Form 8952 Instructions Fill Out & Sign Online 2023-2026

Understanding Form 8952

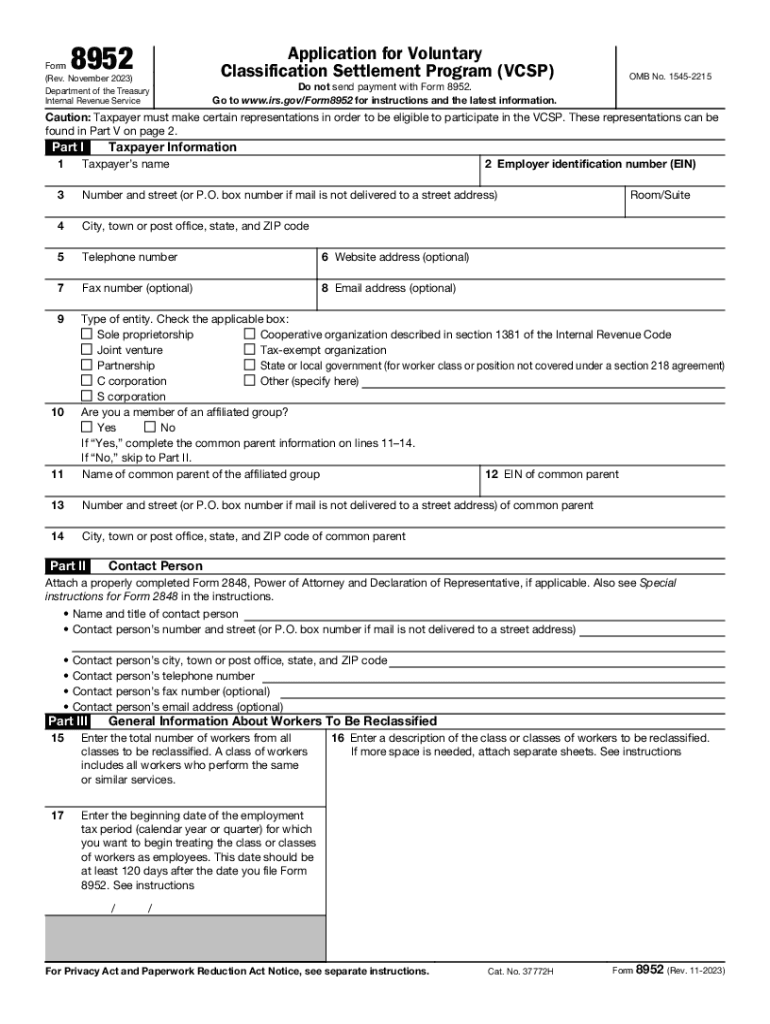

The IRS Form 8952 is a crucial document for businesses seeking to participate in the Voluntary Classification Settlement Program (VCSP). This program allows employers to voluntarily reclassify their workers as employees for federal employment tax purposes. By filing Form 8952, businesses can benefit from reduced penalties and avoid the risks associated with misclassification.

Steps to Complete Form 8952

Completing Form 8952 involves several key steps:

- Gather necessary information about your business and employees.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the IRS according to the guidelines provided.

Eligibility Criteria for Form 8952

To qualify for the Voluntary Classification Settlement Program, certain eligibility criteria must be met:

- Your business must have consistently treated the workers as non-employees.

- You must not be currently under audit by the IRS or the Department of Labor.

- All federal employment taxes must be paid for the previous tax year.

Required Documents for Form 8952

When preparing to file Form 8952, ensure you have the following documents ready:

- Records of payments made to the workers in question.

- Documentation supporting the classification of these workers as non-employees.

- Any correspondence with the IRS or other agencies regarding worker classification.

Filing Deadlines for Form 8952

It is essential to adhere to filing deadlines to avoid penalties. Form 8952 must be submitted at least sixty days before the date you want to begin treating the workers as employees. Ensure you check the IRS guidelines for any updates regarding deadlines.

Submission Methods for Form 8952

Form 8952 can be submitted to the IRS through various methods:

- Online submission via the IRS e-file system.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

IRS Guidelines for Form 8952

The IRS provides specific guidelines for completing and submitting Form 8952. It is important to follow these instructions closely to ensure compliance and avoid delays in processing. Review the IRS instructions for detailed information on filling out the form correctly, including any specific requirements for your business type.

Quick guide on how to complete form 8952 instructions fill out ampamp sign online

Complete Form 8952 Instructions Fill Out & Sign Online seamlessly on any platform

Web-based document management has gained traction among enterprises and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Form 8952 Instructions Fill Out & Sign Online on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and eSign Form 8952 Instructions Fill Out & Sign Online effortlessly

- Locate Form 8952 Instructions Fill Out & Sign Online and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 8952 Instructions Fill Out & Sign Online and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8952 instructions fill out ampamp sign online

Create this form in 5 minutes!

How to create an eSignature for the form 8952 instructions fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form8952 signnow and how does it work?

Form8952 signnow is a powerful tool that enables users to electronically sign and manage Form 8952 documents easily. With airSlate SignNow, you can streamline the signing process, ensuring that you can complete tax forms securely and efficiently. This service not only saves time but also enhances document accuracy and compliance.

-

What are the pricing options for using form8952 signnow?

airSlate SignNow offers various pricing tiers to accommodate different business sizes and needs when using form8952 signnow. Our plans are designed to be cost-effective, providing excellent value for the features offered. For detailed pricing information, please visit our pricing page to find a plan that fits your requirements.

-

Can I integrate form8952 signnow with other software?

Yes, form8952 signnow seamlessly integrates with numerous business applications. This capability allows users to automate workflows, import/export documents, and enhance overall productivity. By integrating with tools such as Google Drive, Salesforce, and others, you can signNowly improve your document management process.

-

What features does form8952 signnow offer?

Form8952 signnow is packed with features designed to simplify electronic signing. Key functionalities include customizable templates, secure document storage, and real-time tracking of document status. These features not only enhance user experience but also ensure compliance with legal standards.

-

Are there any security measures in place for form8952 signnow?

Absolutely! Security is a top priority for form8952 signnow. The platform employs advanced encryption and authentication measures to protect your documents and personal information. Additionally, compliance with industry standards ensures that your data remains safe while using our e-signature service.

-

How can form8952 signnow benefit my business?

Using form8952 signnow can signNowly streamline your business operations. The solution allows for faster document approval processes, reduces paper waste, and enhances collaboration among team members. By simplifying the signing process, businesses can focus more on their core activities rather than getting bogged down by paperwork.

-

Is form8952 signnow suitable for small businesses?

Yes, form8952 signnow is ideal for small businesses looking for a budget-friendly e-signature solution. Its user-friendly interface and affordable pricing make it accessible for organizations of any size. Small business owners can leverage our platform to improve efficiency without breaking the bank.

Get more for Form 8952 Instructions Fill Out & Sign Online

Find out other Form 8952 Instructions Fill Out & Sign Online

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter