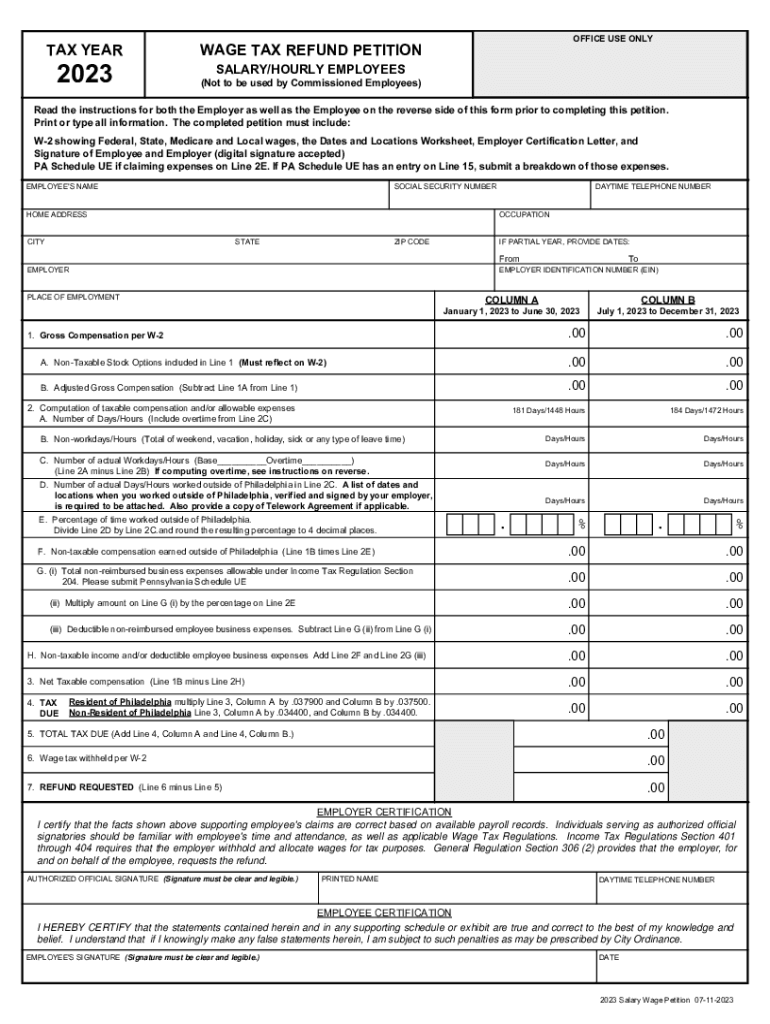

The No Employer Refund for Tax Payments Made on Employee's behalf refers to a specific tax provision that outlines the conditions under which employers cannot receive refunds for certain tax payments. This situation typically arises when an employer has remitted taxes on behalf of their employees, such as payroll taxes, but is not eligible for a refund due to specific IRS regulations. Understanding this provision is crucial for employers to manage their tax liabilities effectively.

Steps to Utilize the No Employer Refund for Tax Payments Made on Employee's Behalf

To utilize the No Employer Refund provision, employers should follow these steps:

- Review the specific IRS guidelines related to employer tax payments.

- Ensure accurate record-keeping of all tax payments made on behalf of employees.

- Consult with a tax professional to clarify any uncertainties regarding eligibility.

- Prepare necessary documentation to support your claims if applicable.

Key Elements of the No Employer Refund for Tax Payments Made on Employee's Behalf

Several key elements define the No Employer Refund provision:

- Eligibility Criteria: Employers must meet specific criteria to determine if they qualify for refunds.

- Documentation: Proper documentation is essential to substantiate any claims related to tax payments.

- IRS Regulations: Familiarity with IRS regulations is necessary to avoid penalties.

IRS Guidelines Related to the No Employer Refund Provision

The IRS provides detailed guidelines regarding the No Employer Refund for Tax Payments Made on Employee's behalf. Employers should familiarize themselves with these guidelines to ensure compliance and avoid potential penalties. Key points include understanding the types of taxes that fall under this provision and the circumstances in which refunds are not permitted.

Filing Deadlines and Important Dates

Employers must be aware of critical filing deadlines associated with the No Employer Refund provision. These dates can vary based on the type of tax and the specific circumstances of the employer. Keeping track of these deadlines is crucial for maintaining compliance and avoiding late fees.

Required Documents for the No Employer Refund Process

To navigate the No Employer Refund for Tax Payments Made on Employee's behalf, employers should prepare the following documents:

- Payroll tax records detailing payments made on behalf of employees.

- IRS forms related to tax payments.

- Any correspondence with the IRS regarding tax payments.

Penalties for Non-Compliance with the No Employer Refund Provision

Failure to comply with the No Employer Refund regulations can lead to significant penalties for employers. These penalties may include fines, interest on unpaid taxes, and potential audits by the IRS. Understanding these risks is essential for employers to ensure they remain compliant with tax laws.

Quick guide on how to complete no employer refund for tax payments made on employees

Complete No Employer Refund For Tax Payments Made On Employee's effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the suitable form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents efficiently without delays. Manage No Employer Refund For Tax Payments Made On Employee's on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign No Employer Refund For Tax Payments Made On Employee's with ease

- Acquire No Employer Refund For Tax Payments Made On Employee's and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Ignore the hassle of lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign No Employer Refund For Tax Payments Made On Employee's and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct no employer refund for tax payments made on employees

Create this form in 5 minutes!

How to create an eSignature for the no employer refund for tax payments made on employees

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an 83 petition and how can airSlate SignNow assist with it?

An 83 petition is a legal form that allows individuals to seek a remedy through the court for issues related to property or contract disputes. airSlate SignNow simplifies the process of eSigning and managing your 83 petition documents, ensuring they are completed quickly and accurately.

-

How does airSlate SignNow ensure the security of my 83 petition documents?

Security is a top priority for airSlate SignNow. We employ advanced encryption, two-factor authentication, and secure cloud storage to protect your 83 petition documents from unauthorized access, ensuring your sensitive information remains private.

-

Is there a cost associated with using airSlate SignNow for my 83 petition?

Yes, airSlate SignNow offers a range of pricing plans tailored to meet different business needs. Our plans are designed to be cost-effective while providing full access to the features necessary for managing your 83 petition documents efficiently.

-

What features does airSlate SignNow offer specifically for managing 83 petitions?

airSlate SignNow includes features like templates for 83 petitions, real-time tracking of document status, and automated reminders. These features streamline the process, making it easier to manage your legal documents and ensure timely submissions.

-

Can I integrate airSlate SignNow with other tools for handling my 83 petition?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and Microsoft Office. This allows you to consolidate your workflows when managing your 83 petition and related documents.

-

How can airSlate SignNow improve the efficiency of submitting my 83 petition?

By utilizing airSlate SignNow’s eSigning capabilities, you can drastically reduce the time it takes to complete and submit your 83 petition. The platform enables multiple signers to sign simultaneously, speeding up the workflow and ensuring quick submission.

-

What support options are available for users handling 83 petitions with airSlate SignNow?

Customers can access a variety of support options including live chat, email support, and an extensive help center. Our dedicated team is trained to assist with any questions related to your 83 petition process, ensuring you receive timely guidance.

Get more for No Employer Refund For Tax Payments Made On Employee's

Find out other No Employer Refund For Tax Payments Made On Employee's

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form