City of Brook Park Income Tax Instructions Form

Understanding the City of Brook Park Income Tax Instructions

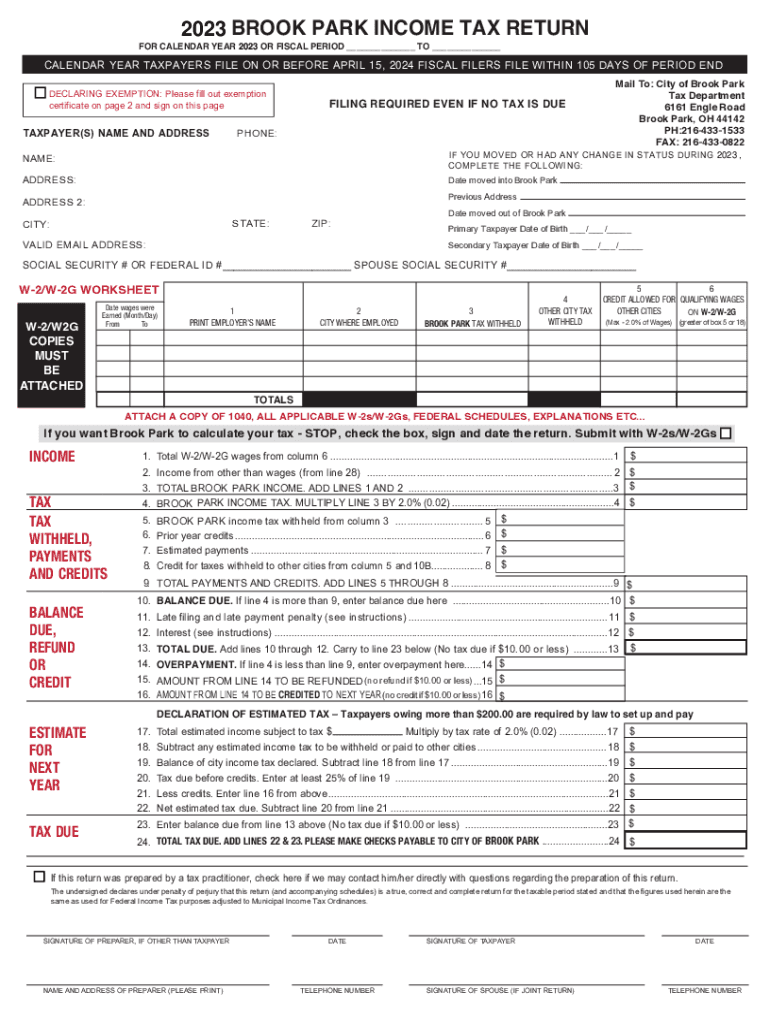

The City of Brook Park income tax return instructions provide essential guidance for residents and businesses filing their income tax returns. These instructions outline the necessary steps to accurately complete the Ohio income tax return form, ensuring compliance with local tax regulations. They cover various aspects, including eligibility criteria, required documents, and specific rules that may apply to different taxpayer scenarios.

Steps to Complete the City of Brook Park Income Tax Instructions

Completing the City of Brook Park income tax return involves several key steps:

- Gather all necessary documents, such as W-2 forms, 1099 forms, and any other income statements.

- Review the specific instructions for the Brook Park income tax return to understand the filing requirements.

- Fill out the Ohio income tax return form accurately, ensuring all income and deductions are reported.

- Double-check the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline, either online, by mail, or in person.

Required Documents for Filing

To file the City of Brook Park income tax return, taxpayers must prepare several documents, including:

- W-2 forms from employers, detailing wages and tax withholdings.

- 1099 forms for any freelance or contract work performed.

- Records of any other income sources, such as rental income or dividends.

- Receipts for deductible expenses, if applicable, to reduce taxable income.

Filing Deadlines and Important Dates

Timely filing of the City of Brook Park income tax return is crucial to avoid penalties. The general deadline for filing is typically April 15 of each year. However, taxpayers should check for any specific extensions or changes that may apply. It is advisable to keep track of any important dates related to tax filing to ensure compliance.

Form Submission Methods

Taxpayers can submit the City of Brook Park income tax return form through various methods:

- Online submission via the city’s tax portal, which offers a streamlined process for filing.

- Mailing a printed copy of the completed form to the designated tax office address.

- In-person submission at the local tax office, allowing for immediate assistance if needed.

Penalties for Non-Compliance

Failing to file the City of Brook Park income tax return on time may result in penalties. These can include late fees and interest on any unpaid taxes. It is important for taxpayers to be aware of these potential consequences and to file their returns promptly to avoid additional financial burdens.

Quick guide on how to complete city of brook park income tax instructions

Effortlessly Prepare City Of Brook Park Income Tax Instructions on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage City Of Brook Park Income Tax Instructions on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Modify and Electronically Sign City Of Brook Park Income Tax Instructions Effortlessly

- Find City Of Brook Park Income Tax Instructions and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools offered by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign City Of Brook Park Income Tax Instructions to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of brook park income tax instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio income tax return form and who needs to file it?

The Ohio income tax return form is a document that residents of Ohio must complete to report their annual income to the state. Anyone who earns income in Ohio, including wages, salaries, and self-employment income, is required to file this form. It's essential to ensure accurate reporting to avoid penalties and interest.

-

How can airSlate SignNow help with submitting my Ohio income tax return form?

airSlate SignNow offers a streamlined solution for electronically signing and sending your Ohio income tax return form. With its intuitive interface, you can quickly fill out your form, obtain necessary signatures, and submit it securely. This helps enhance efficiency and keeps your tax paperwork organized.

-

What are the costs associated with using airSlate SignNow for my Ohio income tax return form?

Using airSlate SignNow comes at a competitive price that is often lower than traditional filing methods. You can choose from different pricing tiers based on your needs, ensuring you get the best value when managing your Ohio income tax return form. Clear pricing structures allow you to select the right plan without any hidden fees.

-

Are there any features specifically designed for Ohio tax filers in airSlate SignNow?

Yes, airSlate SignNow includes features tailored to help Ohio tax filers, like customizable templates for the Ohio income tax return form. Additionally, the platform provides reminders and tracking features to ensure you meet filing deadlines. These tools can signNowly reduce the stress associated with tax season.

-

How secure is my information when using airSlate SignNow for my Ohio income tax return form?

Security is a top priority for airSlate SignNow. When you use the platform to complete your Ohio income tax return form, your data is encrypted and stored securely. You can trust that your sensitive information is protected against unauthorized access and potential bsignNowes.

-

Can I integrate airSlate SignNow with other tax software when filing my Ohio income tax return form?

Absolutely! airSlate SignNow can be integrated with various tax software to streamline your filing process for the Ohio income tax return form. This allows you to import necessary data seamlessly and reduces the chances of errors, making tax preparation more efficient.

-

What are the benefits of using airSlate SignNow to file my Ohio income tax return form?

The primary benefits of using airSlate SignNow for your Ohio income tax return form include convenience, speed, and enhanced organization. The platform allows you to complete and eSign your forms from anywhere at any time, ensuring that you never miss a deadline. Additionally, it simplifies record keeping for future reference.

Get more for City Of Brook Park Income Tax Instructions

Find out other City Of Brook Park Income Tax Instructions

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form