Form it 203 TM ATT ASchedule a Group Return for

What is the Form IT 203 TM ATT ASchedule A Group Return For

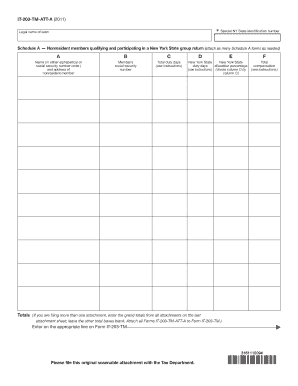

The Form IT 203 TM ATT ASchedule A Group Return is a tax form used by certain businesses in the United States to report income, deductions, and credits for a group of related entities. This form is particularly relevant for partnerships and corporations that wish to file a consolidated return, simplifying the tax process by allowing multiple entities to be reported together. By using this form, businesses can streamline their filing obligations and ensure compliance with IRS regulations.

How to use the Form IT 203 TM ATT ASchedule A Group Return For

To effectively use the Form IT 203 TM ATT ASchedule A, businesses must first gather all necessary financial information from the entities included in the group return. This includes income statements, expense reports, and any applicable deductions or credits. Once the data is compiled, it is essential to fill out the form accurately, ensuring that all figures are correct and all required signatures are obtained. After completing the form, it can be submitted electronically or via mail, depending on the preferences of the filing entity.

Steps to complete the Form IT 203 TM ATT ASchedule A Group Return For

Completing the Form IT 203 TM ATT ASchedule A involves several key steps:

- Gather financial documents from all entities included in the group return.

- Fill out the form, ensuring that all income, deductions, and credits are accurately reported.

- Review the completed form for accuracy and completeness.

- Obtain necessary signatures from authorized representatives of each entity.

- Submit the form electronically or by mail, adhering to the filing guidelines provided by the IRS.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Form IT 203 TM ATT ASchedule A. Typically, the form must be filed by the 15th day of the third month following the end of the tax year for the group return. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these dates helps ensure compliance and avoids potential penalties.

Legal use of the Form IT 203 TM ATT ASchedule A Group Return For

The legal use of the Form IT 203 TM ATT ASchedule A is essential for businesses that qualify to file a group return. This form must be used in accordance with IRS regulations, and it is important that all entities involved meet the eligibility criteria. Filing the form incorrectly or failing to comply with legal requirements can result in penalties, including fines or additional scrutiny from tax authorities.

Eligibility Criteria

To be eligible to use the Form IT 203 TM ATT ASchedule A, businesses must meet specific criteria set forth by the IRS. Generally, this includes being part of a controlled group of corporations or partnerships that are eligible to file a consolidated return. Each entity must also be in good standing with the IRS and must have a valid Employer Identification Number (EIN). Understanding these eligibility requirements is crucial for successful filing.

Quick guide on how to complete form it 203 tm att aschedule a group return for

Accomplish [SKS] effortlessly on any device

Digital document management has gained favor among both corporations and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to edit and eSign [SKS] hassle-free

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 203 tm att aschedule a group return for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 203 TM ATT ASchedule A Group Return For?

The Form IT 203 TM ATT ASchedule A Group Return For is designed to simplify the filing process for tax groups. It allows multiple taxpayers to file their returns collectively, streamlining communication and reducing paperwork. With airSlate SignNow, completing and eSigning this form becomes quick and efficient.

-

How does airSlate SignNow help with the Form IT 203 TM ATT ASchedule A Group Return For?

airSlate SignNow empowers users to complete the Form IT 203 TM ATT ASchedule A Group Return For seamlessly. Our platform provides tools for collaboration and electronic signatures, ensuring that all stakeholders can contribute without delay. This ultimately enhances the accuracy and efficiency of the submission process.

-

Is there a cost associated with using airSlate SignNow for Form IT 203 TM ATT ASchedule A Group Return For?

While airSlate SignNow offers various pricing plans, the costs associated with eSigning the Form IT 203 TM ATT ASchedule A Group Return For are competitive and designed to be cost-effective for businesses of all sizes. You can choose a plan that aligns with your company's needs and budget. Investing in our solution can save both time and resources during tax season.

-

What features does airSlate SignNow offer for managing the Form IT 203 TM ATT ASchedule A Group Return For?

airSlate SignNow includes features such as document sharing, real-time collaboration, and customizable workflows specifically tailored for the Form IT 203 TM ATT ASchedule A Group Return For. Users can track the status of the form and receive notifications for any updates. These tools simplify the overall process, allowing for a smooth filing experience.

-

Can I easily integrate airSlate SignNow with other tools for managing the Form IT 203 TM ATT ASchedule A Group Return For?

Yes, airSlate SignNow offers numerous integrations with popular applications that can assist in managing the Form IT 203 TM ATT ASchedule A Group Return For. Whether you use CRM systems, document management tools, or accounting software, our platform can connect and streamline your processes. This enhances productivity and keeps everything organized.

-

How secure is my information when using airSlate SignNow for the Form IT 203 TM ATT ASchedule A Group Return For?

Security is a priority at airSlate SignNow. When filing the Form IT 203 TM ATT ASchedule A Group Return For, your information is protected with advanced encryption and secure data storage. We adhere to industry standards to ensure that your sensitive information remains confidential and secure during the entire eSigning process.

-

What are the benefits of using airSlate SignNow for the Form IT 203 TM ATT ASchedule A Group Return For?

Using airSlate SignNow for the Form IT 203 TM ATT ASchedule A Group Return For offers numerous benefits, including increased efficiency, reduced paperwork, and improved collaboration among team members. Our platform allows for easy tracking and management of the form, helping you meet deadlines with less hassle. Choose airSlate SignNow to streamline your tax filing experience.

Get more for Form IT 203 TM ATT ASchedule A Group Return For

Find out other Form IT 203 TM ATT ASchedule A Group Return For

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template