Form 8453 F

What is the Form 8453 F

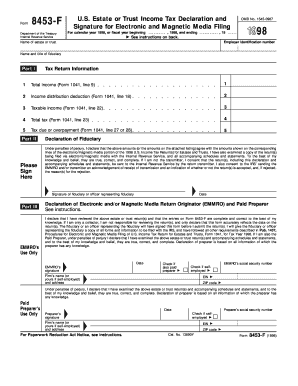

The Form 8453 F is a document used by taxpayers in the United States to authorize the electronic filing of their federal tax returns. This form serves as a declaration that the taxpayer has reviewed their return and confirms that the information provided is accurate. It is specifically designed for use with certain types of electronic submissions, allowing for a streamlined filing process while ensuring compliance with IRS regulations.

How to use the Form 8453 F

To effectively use the Form 8453 F, taxpayers must complete it as part of their electronic filing process. This form is typically generated by tax preparation software. After filling out the necessary information, the taxpayer must sign the form electronically. Once signed, it should be submitted alongside the electronic tax return to the IRS. It is important to retain a copy of the signed form for personal records, as it may be required for future reference or in case of an audit.

Steps to complete the Form 8453 F

Completing the Form 8453 F involves several key steps:

- Gather all necessary tax documents, including income statements and deductions.

- Access your tax preparation software and select the option to e-file your return.

- Fill out the required fields in the Form 8453 F, ensuring all information is accurate.

- Electronically sign the form, confirming your consent for the IRS to process your return.

- Submit the form along with your electronic tax return.

Key elements of the Form 8453 F

The Form 8453 F contains several important elements that must be accurately completed. These include:

- Taxpayer identification information, such as name, address, and Social Security number.

- Details of the tax return being filed, including the type of return and tax year.

- A declaration of consent for electronic filing, which must be signed by the taxpayer.

- Information about any third-party designee, if applicable.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 8453 F. Generally, the deadline for submitting federal tax returns is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any state-specific deadlines that may apply, as these can vary significantly.

Required Documents

When preparing to complete the Form 8453 F, taxpayers should gather the following documents:

- W-2 forms from employers.

- 1099 forms for any additional income.

- Documentation for deductions and credits, such as receipts or statements.

- Previous year’s tax return for reference.

Quick guide on how to complete form 8453 f

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without any holdups. Manage [SKS] on any device using airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, including email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring excellent communication throughout the document preparation phase with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8453 F

Create this form in 5 minutes!

How to create an eSignature for the form 8453 f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8453 F?

Form 8453 F is an important document used to authorize e-filing for certain tax returns. It acts as an electronic signature that confirms your submission, ensuring that the IRS recognizes your electronic documents as valid. By using airSlate SignNow, you can efficiently complete and send Form 8453 F securely.

-

How does airSlate SignNow work with Form 8453 F?

airSlate SignNow allows users to easily eSign Form 8453 F online, streamlining the process of electronic submission. Our platform ensures that all required fields are filled out accurately, making it simple to complete the form and send it directly to the IRS. It's a user-friendly solution designed for businesses looking to optimize their e-filing efforts.

-

Is there a cost to use airSlate SignNow for Form 8453 F?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different business needs, making it a cost-effective choice for signing documents like Form 8453 F. Each plan includes features that enable seamless document management and eSigning capabilities. You can choose a subscription that aligns with your volume of use.

-

What features does airSlate SignNow offer for Form 8453 F?

airSlate SignNow provides several features to enhance the experience of using Form 8453 F, including customizable templates, secure storage, and tracking options. The platform allows for multiple signers, and you can easily request signatures from clients or team members. Additionally, our system guarantees compliance with legal signing standards.

-

Can I integrate airSlate SignNow with other software for Form 8453 F submission?

Absolutely! airSlate SignNow offers integrations with popular accounting software and document management systems, making it easy to work with Form 8453 F in conjunction with other tools. This allows you to streamline your workflows and keep all financial documents organized in one place.

-

What security measures does airSlate SignNow implement for Form 8453 F?

airSlate SignNow prioritizes user security by employing advanced encryption protocols and secure cloud storage for documents like Form 8453 F. Our platform ensures that your data remains protected throughout the signing process, complying with industry standards to keep your sensitive information safe.

-

How can airSlate SignNow improve my business's e-filing process for Form 8453 F?

By using airSlate SignNow, businesses can signNowly enhance their e-filing process for Form 8453 F through increased efficiency and reduced turnaround time. The ability to sign documents remotely means that you can obtain signatures quickly without delays, fostering a smoother workflow and quicker submission to the IRS.

Get more for Form 8453 F

- Dsp34 323 distribution technology home eskom form

- Gma email address form

- Parenting plan utah state courts utcourts form

- Course 2 chapter 2 percents answer key form

- Worksheet sex linked crosses unit 3 genetics form

- Fillable tc 94 32 form

- Audio visual amp technology equipment request form ecusd7

- 3299 supplemental form length of employment

Find out other Form 8453 F

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT