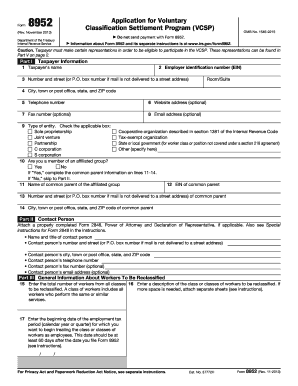

Form 8952 2013

What is the Form 8952

The Form 8952 is an important document used by businesses and self-employed individuals to request an extension of time to file certain tax returns. Specifically, it is utilized to apply for a 6-month extension for filing the Form 941, which is the Employer's Quarterly Federal Tax Return. This form is crucial for ensuring compliance with IRS regulations while allowing taxpayers additional time to gather necessary financial information.

How to use the Form 8952

Using the Form 8952 involves several straightforward steps. First, ensure that you meet the eligibility criteria, which typically includes being a business entity required to file Form 941. Next, accurately complete the form by providing your business information, including the name, address, and Employer Identification Number (EIN). Once filled out, submit the form to the IRS by the specified deadline to ensure that your request for an extension is processed without issues.

Steps to complete the Form 8952

Completing the Form 8952 requires attention to detail. Follow these steps for accurate submission:

- Gather necessary information, including your EIN and business details.

- Fill out the form, ensuring all sections are completed correctly.

- Review the form for accuracy, checking for any errors or omissions.

- Sign and date the form where indicated.

- Submit the form to the IRS either electronically or via mail, depending on your preference.

Legal use of the Form 8952

The legal use of the Form 8952 is governed by IRS regulations. When completed and submitted correctly, the form serves as a formal request for an extension, allowing taxpayers to comply with federal tax laws. It is essential to understand that misuse of the form or failure to submit it on time can result in penalties, so adherence to guidelines is crucial for legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8952 are critical to ensure that your extension request is accepted. Generally, the form must be submitted before the due date of the original Form 941. For example, if you are seeking an extension for the first quarter, ensure that you file the Form 8952 by the end of the month following the quarter's end. Staying aware of these dates helps prevent unnecessary penalties and ensures smooth processing of your extension request.

Required Documents

When completing the Form 8952, certain documents may be required to support your request. Typically, you will need:

- Your Employer Identification Number (EIN).

- Business name and address.

- Any previous correspondence with the IRS regarding your tax filings.

Having these documents ready will facilitate a smoother completion process and help ensure that your request is processed efficiently.

Form Submission Methods (Online / Mail / In-Person)

The Form 8952 can be submitted through various methods, providing flexibility for taxpayers. You can file the form electronically using the IRS e-file system, which is often the quickest option. Alternatively, you may choose to print the form and mail it to the appropriate IRS address. In-person submissions are generally not available for this form, making electronic or mail submissions the primary methods of filing.

Quick guide on how to complete form 8952

Complete Form 8952 effortlessly on any gadget

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools needed to produce, modify, and electronically sign your documents swiftly without delays. Manage Form 8952 on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form 8952 effortlessly

- Locate Form 8952 and click Get Form to begin.

- Use the tools we provide to finish your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any gadget you prefer. Modify and eSign Form 8952 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8952

Create this form in 5 minutes!

How to create an eSignature for the form 8952

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8952 and how is it used?

Form 8952 is used by employers who want to request a waiver of the penalties for late filing of Form 1099. It is designed to help businesses comply with IRS regulations and avoid financial penalties. By utilizing form 8952, companies can ensure they are filing their forms on time, promoting a smooth compliance process.

-

How can airSlate SignNow assist with processing form 8952?

airSlate SignNow provides a seamless eSigning solution that simplifies the process of completing form 8952. With our user-friendly interface, you can easily fill out, sign, and send the form securely. This ensures that your submissions are timely and compliant with IRS regulations.

-

What are the pricing options for using airSlate SignNow to manage form 8952?

airSlate SignNow offers various pricing plans to fit the needs of any business, whether you're a solo entrepreneur or a large enterprise. All plans include unlimited document signing and templates, making it an affordable choice for managing form 8952 and other necessary documentation. You can find a plan that meets your budget while ensuring efficient workflow.

-

What features does airSlate SignNow offer for form 8952 management?

airSlate SignNow features an intuitive drag-and-drop interface that allows businesses to create and manage documents like form 8952 easily. Additional features include automated reminders for signing, secure storage of documents, and the ability to collect signatures from multiple parties. These tools streamline the filing process and reduce errors.

-

Are there integrations available for form 8952 processing with airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with a variety of popular applications and platforms, enhancing your efficiency when managing form 8952. Whether you utilize cloud storage services or project management tools, our integrations allow for easy document sharing and collaboration. This connectivity simplifies the document preparation process.

-

What are the benefits of using airSlate SignNow for form 8952?

Using airSlate SignNow for form 8952 offers numerous benefits, including time savings and improved accuracy. The eSigning process is faster than traditional methods, ensuring that your forms are submitted promptly. Additionally, the platform provides secure storage and easy access to your signed documents at any time.

-

Can I track the status of my form 8952 submissions with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form 8952 submissions in real-time. You can see who has signed the document and when it was completed, making it easy to manage your compliance efforts. This transparency is crucial for businesses that must adhere to strict filing deadlines.

Get more for Form 8952

- Flexible use reservation request floridagrandvacations com form

- Ledger templates type document form

- Translink fare infraction form

- California form 5806

- Winloss statement request form cahuilla casino

- Employment application acumenfiscalagent com form

- Child bipolar questionnaire pdf form

- Ehterium smart contract template form

Find out other Form 8952

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT