Purpose of This Worksheet Use the Caregiver's Statement along with the PIT Childcare, Child Day Care Credit Worksheet When 2010

Understanding the Caregiver's Statement and Its Purpose

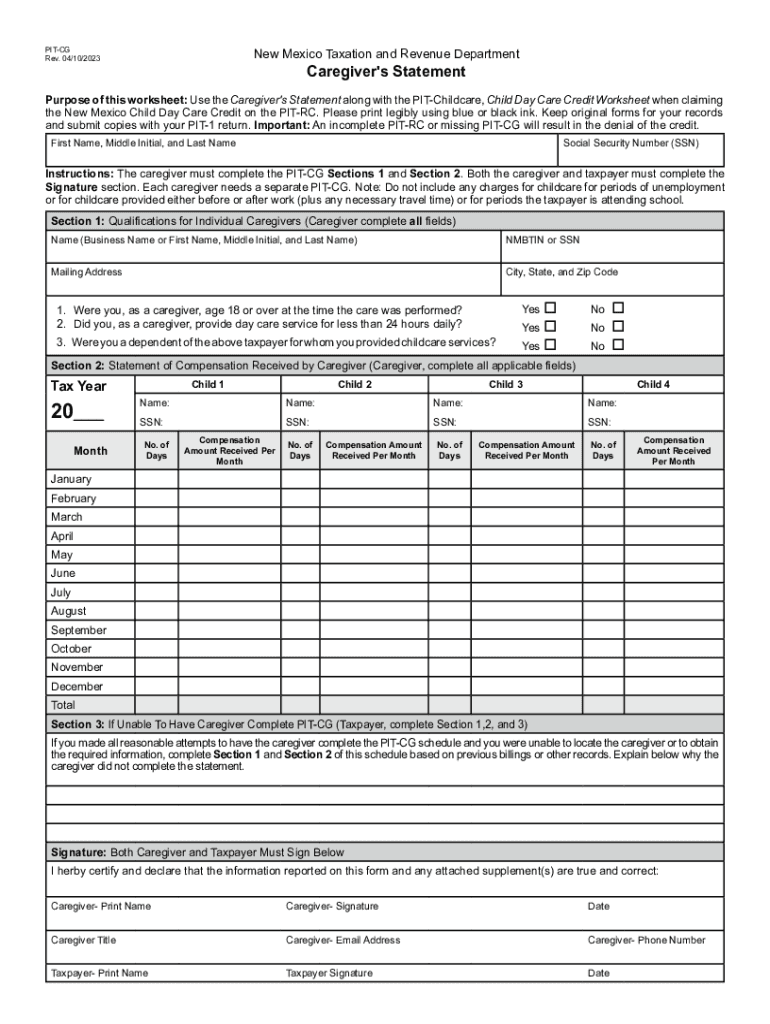

The New Mexico CG caregiver template serves as an essential tool for individuals claiming the Child Day Care Credit. This statement outlines the care provided by a caregiver, detailing the services rendered and the corresponding costs. It is crucial for taxpayers to accurately complete this document to ensure they receive the appropriate tax credits. When used alongside the PIT Childcare Worksheet, this statement helps substantiate claims made on tax returns, ensuring compliance with state regulations.

Steps to Complete the Caregiver's Statement

Completing the New Mexico CG caregiver template involves several key steps:

- Gather necessary information about the caregiver, including their name, address, and taxpayer identification number.

- Document the details of the care provided, including the dates of service and the total amount paid.

- Ensure that the caregiver signs the statement to validate the information provided.

- Attach the completed statement to your PIT Childcare Worksheet when filing your taxes.

Following these steps ensures that the caregiver's statement is accurate and comprehensive, which is vital for claiming the child care credit.

Legal Use of the Caregiver's Statement

The caregiver's statement must adhere to specific legal guidelines to be considered valid. It is essential that the information provided is truthful and verifiable. Misrepresentation or inaccuracies can lead to penalties or denial of tax credits. Taxpayers should retain copies of the caregiver's statement and any related documentation for their records, as these may be required in the event of an audit.

Eligibility Criteria for Claiming Child Care Credits

To qualify for the Child Day Care Credit in New Mexico, certain eligibility criteria must be met:

- The taxpayer must have incurred expenses for childcare while working or looking for work.

- The caregiver must be a qualified individual, such as a licensed daycare provider.

- Expenses must be documented through the caregiver's statement to be considered for the credit.

Understanding these criteria helps ensure that taxpayers can effectively utilize the caregiver's statement in their claims.

Important Filing Deadlines

Taxpayers should be aware of critical deadlines when submitting the caregiver's statement and related forms. Generally, tax returns must be filed by April fifteenth of each year. However, it is advisable to check for any extensions or specific state deadlines that may apply. Timely submission of the caregiver's statement is essential to avoid penalties and ensure eligibility for the child care credit.

Obtaining the Caregiver's Statement Template

The New Mexico CG caregiver template can be obtained through various channels. It is available online through state tax websites and can also be provided by tax professionals. Ensuring you have the correct and most current version of the template is crucial for compliance and accuracy in your tax filings.

Quick guide on how to complete purpose of this worksheet use the caregivers statement along with the pit childcare child day care credit worksheet when

Complete Purpose Of This Worksheet Use The Caregiver's Statement Along With The PIT Childcare, Child Day Care Credit Worksheet When effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Purpose Of This Worksheet Use The Caregiver's Statement Along With The PIT Childcare, Child Day Care Credit Worksheet When on any platform with airSlate SignNow apps for Android or iOS and enhance any document-centric operation today.

How to modify and eSign Purpose Of This Worksheet Use The Caregiver's Statement Along With The PIT Childcare, Child Day Care Credit Worksheet When with ease

- Find Purpose Of This Worksheet Use The Caregiver's Statement Along With The PIT Childcare, Child Day Care Credit Worksheet When and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or black out sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Purpose Of This Worksheet Use The Caregiver's Statement Along With The PIT Childcare, Child Day Care Credit Worksheet When and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct purpose of this worksheet use the caregivers statement along with the pit childcare child day care credit worksheet when

Create this form in 5 minutes!

How to create an eSignature for the purpose of this worksheet use the caregivers statement along with the pit childcare child day care credit worksheet when

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Mexico CG Caregiver Template?

The New Mexico CG Caregiver Template is a pre-designed document crafted to meet the specific requirements for caregivers in New Mexico. It helps streamline the documentation process, ensuring that essential information is captured efficiently. This template is ideal for both individual caregivers and agencies looking to enhance their documentation practices.

-

How can I access the New Mexico CG Caregiver Template?

You can access the New Mexico CG Caregiver Template through the airSlate SignNow platform. Simply sign up for an account, navigate to the templates section, and search for the caregiver template specific to New Mexico. Once you find it, you can customize and use it for your needs.

-

Is there a cost associated with using the New Mexico CG Caregiver Template?

Yes, there is a subscription cost involved when using airSlate SignNow, which grants you access to the New Mexico CG Caregiver Template among many other features. The pricing is designed to be cost-effective for businesses of all sizes, providing superior value through streamlined document management. You can check our pricing page for specific details.

-

What features does the New Mexico CG Caregiver Template include?

The New Mexico CG Caregiver Template comes with features such as customizable fields, electronic signatures, and the ability to save and share documents easily. These features enhance the efficiency of your documentation process by simplifying how you collect and manage caregiver information. Additionally, real-time tracking allows you to monitor the status of your documents.

-

How does using the New Mexico CG Caregiver Template benefit my business?

Utilizing the New Mexico CG Caregiver Template can signNowly reduce the time and effort needed in paperwork management. This template ensures compliance with state requirements and enhances organization within your caregiving operations. With faster processing times, you can focus more on providing quality care rather than getting bogged down by documentation.

-

Can I integrate the New Mexico CG Caregiver Template with other tools?

Yes, airSlate SignNow allows for seamless integration with various tools and platforms, enabling you to use the New Mexico CG Caregiver Template alongside your existing software. Popular integrations include customer relationship management (CRM) systems, project management tools, and cloud storage services. This flexibility enhances your workflow and helps maintain consistency across your operations.

-

Is the New Mexico CG Caregiver Template customizable?

Absolutely! The New Mexico CG Caregiver Template is designed to be fully customizable, allowing you to modify text fields, add company logos, and tailor the document to fit your specific needs. This ensures that the template aligns with your business branding and meets the unique requirements of your caregiving practices. Customization is straightforward and can be done directly in the airSlate SignNow interface.

Get more for Purpose Of This Worksheet Use The Caregiver's Statement Along With The PIT Childcare, Child Day Care Credit Worksheet When

Find out other Purpose Of This Worksheet Use The Caregiver's Statement Along With The PIT Childcare, Child Day Care Credit Worksheet When

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile