Application for Employee Refund of Occupational Taxes Withheld 2023-2026

What is the Application for Employee Refund of Occupational Taxes Withheld

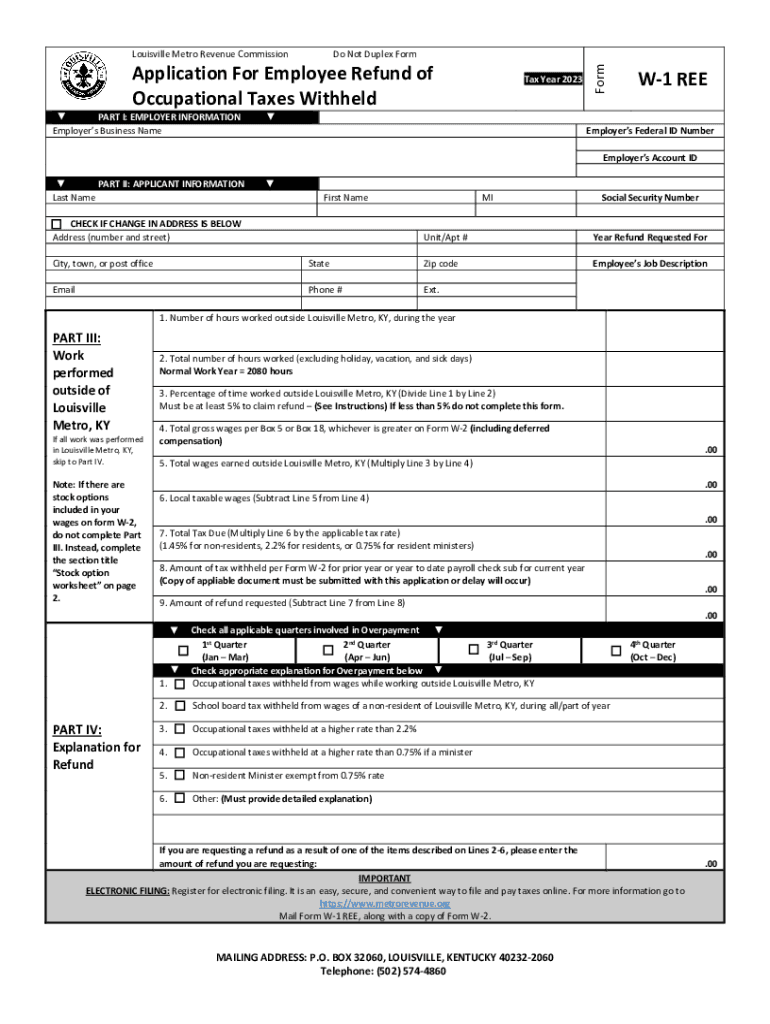

The Application for Employee Refund of Occupational Taxes Withheld, commonly referred to as the W-1 Ree form, is designed for employees who have had occupational taxes withheld from their paychecks in Louisville, Kentucky. This form allows individuals to request a refund for any overpayment of these taxes. Employees may qualify for a refund if they worked in multiple cities or if their residency status changed during the tax year, leading to excess withholding.

How to Use the Application for Employee Refund of Occupational Taxes Withheld

To effectively use the W-1 Ree form, employees must first ensure they meet the eligibility criteria. After confirming eligibility, they should complete the form by providing accurate personal information, including name, address, and Social Security number. It is essential to include details about the taxes withheld, such as the amount and the period during which they were withheld. Once completed, the form can be submitted according to the specified submission methods.

Steps to Complete the Application for Employee Refund of Occupational Taxes Withheld

Completing the W-1 Ree form involves several key steps:

- Gather necessary documents, including pay stubs and tax withholding statements.

- Fill out the form with accurate personal and financial information.

- Double-check all entries for accuracy to avoid delays in processing.

- Sign and date the application to validate your request.

- Submit the form using the preferred method, whether online, by mail, or in person.

Eligibility Criteria

To qualify for a refund using the W-1 Ree form, employees must meet specific eligibility criteria. This includes having occupational taxes withheld during the tax year, being a resident of Louisville, and providing proof of overpayment. Additionally, employees who have worked in multiple jurisdictions or have experienced changes in their employment status may also be eligible for a refund. It is important to review the requirements thoroughly before submitting the application.

Required Documents

When applying for a refund using the W-1 Ree form, certain documents are required to support the application. These typically include:

- Copies of pay stubs showing the amounts withheld.

- Tax withholding statements from employers.

- Proof of residency, if applicable.

- Any correspondence related to previous tax payments or refunds.

Form Submission Methods

The W-1 Ree form can be submitted through various methods to accommodate different preferences. Employees may choose to submit the application online via designated government portals, mail it to the appropriate tax office, or deliver it in person. Each method has its own processing times, so employees should select the one that best fits their needs and ensure they follow any specific instructions related to their chosen submission method.

Filing Deadlines / Important Dates

It is crucial for employees to be aware of the filing deadlines associated with the W-1 Ree form. Typically, applications for refunds must be submitted within a specific time frame following the end of the tax year. Missing these deadlines can result in the forfeiture of the refund. Employees should keep track of important dates and ensure their applications are submitted promptly to avoid complications.

Quick guide on how to complete application for employee refund of occupational taxes withheld

Easily Prepare Application For Employee Refund Of Occupational Taxes Withheld on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Application For Employee Refund Of Occupational Taxes Withheld on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign Application For Employee Refund Of Occupational Taxes Withheld

- Locate Application For Employee Refund Of Occupational Taxes Withheld and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just moments and has the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Edit and electronically sign Application For Employee Refund Of Occupational Taxes Withheld and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for employee refund of occupational taxes withheld

Create this form in 5 minutes!

How to create an eSignature for the application for employee refund of occupational taxes withheld

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a w 1 ree form and how does it work?

The w 1 ree form is a key document for businesses that need to collect tax information from contractors and freelancers. It allows users to easily manage and store sensitive information securely. By using airSlate SignNow to send and eSign the w 1 ree form, you ensure a smoother and more efficient process.

-

Are there any costs associated with using the w 1 ree form on airSlate SignNow?

airSlate SignNow offers cost-effective pricing plans that include the functionality to send and eSign the w 1 ree form. Customers can select a plan that suits their business needs, ensuring they get great value while using our document-management features. Check our pricing page for detailed information on all available plans.

-

What features does airSlate SignNow offer for the w 1 ree form?

With airSlate SignNow, you can access features like customizable templates, secure eSignature capabilities, and real-time tracking for your w 1 ree form. These features enhance user experience and help streamline document management efficiently. Additionally, you can integrate it with various other applications for enhanced productivity.

-

Can I customize the w 1 ree form in airSlate SignNow?

Yes, you can easily customize the w 1 ree form within the airSlate SignNow platform. Our user-friendly interface allows users to create personalized documents that meet their specific requirements. This customization process facilitates a better experience for both the sender and the recipient.

-

How does airSlate SignNow ensure the security of the w 1 ree form?

airSlate SignNow prioritizes the security of your documents, including the w 1 ree form, with advanced encryption protocols and secure cloud storage. This means that your sensitive tax information will be protected at all times. We also comply with industry standards and regulations to further ensure document safety.

-

What are the benefits of using airSlate SignNow for the w 1 ree form?

Using airSlate SignNow for the w 1 ree form simplifies the process of sending and signing documents. Businesses benefit from reduced turnaround times, improved efficiency, and enhanced compliance with tax regulations. Additionally, the platform’s ease of use means that even those unfamiliar with eSigning can navigate it easily.

-

Does airSlate SignNow integrate with other software for managing the w 1 ree form?

Yes, airSlate SignNow offers numerous integrations with popular software, allowing for a seamless experience when managing the w 1 ree form. These integrations enable businesses to streamline workflows, sync data, and overall enhance productivity. Check out our integrations page for a full list of compatible applications.

Get more for Application For Employee Refund Of Occupational Taxes Withheld

- Transcript request form grafton high school

- Membership form for football club template

- West virginia state police forms

- Laramie county common intake form for the sliding fee scale

- Social skills companies offering internet social skills form

- Salary transfer letter format

- 57574 mac progress payment form 57574 mac progress payment form

- Dcs 200mm order bformbxlsx dincel construction system

Find out other Application For Employee Refund Of Occupational Taxes Withheld

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online