Endow Kentucky Tax Credit Preliminary Authorization Form 2023

What is the Endow Kentucky Tax Credit Preliminary Authorization Form

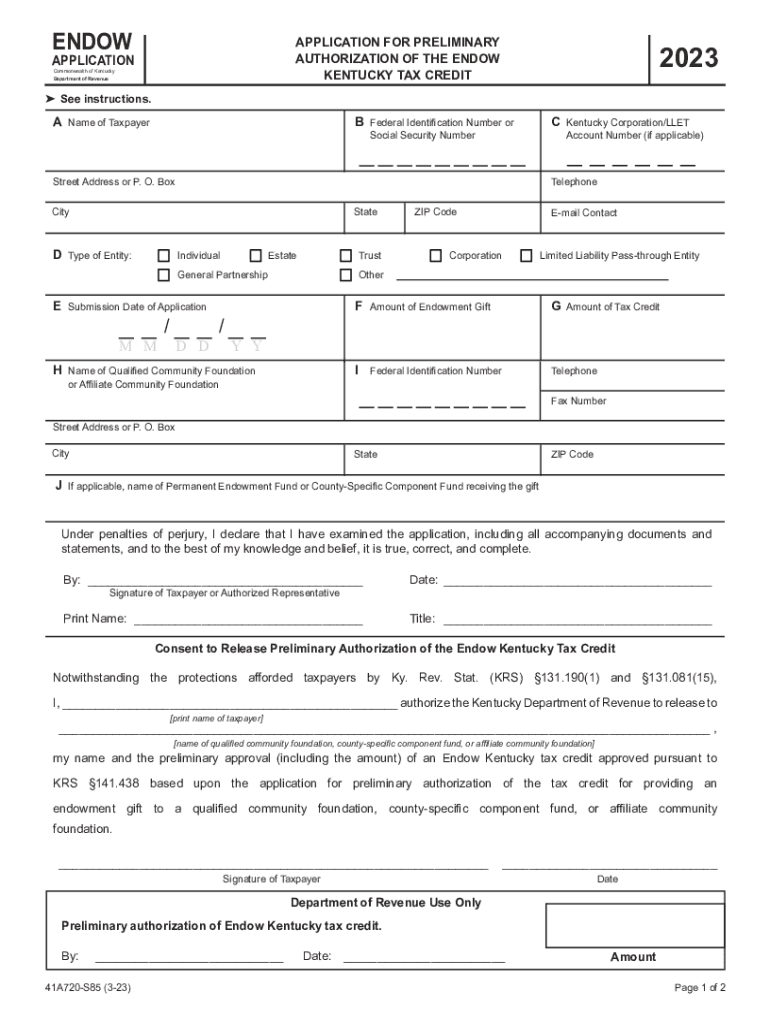

The Endow Kentucky Tax Credit Preliminary Authorization Form is a document used by individuals and businesses in Kentucky to apply for tax credits associated with charitable contributions to qualified endowments. This form serves as an initial request for authorization, allowing applicants to secure potential tax benefits while supporting local nonprofits and community initiatives. By completing this form, applicants can demonstrate their commitment to philanthropy and gain access to financial incentives provided by the state of Kentucky.

How to use the Endow Kentucky Tax Credit Preliminary Authorization Form

To effectively use the Endow Kentucky Tax Credit Preliminary Authorization Form, applicants should first ensure they meet the eligibility criteria outlined by the Kentucky Department of Revenue. Once eligibility is confirmed, the form can be filled out with accurate information regarding the donor, the charitable organization, and the intended contribution amount. After completing the form, it must be submitted to the appropriate state agency for review and approval. It is essential to keep a copy of the submitted form for personal records and future reference.

Steps to complete the Endow Kentucky Tax Credit Preliminary Authorization Form

Completing the Endow Kentucky Tax Credit Preliminary Authorization Form involves several key steps:

- Gather necessary information, including personal identification details and the nonprofit organization’s information.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the completed form for any errors or omissions.

- Submit the form to the Kentucky Department of Revenue, either electronically or by mail.

- Retain a copy of the submitted form for your records.

Eligibility Criteria

To qualify for the Endow Kentucky Tax Credit, applicants must meet specific eligibility criteria. These criteria typically include being an individual or business taxpayer in Kentucky, making a contribution to a qualified endowment fund, and ensuring that the donation aligns with the guidelines set by the state. It is important for applicants to review the detailed eligibility requirements provided by the Kentucky Department of Revenue to confirm their status before submitting the form.

Required Documents

When completing the Endow Kentucky Tax Credit Preliminary Authorization Form, applicants may need to provide several supporting documents. These can include proof of identity, documentation of the charitable organization’s status, and any relevant financial statements that demonstrate the intended contribution. Having these documents ready can streamline the application process and help ensure compliance with state regulations.

Form Submission Methods

The Endow Kentucky Tax Credit Preliminary Authorization Form can be submitted through various methods to accommodate different preferences. Applicants may choose to submit the form online via the Kentucky Department of Revenue's official website, or they can opt for traditional methods such as mailing a printed version of the form. In-person submissions may also be accepted at designated state offices, providing flexibility in how applicants choose to complete their submission.

Quick guide on how to complete endow kentucky tax credit preliminary authorization form

Prepare Endow Kentucky Tax Credit Preliminary Authorization Form effortlessly on any gadget

Online document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed forms, allowing you to access the correct document and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Endow Kentucky Tax Credit Preliminary Authorization Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and electronically sign Endow Kentucky Tax Credit Preliminary Authorization Form with ease

- Find Endow Kentucky Tax Credit Preliminary Authorization Form and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you’d like to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Endow Kentucky Tax Credit Preliminary Authorization Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct endow kentucky tax credit preliminary authorization form

Create this form in 5 minutes!

How to create an eSignature for the endow kentucky tax credit preliminary authorization form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Endow Kentucky Tax Credit Preliminary Authorization Form?

The Endow Kentucky Tax Credit Preliminary Authorization Form is a document required for individuals and businesses to apply for tax credits in Kentucky. This form allows you to access valuable tax incentives for charitable donations, supporting various causes in the state. Completing the form accurately is crucial to ensure eligibility for these credits.

-

How can airSlate SignNow help with the Endow Kentucky Tax Credit Preliminary Authorization Form?

airSlate SignNow streamlines the signing and submission of the Endow Kentucky Tax Credit Preliminary Authorization Form. Our platform provides an easy-to-use interface that allows users to fill out, eSign, and send their forms securely. This saves time and reduces the errors that can occur with manual processes.

-

Is there a cost associated with using airSlate SignNow for the Endow Kentucky Tax Credit Preliminary Authorization Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. Users can choose from a free trial for testing our features or select a paid plan that fits their requirements and budget. The investment in our platform is often surpassed by the time and resources saved in managing documents like the Endow Kentucky Tax Credit Preliminary Authorization Form.

-

What features does airSlate SignNow offer for managing the Endow Kentucky Tax Credit Preliminary Authorization Form?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, and document tracking specifically for the Endow Kentucky Tax Credit Preliminary Authorization Form. These tools streamline the process, making it easy to send out forms for signature and track their status in real time. Our user-friendly platform ensures a hassle-free experience.

-

What are the benefits of using airSlate SignNow for the Endow Kentucky Tax Credit Preliminary Authorization Form?

Using airSlate SignNow for the Endow Kentucky Tax Credit Preliminary Authorization Form has multiple benefits, including faster processing times and reduced paperwork. The electronic format also minimizes the risk of lost documents and ensures a secure exchange of sensitive information. With our platform, users can manage their forms more efficiently than ever before.

-

Can I integrate airSlate SignNow with other applications for the Endow Kentucky Tax Credit Preliminary Authorization Form?

Yes, airSlate SignNow supports integration with various applications, allowing users to enhance their workflow when handling the Endow Kentucky Tax Credit Preliminary Authorization Form. Whether it’s CRM systems, cloud storage, or collaboration tools, our platform can be seamlessly integrated to boost productivity. This means that your forms can be part of a larger, organized workflow.

-

What kind of support does airSlate SignNow provide for users of the Endow Kentucky Tax Credit Preliminary Authorization Form?

airSlate SignNow offers comprehensive support for users navigating the Endow Kentucky Tax Credit Preliminary Authorization Form. Our customer service team is available through multiple channels, including chat and email, to assist with any questions or challenges. Additionally, we provide a rich resource library with tutorials and FAQs to help users maximize their experience.

Get more for Endow Kentucky Tax Credit Preliminary Authorization Form

Find out other Endow Kentucky Tax Credit Preliminary Authorization Form

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple