74 157 2014-2026

What is the 74 157?

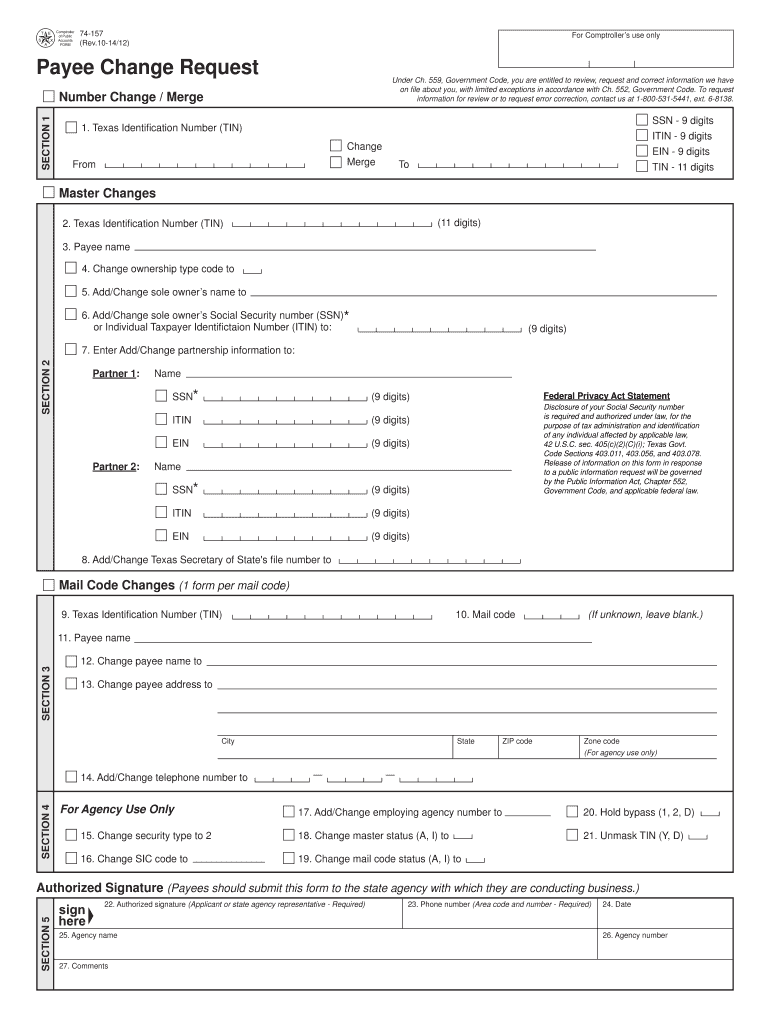

The 74 157 form, also known as the Texas Payee Change Request, is a document used by individuals and businesses in Texas to update or change their payee information with the state. This form is essential for ensuring that payments, including tax refunds and state benefits, are directed to the correct payee. The form requires specific details, such as the current payee information, the new payee details, and the reason for the change. Understanding this form is crucial for maintaining accurate records and facilitating smooth transactions with state agencies.

Steps to complete the 74 157

Completing the 74 157 form involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including your current payee details and the new payee information. Next, fill out the form accurately, ensuring that all fields are completed. It is important to provide a clear reason for the change, as this can expedite the processing of your request. After filling out the form, review it for any errors or omissions before submitting it. Finally, submit the completed form according to the instructions provided, which may include online submission, mailing it to a specific address, or delivering it in person.

Legal use of the 74 157

The legal use of the 74 157 form is governed by Texas state regulations. This form must be filled out correctly and submitted to the appropriate state agency to be considered valid. The form serves as a formal request to change payee information, and improper use or submission can lead to delays or rejections. It is crucial to ensure that all provided information is accurate and that the form is submitted within any required timeframes. Failure to comply with these regulations may result in penalties or complications in receiving payments.

Form Submission Methods

The 74 157 form can be submitted through various methods, depending on the preferences of the payee and the requirements set by the state. Common submission methods include:

- Online Submission: Many state agencies allow for electronic submission of the form through their official websites.

- Mail: The form can be printed and sent via postal mail to the designated address provided in the form instructions.

- In-Person: Payees may also choose to deliver the form in person at designated state offices.

Choosing the right submission method can help ensure that the payee change is processed efficiently.

Key elements of the 74 157

When completing the 74 157 form, several key elements must be included to ensure its validity. These elements include:

- Current Payee Information: This includes the name, address, and identification number of the existing payee.

- New Payee Information: The updated details of the new payee must be clearly stated.

- Reason for Change: A brief explanation of why the payee information is being updated is necessary.

- Signature: The form must be signed by the current payee or an authorized representative.

Including these elements is crucial for the successful processing of the payee change request.

Examples of using the 74 157

There are various scenarios in which the 74 157 form may be utilized. For instance, a business may need to change its payee information due to a merger or acquisition, requiring a new payee to be designated for state payments. Similarly, an individual may need to update their payee information if they change their legal name or if they have a new bank account for direct deposits. Each of these situations highlights the importance of keeping payee information current to avoid payment delays or complications.

Quick guide on how to complete 74 157 payee change request

Your assistance manual on how to prepare your 74 157

If you’re curious about how to generate and dispatch your 74 157, here are a few concise instructions to simplify tax declarations.

To get started, you simply need to set up your airSlate SignNow profile to revolutionize your document handling online. airSlate SignNow is an extremely intuitive and robust document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures, and return to amend responses as necessary. Optimize your tax management with advanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your 74 157 in just a few minutes:

- Create your account and start working on PDFs in minutes.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to load your 74 157 in our editor.

- Populate the mandatory fillable fields with your details (text, numbers, checkmarks).

- Use the Sign Tool to add your legally-valid eSignature (if necessary).

- Verify your document and correct any mistakes.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Make the most of this manual to file your taxes electronically using airSlate SignNow. Keep in mind that submitting on paper may raise return errors and postpone refunds. Additionally, before e-filing your taxes, refer to the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 74 157 payee change request

FAQs

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

Do military personnel need money to fill out a leave request form?

It’s great that you asked. The answer is NO. Also, whatever you are doing with this person, STOP!Bloody hell, how many of these “I need your money to see you sweetheart” scammers are there? It’s probably that or someone totally misunderstood something.All military paperwork is free! However, whether their commander or other sort of boss will let them return or not depends on the nature of duty, deployment terms, and other conditions. They can’t just leave on a whim, that would be desertion and it’s (sorry I don’t know how it works in America) probably punishable by firing (as in termination of job) or FIRING (as in execution)!!!Soldiers are generally paid enough to fly commercial back to home country.Do not give these people any money or any contact information! If you pay him, you’ll probably get a receipt from Nigeria and nothing else.

-

Does a girlfriend have to fill out a leave request form for a US Army Soldier in Special Operations in Africa?

Let me guess, you've been contacted via email by somebody you’ve never met. they've told you a story about being a deployed soldier. At some stage in the dialogue they’ve told you about some kind of emotional drama, sick relative/kid etc. They tell you that because they are in a dangerous part of the world with no facilities they need you to fill in a leave application for them. Some part of this process will inevitably involve you having to pay some money on their behalf. The money will need to be paid via ‘Western Union’. Since you havent had much involvement with the military in the past you dont understand and are tempted to help out this poor soldier. they promise to pay you back once they get back from war.if this sounds familiar you are being scammed. There is no soldier just an online criminal trying to steal your money. If you send any money via Western Union it is gone, straight into the pockets of the scammer. you cant get it back, it is not traceable, this is why scammers love Western Union. They aernt going to pay you back, once they have your money you will only hear from them again if they think they can double down and squeeze more money out of you.Leave applications need to be completed by soldiers themselves. They are normally approved by their unit chain of command. If there is a problem the soldier’s commander will summon them internally to resolve the issue. This is all part of the fun of being a unit commander!! If the leave is not urgent they will wait for a convenient time during a rotation etc to work out the problems, if the leave is urgent (dying parent/spouse/kid etc) they will literally get that soldier out of an operational area ASAP. Operational requirements come first but it would need to be something unthinkable to prevent the Army giving immediate emergency leave to somebody to visit their dying kid in hospital etc.The process used by the scammers is known as ‘Advance fee fraud’ and if you want to read about the funny things people do to scam the scammers have a read over on The largest scambaiting community on the planet!

-

How do I change my address in the Aadhar card?

You can change the following details in Aadhar Card:NameGenderDate of BirthAddressE-mail IDTHINGS TO REMEMBER BEFORE APPLYING FOR AADHAR CARD DETAILS CHANGE:Your Registered Mobile Number is mandatory in the online process.You need to submit Documents for change of – Name, Date of Birth and Address. However, Change in Gender and E-mail ID do not require any document.You have to fill details in both – English and Regional/Local language (Eg. Hindi, Oriya, Bengali etc)Aadhar Card Details are not changed instantly. It is changed after Verification and Validation by the authoritySTEPS TO AADHAR CARD DETAILS CHANGE ONLINE:Click Here for going to the link.Enter your Aadhar Number.Fill Text VerificationClick on Send OTP. OTP is sent on your Registered mobile number.Also Read: Simple Steps to Conduct Aadhar Card Status Enquiry by NameYou will be asked to choose the Aadhar Card Details that you want to change.You can select multiple fields. Select the field and Submit.In next window fill the Correct Detail in both – English and Local language (if asked) and Submit.For Example – Here one has to fill the Email IdNOTE – If you are changing – Name, Date of Birth or Address, you have to upload the scanned documents. Click Here to know the Documents or Check them here.Verify the details that you have filled. If all the details look good then proceed or you can go back and edit once again.You may be asked for BPO Service Provider Selection. Select the provider belonging to your region.At last – You will be given an Update Request Number. Download or Print the document and keep it safe. It is required in checking the status of the complaint in future.So this step completes the process of Aadhar Card details change online.CHECK THE STATUS OF YOUR AADHAR CARD DETAILS CHANGE REQUESTStep 1 – Go the website by Clicking HereStep 2 – Fill the Aadhaar No. and URN – Update Request NumberStep 3 – Click on “Get Status”You are done. The new window on the screen will show the status of your request for change in Aadhar Card Details.

-

My neighborhood road has a a lot potholes. What can I do to get it fixed? Do I need to fill out a request form to the government?

First, you need to find out who has maintenance responsibility for the street. Sometimes, it’s the municipality, sometimes, the county, sometimes, the state. It could also be privately maintained.Let’s say it’s a city maintained street. Contact the city Public Works department and report the condition of the street. Most Public Works departments should have a priority list of streets in need of repair. They should be able to tell you where your street ranks on that list. If you think it’s too far down on the list, you might contact your City Councilman/Alderman to complain. It’d be a good idea to get as many of your neighbors to do the same thing.

Create this form in 5 minutes!

How to create an eSignature for the 74 157 payee change request

How to generate an electronic signature for your 74 157 Payee Change Request in the online mode

How to create an electronic signature for the 74 157 Payee Change Request in Chrome

How to generate an electronic signature for signing the 74 157 Payee Change Request in Gmail

How to create an electronic signature for the 74 157 Payee Change Request from your smartphone

How to create an electronic signature for the 74 157 Payee Change Request on iOS devices

How to create an electronic signature for the 74 157 Payee Change Request on Android

People also ask

-

What is airSlate SignNow and how does it relate to 74 157?

airSlate SignNow is a robust eSignature solution that empowers businesses to send and eSign documents efficiently. The reference to 74 157 highlights a specific feature or compliance aspect that users should be aware of when utilizing the platform for legally binding signatures.

-

How much does airSlate SignNow cost for businesses looking to comply with 74 157?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains competitive to help businesses comply with regulations like 74 157. Our plans are designed to cater to different needs, ensuring that you can find a cost-effective solution for your eSigning requirements.

-

What features does airSlate SignNow offer to ensure compliance with 74 157?

airSlate SignNow includes features such as advanced security protocols, customizable templates, and audit trails, all essential for compliance with 74 157. These features help ensure that your document transactions are secure and legally binding.

-

Can airSlate SignNow integrate with other applications to support compliance with 74 157?

Yes, airSlate SignNow offers seamless integrations with a variety of applications, making it easier for businesses to comply with 74 157. Whether you’re using CRM systems, cloud storage, or productivity tools, you can streamline your workflows for better efficiency.

-

What are the benefits of using airSlate SignNow for 74 157 compliance?

Using airSlate SignNow for 74 157 compliance provides businesses with a user-friendly platform that ensures document integrity and security. Additionally, it helps reduce turnaround times and improves overall operational efficiency, making it a smart choice for any organization.

-

Is airSlate SignNow suitable for small businesses needing to meet 74 157 regulations?

Absolutely! airSlate SignNow is particularly well-suited for small businesses looking to meet 74 157 regulations without breaking the bank. Its scalable pricing and intuitive interface make it an ideal solution for companies of all sizes.

-

Does airSlate SignNow provide customer support for 74 157 compliance issues?

Yes, airSlate SignNow offers dedicated customer support to assist businesses with any compliance questions related to 74 157. Our support team is knowledgeable about the platform and can help guide you through compliance processes.

Get more for 74 157

- Incomplete devry form

- Cmaa document cmar2 standard form of contract between construction manager and contractor edition this document is to be used

- Nms self assessment form

- Bank muscat download forms

- Wh405 pdf sc department of revenue sc gov form

- Www uslegalforms comform library117168 city ofget city of raeford zoning permit application us legal forms

- Publication 678 w form

- Secured loan agreement template form

Find out other 74 157

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now