New Mexico Taxation and Revenue DepartmentOfficial SiteHome Taxation and Revenue New Mexico 2022

Understanding the New Mexico Taxation and Revenue Department

The New Mexico Taxation and Revenue Department (TRD) is responsible for administering the state's tax laws and collecting taxes. It oversees various tax types, including income tax, gross receipts tax, and property tax. The department also provides resources and support for taxpayers to ensure compliance with state regulations. Understanding the role of the TRD is essential for navigating tax obligations in New Mexico.

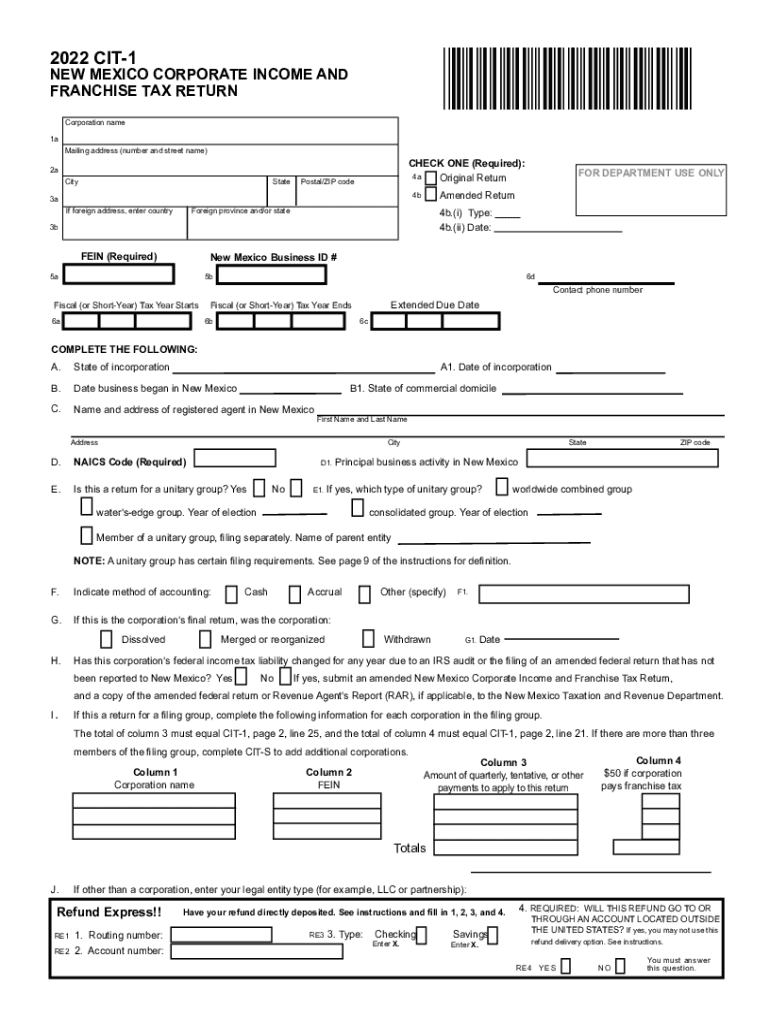

Steps to Complete the Taxpayer NM P2 Form

Filling out the taxpayer NM P2 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details and income records. Next, carefully read the instructions provided with the form to understand the requirements. Fill out the form completely, ensuring that all fields are accurately filled. Once completed, review the form for any errors before submission.

Required Documents for the Taxpayer NM P2 Form

When completing the taxpayer NM P2 form, certain documents are required to support your submission. These may include:

- Proof of income, such as W-2s or 1099s

- Identification documents, like a driver's license or Social Security card

- Previous tax returns, if applicable

Having these documents ready will facilitate a smoother filing process and help ensure that your submission is complete.

Form Submission Methods

The taxpayer NM P2 form can be submitted through various methods, catering to different preferences. Options include:

- Online submission via the New Mexico TRD website, which offers a secure and efficient way to file

- Mailing the completed form to the appropriate TRD office

- In-person submission at designated TRD locations

Choosing the right submission method can enhance the efficiency of your filing process.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the taxpayer NM P2 form can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to meet all deadlines and ensure that the form is filled out correctly to avoid these consequences.

Eligibility Criteria for Filing

Eligibility to file the taxpayer NM P2 form typically depends on several factors, including your income level, residency status, and specific tax obligations. It is essential to review the eligibility criteria outlined by the New Mexico TRD to determine if you are required to file this form. Understanding these criteria can help you stay compliant and avoid unnecessary complications.

Quick guide on how to complete new mexico taxation and revenue departmentofficial sitehome taxation and revenue new mexico

Fulfill New Mexico Taxation And Revenue DepartmentOfficial SiteHome Taxation And Revenue New Mexico seamlessly on any gadget

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the correct template and securely store it online. airSlate SignNow equips you with all the resources necessary to produce, modify, and electronically sign your documents promptly without interruptions. Handle New Mexico Taxation And Revenue DepartmentOfficial SiteHome Taxation And Revenue New Mexico on any device with airSlate SignNow's Android or iOS apps and simplify any document-centric process today.

How to modify and electronically sign New Mexico Taxation And Revenue DepartmentOfficial SiteHome Taxation And Revenue New Mexico with ease

- Locate New Mexico Taxation And Revenue DepartmentOfficial SiteHome Taxation And Revenue New Mexico and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Decide how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign New Mexico Taxation And Revenue DepartmentOfficial SiteHome Taxation And Revenue New Mexico to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexico taxation and revenue departmentofficial sitehome taxation and revenue new mexico

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for taxpayer nm p2?

airSlate SignNow offers a range of features for taxpayer nm p2, including document editing, templates, and advanced eSignature functionality. These features ensure that users can manage their signing processes easily and efficiently. With real-time collaboration tools, businesses can streamline their document workflows.

-

How does airSlate SignNow support taxpayer nm p2 with pricing?

With competitive pricing tailored for taxpayer nm p2, airSlate SignNow provides various plans to suit different business needs. Users can choose from monthly or annual subscriptions that come with a free trial option. This ensures that businesses can assess the platform’s value before committing financially.

-

Can airSlate SignNow integrate with existing systems for taxpayer nm p2?

Yes, airSlate SignNow seamlessly integrates with various platforms for taxpayer nm p2, including CRM systems like Salesforce and document management solutions. These integrations make it easier for businesses to utilize their existing workflows. The API allows for additional customization, ensuring a cohesive experience.

-

What are the benefits of using airSlate SignNow for taxpayer nm p2?

The benefits of using airSlate SignNow for taxpayer nm p2 include increased efficiency, reduced turnaround time for document signing, and enhanced security. By automating the signing process, businesses can focus on core operations instead of paperwork. Moreover, the solution is cost-effective, providing signNow savings over traditional methods.

-

Is airSlate SignNow user-friendly for taxpayer nm p2?

Absolutely, airSlate SignNow has a user-friendly interface designed for all skill levels, making it ideal for taxpayer nm p2. Users can quickly navigate through the platform without extensive training. This ease of use reduces the learning curve and speeds up document management processes.

-

How can I ensure the security of documents with airSlate SignNow for taxpayer nm p2?

AirSlate SignNow implements robust security measures to protect documents for taxpayer nm p2, including encryption and user authentication. Each document transaction is securely logged, ensuring a detailed audit trail. These security features help businesses maintain compliance with various regulations.

-

What types of documents can be signed using airSlate SignNow for taxpayer nm p2?

With airSlate SignNow, users can sign a variety of document types relevant to taxpayer nm p2, including contracts, tax forms, and agreements. The platform supports PDF and various other formats, providing flexibility in document management. This versatility makes it suitable for both personal and professional needs.

Get more for New Mexico Taxation And Revenue DepartmentOfficial SiteHome Taxation And Revenue New Mexico

- New york assignment form

- Notice of assignment of lien corporation or llc new york form

- Ny waiver 497321338 form

- Assignment mortgage new york form

- Assignment of mortgage by corporate mortgage holder new york form

- Ny pay rent form

- New york lien 497321343 form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property new york form

Find out other New Mexico Taxation And Revenue DepartmentOfficial SiteHome Taxation And Revenue New Mexico

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template