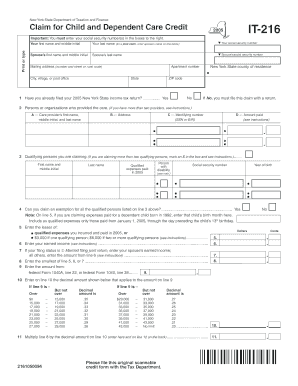

New York State Department of Taxation and Finance it 216 Claim for Child and Dependent Care Credit Important You Must Enter Your Form

Understanding the New York State Department Of Taxation And Finance IT 216 Claim For Child And Dependent Care Credit

The IT 216 form is a crucial document for taxpayers in New York seeking to claim the Child and Dependent Care Credit. This credit is designed to assist families with the costs of care for children under the age of thirteen or for dependents who are physically or mentally incapable of self-care. By completing this form, eligible taxpayers can reduce their overall tax liability, making it an important financial resource for many households.

Steps to Complete the IT 216 Form

Completing the IT 216 form involves several steps that ensure accurate reporting of child and dependent care expenses. First, gather all necessary documentation, including Social Security numbers for both the taxpayer and the dependents. Next, fill out the required sections of the form, detailing the care expenses incurred. It is essential to double-check the information entered, particularly the Social Security numbers, as errors can lead to processing delays or denial of the credit. Finally, submit the form along with your tax return to the New York State Department of Taxation and Finance.

Eligibility Criteria for the IT 216 Claim

To qualify for the Child and Dependent Care Credit using the IT 216 form, taxpayers must meet specific eligibility requirements. The care must be provided for a qualifying child under the age of thirteen or for a dependent who is unable to care for themselves. Additionally, the taxpayer must have earned income during the tax year, and the care expenses must be necessary for the taxpayer to work or look for work. It is important to review these criteria to ensure that you meet all necessary conditions before filing.

Required Documents for Submission

When preparing to submit the IT 216 form, certain documents are required to support your claim. This includes proof of the care expenses, such as receipts or invoices from the care provider. You will also need to provide the Social Security numbers of both the taxpayer and the dependents. Having these documents ready will facilitate a smoother filing process and help avoid potential issues with your claim.

Form Submission Methods

The IT 216 form can be submitted in various ways, providing flexibility for taxpayers. You can file the form electronically if you are submitting your tax return online. Alternatively, you may print the completed form and mail it along with your tax return to the appropriate address. In-person submissions are also an option at designated tax offices, although this may vary based on local regulations and office hours.

Important Deadlines for Filing

Awareness of filing deadlines is crucial when submitting the IT 216 form. Typically, the deadline aligns with the federal tax return due date, which is usually April fifteenth. However, it is advisable to check for any specific state extensions or changes that may affect the filing timeline. Missing the deadline can result in the loss of the credit for that tax year, so timely submission is essential.

Quick guide on how to complete new york state department of taxation and finance it 216 claim for child and dependent care credit important you must enter

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York State Department Of Taxation And Finance IT 216 Claim For Child And Dependent Care Credit Important You Must Enter Your

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance it 216 claim for child and dependent care credit important you must enter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State Department Of Taxation And Finance IT 216 Claim For Child And Dependent Care Credit?

The New York State Department Of Taxation And Finance IT 216 Claim For Child And Dependent Care Credit is a tax form used to claim credits for eligible child and dependent care expenses. It's important to complete this form accurately, as it can signNowly reduce your taxable income. Remember, you must enter your Social Security numbers in the boxes specified to avoid processing delays.

-

Why do I need to enter my Social Security numbers on the IT 216 form?

You must enter your Social Security numbers in the boxes to the right to ensure proper identification and verification of your claim. This helps the New York State Department Of Taxation And Finance process your IT 216 Claim For Child And Dependent Care Credit without errors. Missing or incorrect Social Security numbers can lead to delays in processing your credit.

-

How can airSlate SignNow help with the IT 216 Claim form?

airSlate SignNow provides a user-friendly platform to easily fill out and eSign essential documents like the IT 216 Claim For Child And Dependent Care Credit. Our solution ensures that you can complete and submit your forms quickly while maintaining compliance with New York State regulations. Plus, our digital workflow helps streamline the entire process.

-

What features does airSlate SignNow offer for managing tax documents?

With airSlate SignNow, you can manage your tax documents effortlessly through digital signing, templates, and secure storage. Our platform allows you to collaborate in real-time, ensuring everyone involved can contribute to the IT 216 Claim For Child And Dependent Care Credit accurately. This efficiency is key to meeting tax deadlines.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow offers flexible pricing plans tailored for small businesses. Our cost-effective solution allows you to manage your documents, including the IT 216 Claim For Child And Dependent Care Credit, without breaking the bank. Investing in our platform can help save time and reduce errors in your documentation process.

-

Can airSlate SignNow integrate with other tools for tax management?

Absolutely! airSlate SignNow supports a wide array of integrations with popular tools that assist in tax management. This makes it easier to manage and submit your IT 216 Claim For Child And Dependent Care Credit as part of your overall financial workflow. Integrate with your accounting software for a seamless experience.

-

What benefits do I get from using airSlate SignNow for my tax claims?

Using airSlate SignNow provides numerous benefits such as increased document security, reduced processing time, and improved accuracy in your filings. You can efficiently prepare your New York State Department Of Taxation And Finance IT 216 Claim For Child And Dependent Care Credit while ensuring that all required details, like your Social Security numbers, are correctly entered. It's a smart choice for anyone looking to streamline tax processes.

Get more for New York State Department Of Taxation And Finance IT 216 Claim For Child And Dependent Care Credit Important You Must Enter Your

- Union 829 form

- Construction liability waiver form

- Informed consent for laser periodontal treatment drmbudd com

- Printable concussion evaluation form

- Debrief template word form

- Adolescent informed consent form

- New acs website page m crba corrections letter docx photos state form

- Non invasive prenatal test request form dorevitch pathology

Find out other New York State Department Of Taxation And Finance IT 216 Claim For Child And Dependent Care Credit Important You Must Enter Your

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template