New Mexico Taxation and Revenue Department 1 866 2 2024-2026

What is the New Mexico Taxation And Revenue Department 1 866 2

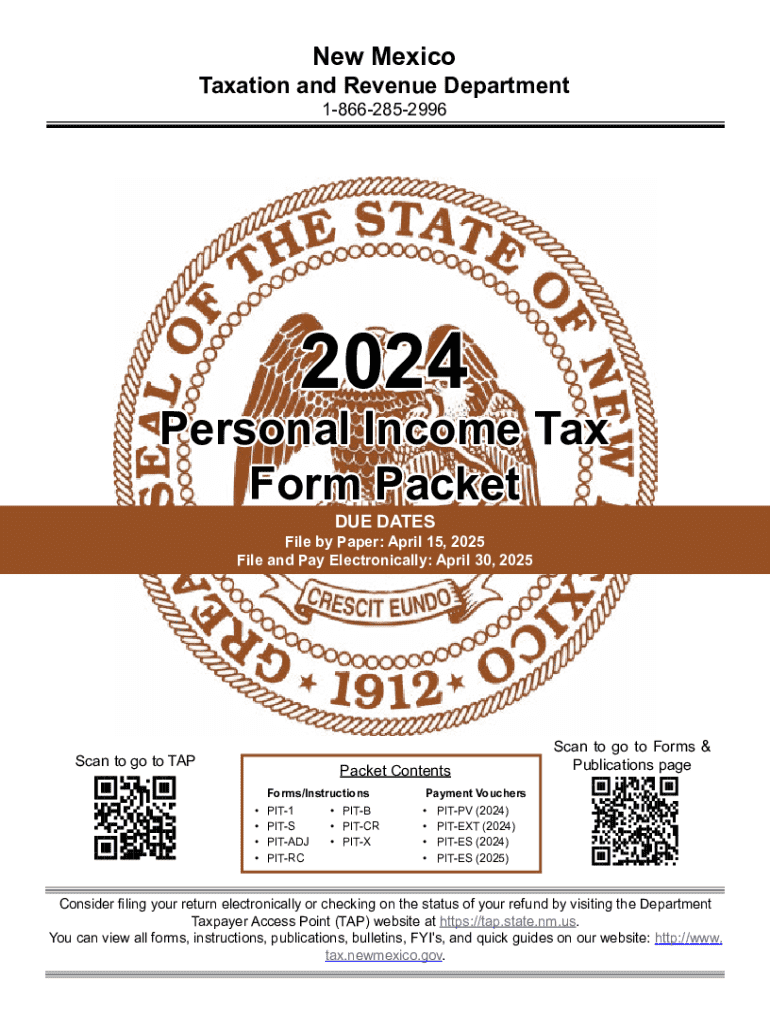

The New Mexico Taxation and Revenue Department, often referred to by its contact number 1 866 2, is the state agency responsible for administering tax laws and collecting revenue in New Mexico. This department oversees various tax-related functions, including income tax, gross receipts tax, and property tax. It plays a crucial role in ensuring compliance with state tax regulations and providing resources for taxpayers to understand their obligations.

How to use the New Mexico Taxation And Revenue Department 1 866 2

Utilizing the New Mexico Taxation and Revenue Department involves accessing their services for tax inquiries, filing returns, and obtaining necessary forms. Taxpayers can contact the department through the provided number for assistance with specific tax questions or issues. Additionally, the department offers online resources where individuals can find forms, guidelines, and information relevant to their tax situation.

Steps to complete the New Mexico Taxation And Revenue Department 1 866 2

Completing tasks related to the New Mexico Taxation and Revenue Department typically involves several steps:

- Gather necessary documentation, such as income statements and previous tax returns.

- Visit the department's website or call the provided number for specific forms and instructions.

- Fill out the required forms accurately, ensuring all information is complete.

- Submit the forms through the designated method, whether online, by mail, or in person.

- Keep copies of submitted documents for your records.

Required Documents

When dealing with the New Mexico Taxation and Revenue Department, specific documents may be required depending on the nature of the tax matter. Commonly required documents include:

- W-2 forms for wage earners.

- 1099 forms for independent contractors.

- Records of any deductions or credits claimed.

- Previous year’s tax return for reference.

Penalties for Non-Compliance

Failure to comply with the regulations set forth by the New Mexico Taxation and Revenue Department can result in penalties. These may include:

- Late filing fees for overdue tax returns.

- Interest on unpaid taxes.

- Potential legal action for severe non-compliance.

Eligibility Criteria

Eligibility for various tax programs and benefits administered by the New Mexico Taxation and Revenue Department often depends on specific criteria, which may include:

- Residency status in New Mexico.

- Income level and sources of income.

- Filing status, such as single, married, or head of household.

Create this form in 5 minutes or less

Find and fill out the correct new mexico taxation and revenue department 1 866 2

Create this form in 5 minutes!

How to create an eSignature for the new mexico taxation and revenue department 1 866 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the New Mexico Taxation And Revenue Department 1 866 2 provide?

The New Mexico Taxation And Revenue Department 1 866 2 offers a variety of services including tax collection, revenue management, and assistance with tax-related inquiries. They provide resources for both individuals and businesses to ensure compliance with state tax laws. Their services are designed to simplify the tax process and enhance customer support.

-

How can I contact the New Mexico Taxation And Revenue Department 1 866 2 for assistance?

You can signNow the New Mexico Taxation And Revenue Department 1 866 2 by calling their dedicated helpline. They offer support for various tax-related questions and concerns. Additionally, you can visit their official website for more resources and contact options.

-

What are the benefits of using airSlate SignNow with the New Mexico Taxation And Revenue Department 1 866 2?

Using airSlate SignNow in conjunction with the New Mexico Taxation And Revenue Department 1 866 2 allows for seamless document management and eSigning. This integration streamlines the process of submitting tax documents, making it faster and more efficient. Businesses can save time and reduce errors by utilizing this user-friendly solution.

-

Are there any fees associated with the New Mexico Taxation And Revenue Department 1 866 2 services?

While the New Mexico Taxation And Revenue Department 1 866 2 provides many services at no cost, certain transactions may incur fees. It's important to check their official website or contact them directly for detailed information on any applicable fees. Understanding these costs can help you budget effectively for your tax obligations.

-

What features does airSlate SignNow offer that can help with New Mexico tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking that are particularly beneficial for handling New Mexico tax documents. These tools help ensure that your submissions are accurate and timely. By leveraging these features, you can enhance your compliance with the New Mexico Taxation And Revenue Department 1 866 2 requirements.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow can be integrated with various accounting and tax management software to streamline your workflow. This integration allows for easy transfer of documents and data, enhancing your efficiency when dealing with the New Mexico Taxation And Revenue Department 1 866 2. By connecting these tools, you can simplify your tax preparation and filing processes.

-

What types of documents can I eSign for the New Mexico Taxation And Revenue Department 1 866 2?

You can eSign a variety of documents for the New Mexico Taxation And Revenue Department 1 866 2, including tax returns, forms, and compliance documents. airSlate SignNow supports multiple document formats, ensuring you can handle all necessary paperwork efficiently. This capability helps you stay organized and compliant with state regulations.

Get more for New Mexico Taxation And Revenue Department 1 866 2

- Consent ampamp release for inactivated influenza vaccine wichita form

- Enrollment forms are in pdf format and require adobe reader

- What applies form

- Mutual death claim form

- Fellowship application form studylib

- Samples received lab use only med stanford form

- Credentialing coordinatorthe oncology institute of hope form

- To order additional forms call 18004500962

Find out other New Mexico Taxation And Revenue Department 1 866 2

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF