New York State Department of Taxation and Finance Sales and Use Tax Report for Purchases of Items and Services Costing $25,000 O Form

Understanding the New York State Department Of Taxation And Finance Sales And Use Tax Report IT 135

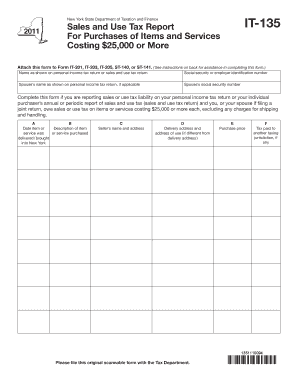

The New York State Department Of Taxation And Finance Sales And Use Tax Report for Purchases of Items and Services Costing $25,000 or More, commonly referred to as IT 135, is a crucial document for taxpayers making significant purchases. This form is specifically designed to report sales and use tax obligations related to high-value transactions. Taxpayers must attach this form to other relevant tax forms, such as IT 201, IT 203, IT 205, ST 140, or ST 141, to ensure compliance with state tax regulations.

Steps to Complete the IT 135 Form

Completing the IT 135 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the purchase, including invoices and receipts. Next, accurately fill out the form, providing details about the items or services purchased, including their cost and the applicable sales tax. It is essential to double-check all entries for accuracy before submission. Once completed, attach the IT 135 to the appropriate tax form and submit it according to the guidelines set by the New York State Department of Taxation and Finance.

Legal Use of the IT 135 Form

The IT 135 form serves a vital legal purpose in the reporting of sales and use tax for large purchases. It ensures that taxpayers fulfill their tax obligations under New York State law. Proper completion and submission of this form help avoid potential legal issues, including penalties for non-compliance. Understanding the legal implications of the IT 135 is essential for both individuals and businesses making significant purchases.

Key Elements of the IT 135 Form

Several key elements must be included when filling out the IT 135 form. These include:

- Purchaser Information: Name, address, and taxpayer identification number.

- Purchase Details: Description of items or services, purchase date, and total cost.

- Sales Tax Calculation: Accurate calculation of the sales tax owed based on the total cost of the purchase.

- Signature: The form must be signed and dated by the purchaser or an authorized representative.

Obtaining the IT 135 Form

Taxpayers can obtain the IT 135 form through the New York State Department of Taxation and Finance website or by contacting their office directly. It is also available at various tax preparation offices and libraries. Ensuring that you have the most current version of the form is vital for compliance and accurate reporting.

Filing Deadlines for the IT 135 Form

Timely submission of the IT 135 form is essential to avoid penalties. Taxpayers should be aware of specific filing deadlines, which may vary based on the type of tax form to which the IT 135 is attached. Generally, it is advisable to submit the form along with the associated tax return by the standard tax filing deadline, which is typically April 15 for individuals. Businesses may have different deadlines based on their fiscal year.

Quick guide on how to complete new york state department of taxation and finance sales and use tax report for purchases of items and services costing 25000 or

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications, and enhance any document-centered operation today.

The easiest way to modify and eSign [SKS] without stress

- Find [SKS] and click on Get Form to get started.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form—by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance sales and use tax report for purchases of items and services costing 25000 or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State Department Of Taxation And Finance Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More IT 135?

The New York State Department Of Taxation And Finance Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More IT 135 is a form required to report sales and use tax for signNow purchases in New York. This form must be completed and submitted to ensure compliance with state tax regulations, particularly for items and services exceeding the $25,000 threshold.

-

How do I complete the IT 135 form accurately?

To complete the IT 135 form accurately, gather all necessary purchase details and ensure you meet the threshold criteria. Fill out the required fields, paying particular attention to attaching this form to Form IT 201, IT 203, IT 205, ST 140, or ST 141, as instructed by the New York State Department Of Taxation And Finance.

-

Where do I send my completed IT 135 form?

Once you have completed the IT 135 form, you should attach it to the relevant tax form—such as IT 201, IT 203, IT 205, ST 140, or ST 141—and submit it to the New York State Department Of Taxation And Finance. Ensure that you follow the submission guidelines to avoid penalties.

-

What happens if I don't submit the IT 135 form?

Failing to submit the New York State Department Of Taxation And Finance Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More IT 135 could result in penalties or interest on unpaid taxes. It is crucial to comply with the submission requirements to avoid potential issues with state tax authorities.

-

Are there any penalties for late submission of the IT 135 form?

Yes, there may be penalties for late submissions of the IT 135 form. The New York State Department Of Taxation And Finance imposes fines and interest on unpaid taxes, so timely submission of the New York State Department Of Taxation And Finance Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More IT 135 is essential.

-

Can I eSign the IT 135 form for submission?

Yes, you can use airSlate SignNow to eSign the IT 135 form for submission. This electronic signature solution streamlines the process, making it easy and efficient to complete and submit your documents to the New York State Department Of Taxation And Finance.

-

What benefits does eSigning the IT 135 form provide?

eSigning the IT 135 form allows for quicker submissions and a more efficient documentation process. By using airSlate SignNow, you can reduce paper usage, minimize errors, and keep your tax-related documents organized, all while ensuring compliance with New York State Department Of Taxation And Finance regulations.

Get more for New York State Department Of Taxation And Finance Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 O

- Ccusupportcharlotteflcom form

- Form 3 incident notification form incident notification form to be used notify when certain workplace incidents occur

- Approved employer per summary form acca

- Boe230 b form

- Constitution and by laws the bakery confectionery bctgm374g form

- Zoning board of adjustment application city of el paso form

- Animal health screening form pet partners petpartners

- Dr 057 11 12 cash maryland motor vehicle administration form

Find out other New York State Department Of Taxation And Finance Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 O

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later