New Mexico Announces Tax Filing Season Begins 2023

Understanding the New Mexico Tax Filing Season

The New Mexico tax filing season signifies the period when residents and businesses are required to submit their state tax returns. This season typically aligns with federal tax filing deadlines, providing taxpayers with a structured timeline to fulfill their obligations. Understanding this timeline is crucial for compliance and to avoid potential penalties.

Steps to Complete Your Tax Filing in New Mexico

Completing your tax filing in New Mexico involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Determine your filing status, which may affect your tax rate and eligibility for certain deductions.

- Choose the appropriate tax forms, such as the New Mexico Personal Income Tax Form (PIT-1) for individuals.

- Calculate your taxable income and applicable deductions or credits.

- File your completed tax return either online, by mail, or in person at designated locations.

Required Documents for Tax Filing

To successfully file your taxes in New Mexico, you will need several documents, including:

- Proof of income, such as W-2 forms from employers and 1099 forms for freelance work.

- Documentation for any deductions or credits you plan to claim, such as receipts for medical expenses or education costs.

- Your previous year's tax return, which can provide a reference for your current filing.

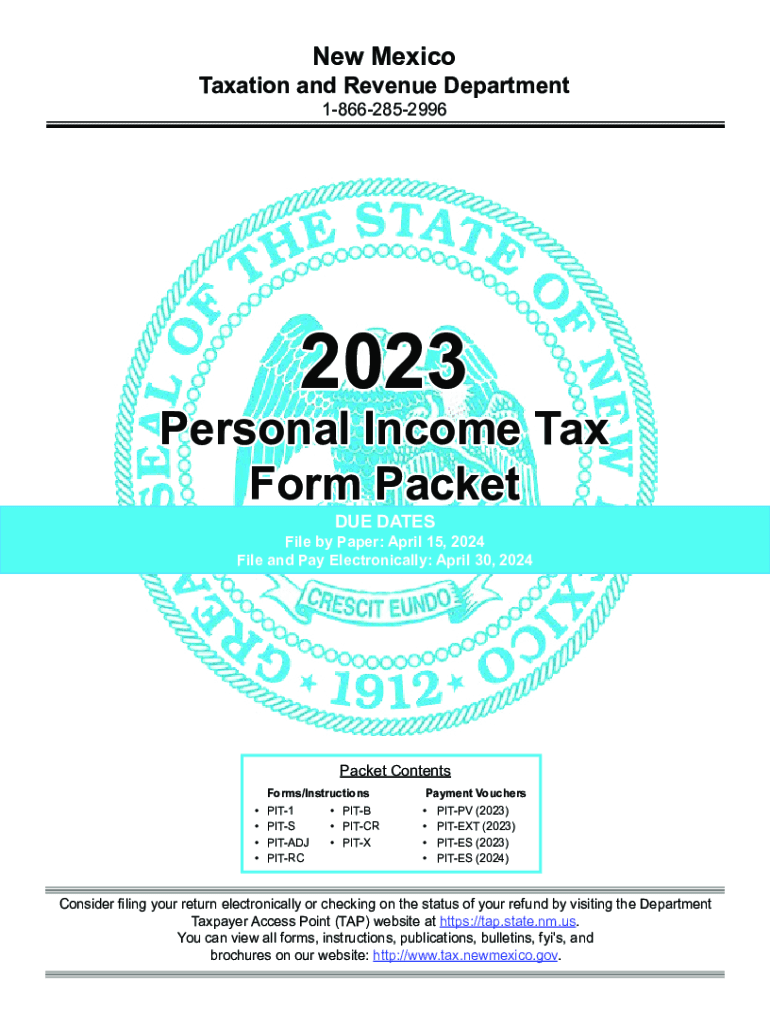

Filing Deadlines and Important Dates

Being aware of key dates is essential for timely filing. The general deadline for filing state tax returns in New Mexico typically coincides with the federal deadline, which is usually April 15. However, it is advisable to confirm specific dates each year, as they may vary due to weekends or holidays.

Form Submission Methods

New Mexico offers various methods for submitting tax forms:

- Online: Many taxpayers prefer to file electronically through the New Mexico Taxation and Revenue Department's website.

- By Mail: Paper forms can be mailed to the appropriate address provided in the tax instructions.

- In-Person: Taxpayers may also submit forms directly at designated tax offices.

Penalties for Non-Compliance

Failing to file your taxes on time or submitting inaccurate information can result in penalties. New Mexico imposes fines based on the amount owed and the duration of the delay. It is crucial to file your return accurately and on time to avoid unnecessary financial burdens.

Quick guide on how to complete new mexico announces tax filing season begins

Complete New Mexico Announces Tax Filing Season Begins effortlessly on any device

Managing documents online has gained signNow traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without holdups. Handle New Mexico Announces Tax Filing Season Begins on any platform using the airSlate SignNow apps for Android or iOS, and enhance any document-driven process today.

How to modify and electronically sign New Mexico Announces Tax Filing Season Begins with ease

- Obtain New Mexico Announces Tax Filing Season Begins and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using the tools specifically designed by airSlate SignNow for this task.

- Create your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you would like to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs within just a few clicks from any device you prefer. Modify and electronically sign New Mexico Announces Tax Filing Season Begins and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexico announces tax filing season begins

Create this form in 5 minutes!

How to create an eSignature for the new mexico announces tax filing season begins

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the New Mexico Announces Tax Filing Season Begins?

The New Mexico Announces Tax Filing Season Begins is a critical period for taxpayers to prepare their documents and file their taxes efficiently. It's essential to stay informed about this timeline to ensure compliance and avoid penalties. Using airSlate SignNow can streamline your document management during this season.

-

How can airSlate SignNow help during the New Mexico tax filing season?

airSlate SignNow provides an easy-to-use platform for eSigning and managing tax documents. With its cost-effective solution, you can prepare, send, and securely sign necessary documents quickly. This efficiency is vital as the New Mexico Announces Tax Filing Season Begins.

-

What features does airSlate SignNow offer for tax season management?

airSlate SignNow offers features such as customizable templates, bulk sending, and automated reminders for document signing. These tools are particularly useful as the New Mexico Announces Tax Filing Season Begins, allowing you to focus on getting your taxes done on time.

-

Are there specific pricing plans for businesses during the New Mexico tax filing season?

Yes, airSlate SignNow provides flexible pricing plans tailored to meet the needs of various businesses. These options allow you to choose the best fit as the New Mexico Announces Tax Filing Season Begins, ensuring you get the features you need at a cost-effective rate.

-

Can I integrate airSlate SignNow with other software during the tax filing season?

Absolutely! airSlate SignNow integrates seamlessly with a variety of third-party applications such as accounting software and CRM platforms. This capability is particularly beneficial as the New Mexico Announces Tax Filing Season Begins, enabling streamlined workflows and more efficient document handling.

-

What security measures does airSlate SignNow provide for tax documents?

airSlate SignNow prioritizes the security of your sensitive tax documents with state-of-the-art encryption and secure storage. As the New Mexico Announces Tax Filing Season Begins, you can trust that your documents are protected from unauthorized access, ensuring peace of mind for businesses and individuals alike.

-

Is it easy to get started with airSlate SignNow for tax season?

Yes, getting started with airSlate SignNow is quick and straightforward. You can sign up, access templates, and begin sending documents within minutes, making it an ideal choice as the New Mexico Announces Tax Filing Season Begins. User-friendly tutorials are also available to assist you.

Get more for New Mexico Announces Tax Filing Season Begins

Find out other New Mexico Announces Tax Filing Season Begins

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document