For Office Use Only New York State Department of Taxation and Finance Claim for Child and Dependent Care Credit it 216 Important Form

Understanding the Claim for Child and Dependent Care Credit IT-216

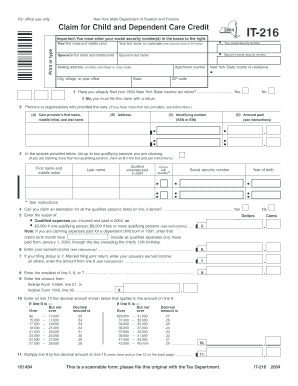

The For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT-216 is a tax form designed for New York residents seeking to claim credits for child and dependent care expenses. This form allows eligible taxpayers to reduce their tax liability based on qualifying care costs incurred while they work or look for work. It is essential to complete this form accurately to ensure you receive the correct credit amount.

Steps to Complete the IT-216 Form

Completing the IT-216 form involves several key steps:

- Gather necessary documentation, including Social Security numbers for you and your dependents.

- Fill out your personal information, ensuring accuracy in names and Social Security numbers.

- Detail the care expenses incurred, including the names of the care providers and their respective Tax Identification Numbers (TINs).

- Calculate the credit amount based on your qualifying expenses and enter it in the designated section.

- Review the completed form for any errors before submission.

Eligibility Criteria for Claiming the Credit

To qualify for the Child and Dependent Care Credit, you must meet specific criteria:

- You must have incurred expenses for the care of a child under the age of thirteen or a dependent who is physically or mentally incapable of self-care.

- Both you and your spouse (if filing jointly) must have earned income during the tax year.

- The care must be provided so that you can work or actively look for work.

Required Documents for Submission

When submitting the IT-216 form, it is crucial to include the following documents:

- Proof of income, such as W-2 forms or pay stubs.

- Receipts or invoices from care providers detailing the services rendered.

- Tax Identification Numbers (TINs) for all care providers.

Form Submission Methods

The IT-216 form can be submitted through various methods:

- Online: Some taxpayers may have the option to file electronically through approved tax software.

- By Mail: Print and mail the completed form to the appropriate address provided by the New York State Department of Taxation and Finance.

- In-Person: Visit a local tax office to submit the form directly.

Important Filing Deadlines

Be aware of the filing deadlines for the IT-216 form to ensure timely submission:

- The form must be submitted by the tax return deadline, typically April 15 of the following year.

- Extensions may be available, but it is essential to check specific guidelines.

Quick guide on how to complete for office use only new york state department of taxation and finance claim for child and dependent care credit it 216

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a suitable eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest method to adjust and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark essential sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and eSign [SKS] to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT 216 Important

Create this form in 5 minutes!

How to create an eSignature for the for office use only new york state department of taxation and finance claim for child and dependent care credit it 216

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT 216'?

The 'For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT 216' is a form used in New York State for claiming tax credits. Individuals must complete this form accurately and enter their Social Security Numbers as instructed. It's essential to follow these guidelines to ensure your claim is processed smoothly and efficiently.

-

How does airSlate SignNow help with the IT 216 form?

airSlate SignNow simplifies the process of completing and signing the 'For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT 216'. Our platform allows users to easily fill out the form, eSign it, and send it securely. This makes it an ideal solution for busy individuals needing to submit their claims quickly.

-

Is there a cost associated with using airSlate SignNow for this claim?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. We provide a cost-effective solution for managing the 'For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT 216'. You can choose a plan that fits your requirements, regardless of whether you're a single user or an organization.

-

What features does airSlate SignNow provide for the IT 216 form?

Our platform includes features such as document templates, eSigning capabilities, secure storage, and automated workflows to facilitate completing the 'For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT 216'. These tools streamline your document management process and ensure compliance with tax regulations.

-

Are there integrations available with airSlate SignNow?

airSlate SignNow integrates with various applications and services to enhance your experience while managing the 'For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT 216'. Whether you use cloud storage or CRM systems, our integrations make it easier to manage your documents and collaborate with others.

-

Can airSlate SignNow help with tracking the status of my claim?

Yes, airSlate SignNow allows users to track the status of their submissions, including the 'For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT 216'. You can receive notifications and updates, ensuring you are always informed about where your claim stands in the review process.

-

What are the benefits of using airSlate SignNow for tax forms?

The key benefits of using airSlate SignNow for tax forms like the 'For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT 216' include improved accuracy, faster processing, and enhanced security. Our user-friendly platform helps you manage forms efficiently, reducing errors and compliance risks.

Get more for For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT 216 Important

Find out other For Office Use Only New York State Department Of Taxation And Finance Claim For Child And Dependent Care Credit IT 216 Important

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document