LAT 5A TAX EXEMPT ANALYSIS RETURN TO20 PERSONAL 2019

Understanding the LAT 5A Tax Exempt Analysis Return

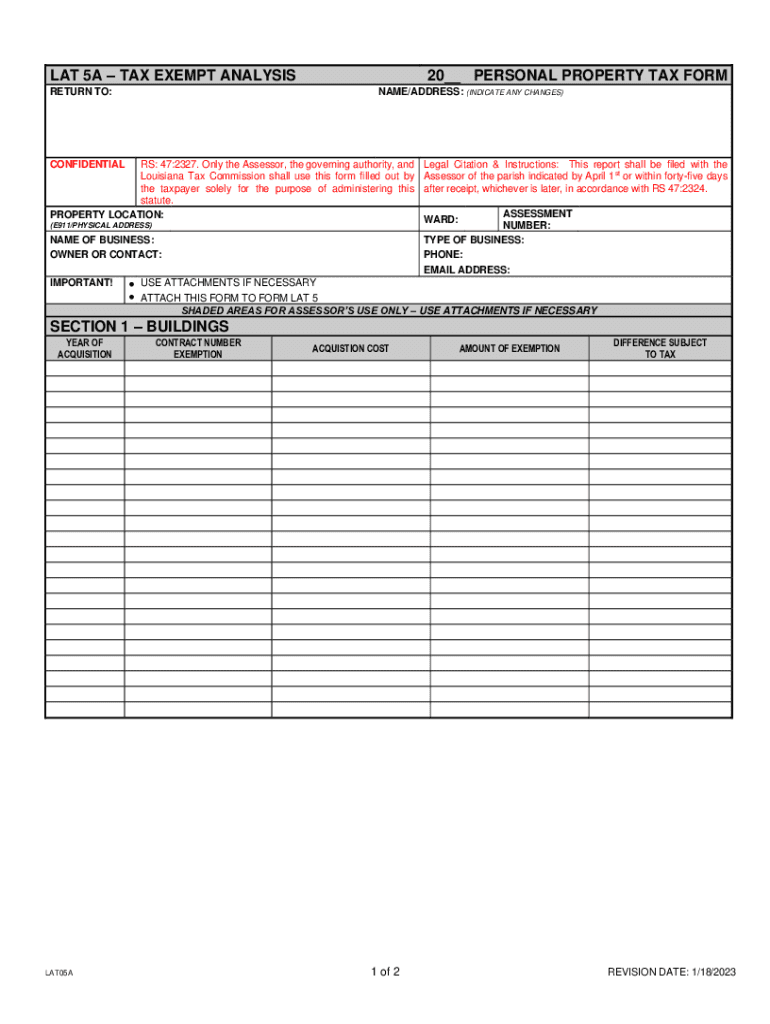

The LAT 5A Tax Exempt Analysis Return is a form used in Louisiana for individuals and entities seeking tax exemptions. This form allows taxpayers to demonstrate their eligibility for exemptions based on specific criteria set forth by the state. It is essential for individuals to understand the purpose of this form, as it directly impacts their tax obligations and potential savings.

Steps to Complete the LAT 5A Tax Exempt Analysis Return

Completing the LAT 5A Tax Exempt Analysis Return involves several key steps:

- Gather necessary documentation, including proof of eligibility for tax exemption.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for accuracy to avoid delays in processing.

- Submit the completed form by the designated deadline to ensure timely consideration.

Eligibility Criteria for the LAT 5A Tax Exempt Analysis Return

To qualify for the LAT 5A Tax Exempt Analysis Return, applicants must meet specific eligibility criteria. This may include:

- Being a resident of Louisiana or having a business presence in the state.

- Meeting income thresholds or other financial criteria as defined by state regulations.

- Providing documentation that supports the claim for exemption.

Required Documents for the LAT 5A Tax Exempt Analysis Return

When submitting the LAT 5A Tax Exempt Analysis Return, several documents are typically required. These may include:

- Proof of income or financial statements.

- Identification documents to verify residency or business status.

- Any additional forms that support the exemption claim.

Form Submission Methods for the LAT 5A Tax Exempt Analysis Return

The LAT 5A Tax Exempt Analysis Return can be submitted through various methods, including:

- Online submission via the state’s tax portal.

- Mailing a hard copy to the appropriate tax authority.

- In-person submission at designated tax offices.

Legal Use of the LAT 5A Tax Exempt Analysis Return

The LAT 5A Tax Exempt Analysis Return is recognized by Louisiana tax authorities as a valid document for claiming tax exemptions. Understanding the legal implications of this form is crucial for compliance with state tax laws. Proper use ensures that taxpayers can take advantage of available exemptions without facing penalties.

Quick guide on how to complete lat 5a tax exempt analysis return to20 personal

Effortlessly Prepare LAT 5A TAX EXEMPT ANALYSIS RETURN TO20 PERSONAL on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without any hold-ups. Manage LAT 5A TAX EXEMPT ANALYSIS RETURN TO20 PERSONAL across any platform with airSlate SignNow's Android or iOS applications and enhance your document-related operations today.

How to Modify and Electronically Sign LAT 5A TAX EXEMPT ANALYSIS RETURN TO20 PERSONAL with Ease

- Locate LAT 5A TAX EXEMPT ANALYSIS RETURN TO20 PERSONAL and select Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important portions of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign LAT 5A TAX EXEMPT ANALYSIS RETURN TO20 PERSONAL and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lat 5a tax exempt analysis return to20 personal

Create this form in 5 minutes!

How to create an eSignature for the lat 5a tax exempt analysis return to20 personal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is LA tax exempt status and how can it benefit my business?

LA tax exempt status allows businesses to avoid paying sales tax on certain purchases, which can lead to signNow savings. By becoming LA tax exempt, your business can reallocate funds to other essential areas, enhancing overall financial efficiency. Additionally, this status can improve cash flow, making it easier to invest in growth opportunities.

-

How can airSlate SignNow assist with managing LA tax exempt documentation?

airSlate SignNow streamlines the process of managing LA tax exempt documentation by providing easy eSigning capabilities. You can quickly send and receive documents related to your tax exempt status, ensuring compliance and proper record-keeping. This efficiency eliminates the hassle of physical paperwork, allowing you to focus on more critical aspects of your business.

-

What features does airSlate SignNow offer for LA tax exempt applications?

airSlate SignNow offers features such as customizable templates and real-time tracking for LA tax exempt applications. These tools facilitate quicker approvals and streamline workflows. With airSlate SignNow, you can easily collect signatures from multiple parties, ensuring that your LA tax exempt applications are processed efficiently.

-

Is airSlate SignNow a cost-effective solution for LA tax exempt needs?

Yes, airSlate SignNow is a cost-effective solution for businesses managing their LA tax exempt needs. The platform offers competitive pricing plans that cater to various business sizes without compromising on essential features. By reducing the time spent on paperwork, your business can enjoy additional savings in operational costs.

-

Can airSlate SignNow integrate with my existing accounting software for LA tax exempt management?

Absolutely, airSlate SignNow can integrate seamlessly with many popular accounting software applications. This integration allows for efficient tracking and management of LA tax exempt documentation within your existing systems. By linking these platforms, you can maintain accurate financial records while saving time and minimizing errors.

-

How does electronic signature compliance work with LA tax exempt documents?

Electronic signatures through airSlate SignNow are compliant with the legal requirements for LA tax exempt documents. The platform uses industry-standard security protocols to ensure that all signed documents are valid and legally binding. This compliance simplifies the process of securing your LA tax exempt status while providing peace of mind.

-

How can I ensure my business qualifies for LA tax exempt status?

To qualify for LA tax exempt status, your business must meet specific criteria set by the state of Louisiana. Consulting airSlate SignNow for document management can help you gather all necessary paperwork and ensure compliance with state regulations. Additionally, there are various resources available online that detail the steps needed to achieve and maintain LA tax exempt status.

Get more for LAT 5A TAX EXEMPT ANALYSIS RETURN TO20 PERSONAL

- Life company enrollment form

- Informed consent for tonsillectomy and adenoidectomy

- Visalia project homeless connect sign upkings tulare form

- Occupational medicine demographics and form

- 333 route 46 west mountain lakes form

- J michael king md jonathan c mills md michael vidas form

- Chubb accidental death insurance form

- Pharmacy credentialing application 04 02 12doc form

Find out other LAT 5A TAX EXEMPT ANALYSIS RETURN TO20 PERSONAL

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself