TAX YEAR WAGE TAX REFUND PETITION % % 2024-2026

What is the TAX YEAR WAGE TAX REFUND PETITION?

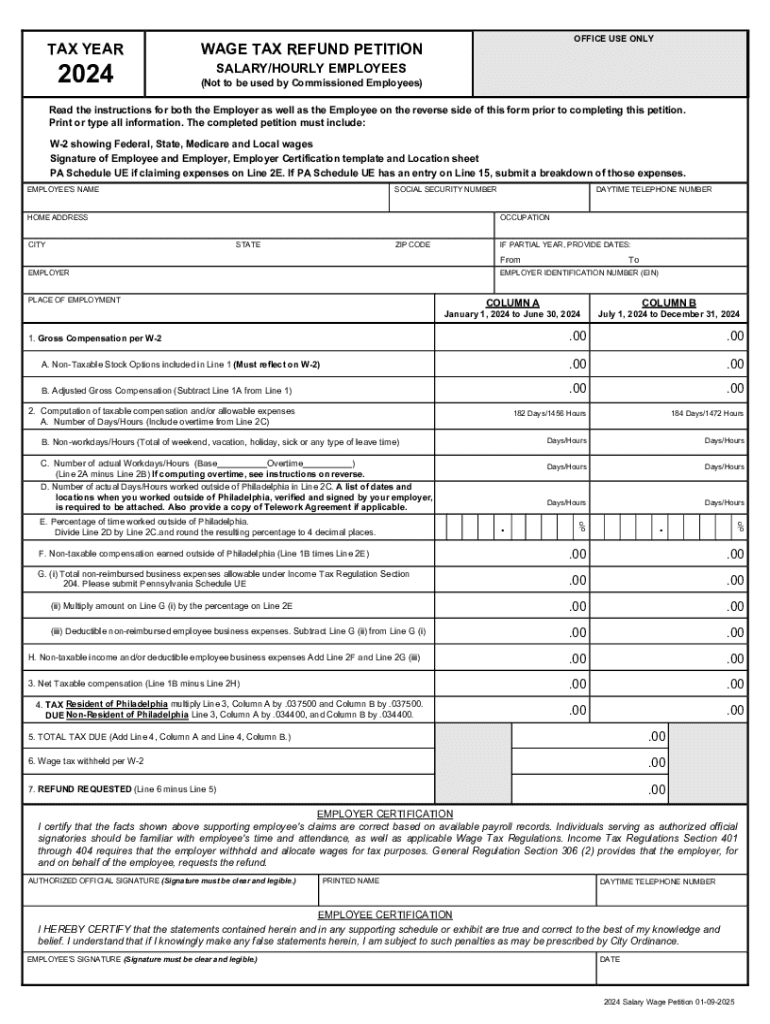

The TAX YEAR WAGE TAX REFUND PETITION is a formal request submitted by taxpayers to recover overpaid taxes from their wages during a specific tax year. This petition allows individuals to claim refunds for excess withholding or other discrepancies that may have occurred in their tax filings. Understanding the purpose of this petition is crucial for taxpayers seeking to ensure they receive the correct amount of refund owed to them based on their earnings and tax obligations.

Key elements of the TAX YEAR WAGE TAX REFUND PETITION

Several key elements make up the TAX YEAR WAGE TAX REFUND PETITION. These include:

- Taxpayer Information: This section requires the taxpayer's name, Social Security number, and contact details.

- Tax Year: Specify the tax year for which the refund is being claimed.

- Income Details: Include information about wages earned, taxes withheld, and any relevant deductions.

- Reason for Refund: Clearly state the reasons for the refund request, such as overpayment or miscalculation.

- Signature: The petition must be signed by the taxpayer or their authorized representative to validate the claim.

Steps to complete the TAX YEAR WAGE TAX REFUND PETITION

Completing the TAX YEAR WAGE TAX REFUND PETITION involves several steps to ensure accuracy and compliance:

- Gather necessary documents, including W-2 forms, pay stubs, and previous tax returns.

- Fill out the petition form with accurate taxpayer information and income details.

- Clearly explain the reason for the refund request in the designated section.

- Review the completed petition for any errors or omissions.

- Sign and date the petition before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the TAX YEAR WAGE TAX REFUND PETITION. Generally, taxpayers must submit their petitions within three years from the original tax return due date. For example, if the tax return for a specific year was due on April fifteenth, the petition must be filed by April fifteenth of the third year following that due date. Keeping track of these deadlines helps ensure that taxpayers do not miss the opportunity to claim their refunds.

Required Documents

When filing the TAX YEAR WAGE TAX REFUND PETITION, certain documents are necessary to support the claim. These typically include:

- W-2 Forms: To verify income and tax withholdings for the relevant tax year.

- Pay Stubs: To provide additional evidence of wages earned and taxes withheld.

- Previous Tax Returns: To compare reported income and tax obligations.

- Any Correspondence: Related to tax payments or adjustments that may support the refund claim.

Eligibility Criteria

To be eligible for the TAX YEAR WAGE TAX REFUND PETITION, taxpayers must meet certain criteria. Primarily, they should have had excess taxes withheld from their wages during the tax year in question. Additionally, they must have filed a tax return for that year, as the petition is typically based on the information reported in the return. Understanding these criteria helps taxpayers determine their eligibility before initiating the petition process.

Create this form in 5 minutes or less

Find and fill out the correct tax year wage tax refund petition

Create this form in 5 minutes!

How to create an eSignature for the tax year wage tax refund petition

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TAX YEAR WAGE TAX REFUND PETITION % %?

A TAX YEAR WAGE TAX REFUND PETITION % % is a formal request to recover overpaid taxes from a specific tax year. This petition allows individuals to claim refunds based on their wage tax contributions. Understanding this process can help you maximize your tax returns effectively.

-

How can airSlate SignNow assist with my TAX YEAR WAGE TAX REFUND PETITION % %?

airSlate SignNow simplifies the process of submitting your TAX YEAR WAGE TAX REFUND PETITION % %. With our eSignature capabilities, you can easily sign and send necessary documents securely and efficiently. This ensures that your petition is processed quickly, helping you receive your refund sooner.

-

What are the pricing options for using airSlate SignNow for my TAX YEAR WAGE TAX REFUND PETITION % %?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Whether you're an individual or a business, our cost-effective solutions ensure you can manage your TAX YEAR WAGE TAX REFUND PETITION % % without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow provide for managing TAX YEAR WAGE TAX REFUND PETITION % %?

Our platform includes features such as customizable templates, secure document storage, and real-time tracking for your TAX YEAR WAGE TAX REFUND PETITION % %. These tools streamline the process, making it easier to manage your documents and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for my TAX YEAR WAGE TAX REFUND PETITION % %?

Yes, airSlate SignNow offers seamless integrations with various software applications. This allows you to connect your existing tools and enhance your workflow when handling your TAX YEAR WAGE TAX REFUND PETITION % %. Integrating with accounting software can further simplify your tax processes.

-

What benefits can I expect from using airSlate SignNow for my TAX YEAR WAGE TAX REFUND PETITION % %?

Using airSlate SignNow for your TAX YEAR WAGE TAX REFUND PETITION % % provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care, allowing you to focus on maximizing your tax refund.

-

Is airSlate SignNow secure for submitting my TAX YEAR WAGE TAX REFUND PETITION % %?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your TAX YEAR WAGE TAX REFUND PETITION % % is submitted safely. Our platform uses advanced encryption and secure storage to protect your sensitive information throughout the process.

Get more for TAX YEAR WAGE TAX REFUND PETITION % %

- Mv912 form

- Api 1104 pdf form

- The gilded age worksheet answer key pdf form

- Early decision agreement the george washington university gwired gwu form

- Wic form florida

- Dmv accident report oregon online form

- Lab 5 2 creating a personalized program for developing flexibility form

- Driver license or identification card application dl 44 dmv ca gov form

Find out other TAX YEAR WAGE TAX REFUND PETITION % %

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure