First Quarterly Estimated Payments for Corporate Income Tax 2023-2026

What is the First Quarterly Estimated Payments For Corporate Income Tax

The First Quarterly Estimated Payments for Corporate Income Tax in New Mexico are prepayments made by corporations to meet their tax obligations. These payments are based on the corporation's expected tax liability for the year. Corporations are required to estimate their tax liability and make payments throughout the year to avoid penalties and interest that may accrue from underpayment. This system helps ensure that businesses remain compliant with state tax regulations.

How to use the First Quarterly Estimated Payments For Corporate Income Tax

To use the First Quarterly Estimated Payments for Corporate Income Tax, corporations must first calculate their estimated tax liability for the year. This involves reviewing previous tax returns and considering any changes in income or deductions. Once the estimated amount is determined, corporations can make their payments via mail or electronically, ensuring they meet the deadlines established by the New Mexico Taxation and Revenue Department. Keeping accurate records of these payments is crucial for future tax filings and compliance.

Steps to complete the First Quarterly Estimated Payments For Corporate Income Tax

Completing the First Quarterly Estimated Payments involves several key steps:

- Determine the estimated tax liability based on projected income.

- Calculate the amount due for the first quarter, typically 25% of the total estimated tax.

- Choose a payment method, either online through the New Mexico Taxation and Revenue website or by mailing a check with the appropriate form.

- Submit the payment by the specified deadline to avoid penalties.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines for the First Quarterly Estimated Payments. For the 2023 tax year, the first payment is generally due on April 15. Subsequent payments are typically due on June 15, September 15, and December 15. It is important to verify these dates each year, as they may change. Marking these deadlines on a calendar can help ensure timely compliance.

Required Documents

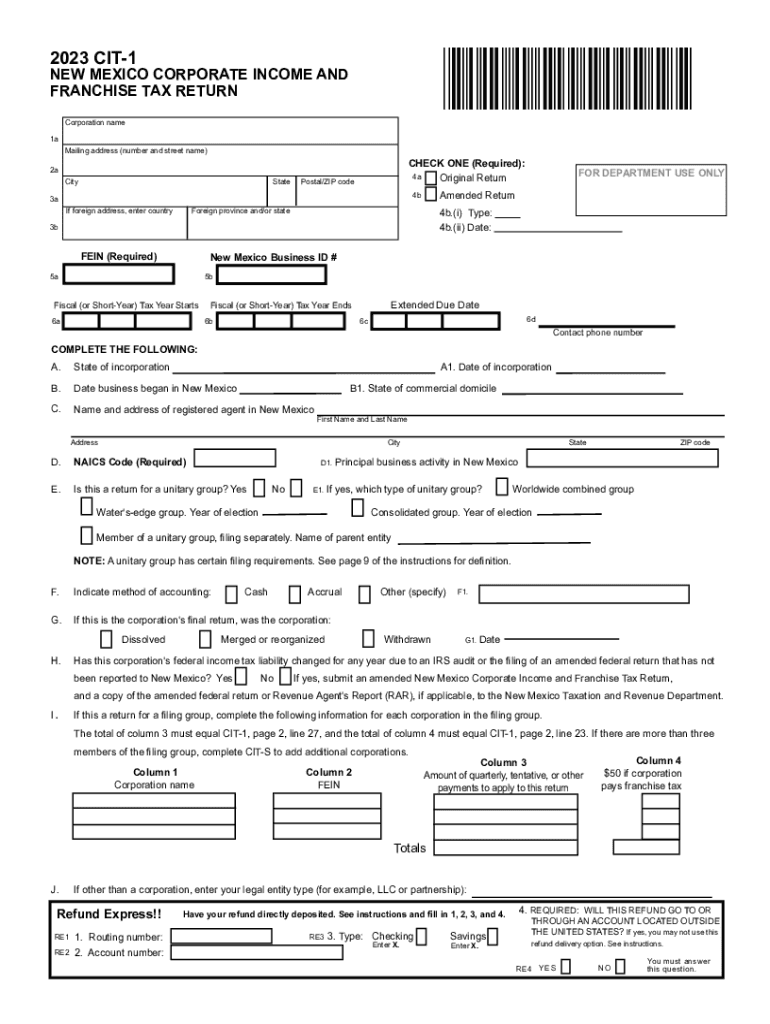

To complete the First Quarterly Estimated Payments, corporations need specific documents, including:

- Previous year's tax return for reference.

- Current financial statements to estimate income.

- New Mexico Corporate Income Tax form, if applicable.

Having these documents readily available will streamline the payment process and help ensure accuracy in estimating tax liability.

Penalties for Non-Compliance

Failure to make the First Quarterly Estimated Payments on time can result in penalties and interest charges. The New Mexico Taxation and Revenue Department may impose a penalty for underpayment, which can increase the overall tax liability. It is crucial for corporations to adhere to payment deadlines and accurately estimate their tax obligations to avoid these financial repercussions.

Quick guide on how to complete first quarterly estimated payments for corporate income tax

Complete First Quarterly Estimated Payments For Corporate Income Tax seamlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage First Quarterly Estimated Payments For Corporate Income Tax on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign First Quarterly Estimated Payments For Corporate Income Tax effortlessly

- Locate First Quarterly Estimated Payments For Corporate Income Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that function.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign First Quarterly Estimated Payments For Corporate Income Tax and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct first quarterly estimated payments for corporate income tax

Create this form in 5 minutes!

How to create an eSignature for the first quarterly estimated payments for corporate income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are nm cit 1 instructions 2023 for using airSlate SignNow?

The nm cit 1 instructions 2023 provide a comprehensive guideline on how to effectively use airSlate SignNow for document signing and management. Following these instructions will help users navigate the platform's features and ensure a seamless experience. For detailed instructions, refer to our dedicated resources on the website.

-

How much does airSlate SignNow cost in 2023?

AirSlate SignNow offers a variety of pricing plans to accommodate different business needs in 2023. Depending on the features and number of users, prices may vary. For specific pricing information related to nm cit 1 instructions 2023, visit our pricing page for the latest options and deals.

-

What features are included with airSlate SignNow subscriptions for 2023?

In 2023, airSlate SignNow subscriptions include a range of features such as eSigning, document templates, and advanced reporting. When following the nm cit 1 instructions 2023, users can leverage these features to enhance their document management processes. Check our feature overview for a complete list.

-

Can airSlate SignNow be integrated with other applications?

Yes, airSlate SignNow can seamlessly integrate with various applications to enhance workflow efficiency. Whether you are using CRM, project management, or other tools, following the nm cit 1 instructions 2023 will guide you through the integration process. Explore our integration options for more information.

-

How secure is airSlate SignNow for document signing?

AirSlate SignNow prioritizes security by implementing advanced encryption and compliance standards. When following the nm cit 1 instructions 2023, users can trust that their documents are protected against unauthorized access. Our platform regularly undergoes security audits to ensure the highest level of protection.

-

What benefits does airSlate SignNow offer for businesses in 2023?

AirSlate SignNow simplifies the eSigning process, helping businesses save time and reduce paper waste. By utilizing the nm cit 1 instructions 2023, companies can streamline their approval workflows and enhance operational efficiency. This results in quicker turnaround times and increased productivity.

-

Is there a free trial available for airSlate SignNow in 2023?

Yes, airSlate SignNow offers a free trial that allows users to explore the platform's capabilities without any commitment. This is a great opportunity to familiarize yourself with the nm cit 1 instructions 2023 and understand how the service can benefit your business. Sign up on our website to start your free trial today.

Get more for First Quarterly Estimated Payments For Corporate Income Tax

- Current event sheet form

- Etr form

- What is academic intervention services form

- Expungement information student affairs penn state university studentaffairs psu

- Parentguardian sign in sign out sheet form

- Psychotherapy case discussion form ranzcp

- Confidential recommendation form endicott college

- Student accident report form

Find out other First Quarterly Estimated Payments For Corporate Income Tax

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement