EquifaxExtended Fraud Alert Request FormTo Place a 2018-2026

Understanding the Experian Fraud Alert Form

The Experian fraud alert form is a crucial document designed to help individuals protect themselves against identity theft. By placing a fraud alert on their credit report, consumers can notify potential creditors to take extra steps to verify their identity before extending credit. This form is particularly important for those who suspect they may be victims of fraud or have experienced data breaches. It serves as a proactive measure to safeguard personal financial information.

Key Elements of the Experian Fraud Alert Form

When filling out the Experian fraud alert form, several key elements must be included to ensure its effectiveness. These elements typically consist of:

- Personal Information: Full name, address, date of birth, and Social Security number.

- Type of Alert: Indicating whether a standard or extended fraud alert is desired.

- Contact Information: A phone number or email address for follow-up communications.

- Signature: A signature is required to validate the request.

Providing accurate and complete information is essential to facilitate the processing of the alert.

Steps to Complete the Experian Fraud Alert Form

Completing the Experian fraud alert form involves several straightforward steps:

- Gather necessary personal information, including identification documents.

- Download or print the Experian fraud alert form from the official website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form via the designated method, such as online submission or mail.

Following these steps carefully can help ensure that the fraud alert is placed efficiently and effectively.

Submitting the Experian Fraud Alert Form

There are multiple methods available for submitting the Experian fraud alert form. Consumers can choose the method that best suits their needs:

- Online Submission: Many consumers prefer to submit the form electronically through the Experian website, which can expedite the process.

- Mail: For those who prefer traditional methods, mailing the form to Experian's designated address is an option.

- In-Person: Some individuals may opt to visit a local Experian office to submit the form directly.

Each submission method has its own processing times, so it is advisable to choose based on personal convenience and urgency.

Legal Use of the Experian Fraud Alert Form

The Experian fraud alert form is governed by specific legal guidelines that individuals should be aware of. Under the Fair Credit Reporting Act (FCRA), consumers have the right to place a fraud alert on their credit reports. This legal framework ensures that creditors must take additional steps to verify identity before approving credit applications when a fraud alert is active. Understanding these rights can empower consumers to take control of their financial security.

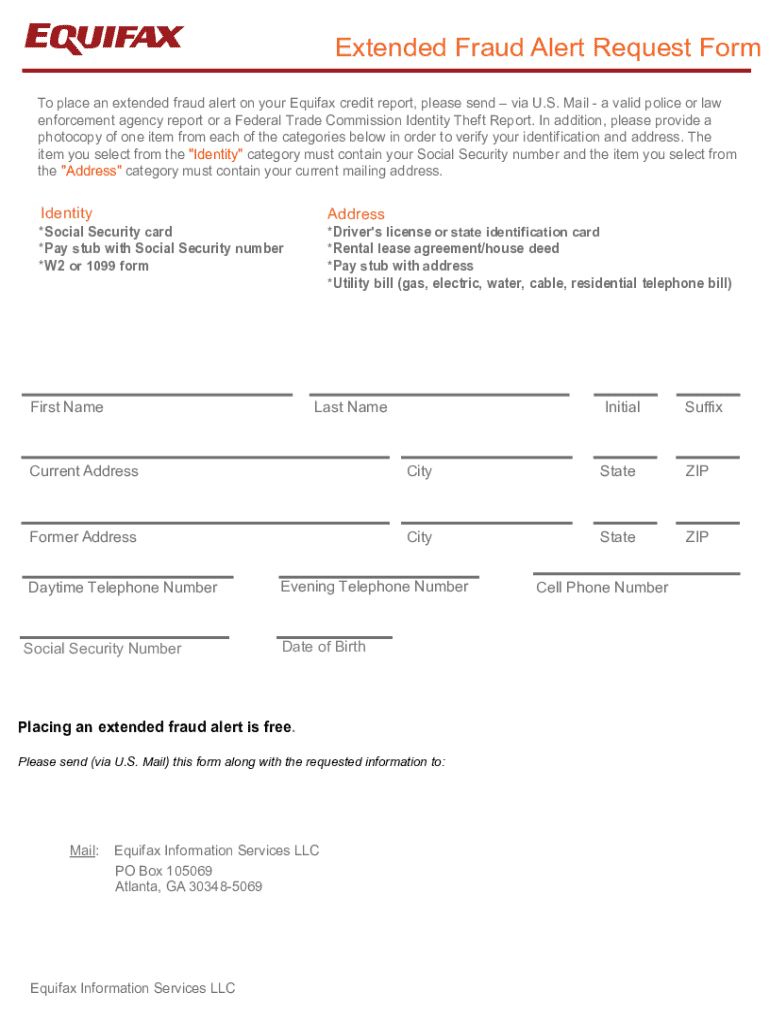

Extended Fraud Alerts: What You Need to Know

For individuals who believe they are at a higher risk of identity theft, an extended fraud alert may be appropriate. This type of alert lasts for seven years and requires creditors to take extra steps to verify identity. The process for placing an extended alert is similar to that of a standard fraud alert but may involve additional documentation. Individuals can specify their need for an extended alert on the Experian fraud alert form, ensuring that their request is processed accordingly.

Quick guide on how to complete equifaxextended fraud alert request formto place a

Complete EquifaxExtended Fraud Alert Request FormTo Place A effortlessly on any device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the features you need to create, modify, and electronically sign your documents quickly and without interruptions. Handle EquifaxExtended Fraud Alert Request FormTo Place A on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to modify and electronically sign EquifaxExtended Fraud Alert Request FormTo Place A easily

- Obtain EquifaxExtended Fraud Alert Request FormTo Place A and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign EquifaxExtended Fraud Alert Request FormTo Place A and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct equifaxextended fraud alert request formto place a

Create this form in 5 minutes!

How to create an eSignature for the equifaxextended fraud alert request formto place a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Experian fraud alert form?

The Experian fraud alert form is a document that allows consumers to notify credit reporting agencies of potential identity theft. By submitting this form, you can place a fraud alert on your credit report, making it harder for identity thieves to open accounts in your name. This is an essential step in protecting your financial identity.

-

How can I access the Experian fraud alert form?

You can easily access the Experian fraud alert form through the Experian website or by contacting their customer service. Once you have the form, you can fill it out and submit it online or via mail. This process is straightforward and designed to help you quickly secure your credit information.

-

Is there a cost associated with the Experian fraud alert form?

No, there is no cost to submit the Experian fraud alert form. This service is provided free of charge to consumers who want to protect themselves from identity theft. Utilizing this form is a proactive measure that can save you from potential financial loss.

-

What are the benefits of using the Experian fraud alert form?

Using the Experian fraud alert form helps you safeguard your credit by alerting lenders to take extra steps to verify your identity before granting credit. This added layer of security can signNowly reduce the risk of identity theft. Additionally, it gives you peace of mind knowing that you are taking action to protect your financial future.

-

How long does a fraud alert last when using the Experian fraud alert form?

A fraud alert placed using the Experian fraud alert form typically lasts for 90 days. After this period, you can renew the alert if you still feel at risk. This temporary measure is an effective way to monitor your credit activity and ensure your identity remains secure.

-

Can I use the Experian fraud alert form if I live outside the United States?

Yes, you can use the Experian fraud alert form even if you live outside the United States, but the process may vary. It's important to check with Experian for specific guidelines applicable to international consumers. They provide resources to help you navigate the process regardless of your location.

-

Does submitting the Experian fraud alert form affect my credit score?

No, submitting the Experian fraud alert form does not affect your credit score. It is a protective measure that alerts lenders but does not impact your creditworthiness. Maintaining your credit score is crucial, and using this form is a smart way to protect it without any negative consequences.

Get more for EquifaxExtended Fraud Alert Request FormTo Place A

Find out other EquifaxExtended Fraud Alert Request FormTo Place A

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast